Planning for retirement may seem intimidating, but it’s not quite as difficult as you might expect. In fact, with the answers to just a few key questions, you can have a good idea of where you’re headed, and how rosy that final destination may be. You can also easily pinpoint your “move back in with the kids date,” in the event that you need to give them some advance notice.

When it comes to determining future financial needs, there is one particular mistake that we see investors make time and time again: not taking into account the effects of inflation.

Most of us remain generally unaware of the slow but steady decline in the purchasing power of the dollar. But failing to account for this in your retirement planning can leave you high and dry during your finest years.

What is Inflation?

Most people think of inflation as a general rise in prices over time. While this true with regard to how we experience it, in reality there is something much more devious going on. Rather than price levels rising, what’s really occurring is that the U.S. dollar – our currency – is weakening. The dollar is slowly losing its purchasing power over time.

The mechanics behind why this occurs are beyond the scope of this article, but inflation in something that we must deal with at all times. It’s always in the background, no matter where we are, or what we are doing.

There are various ways to measure inflation, and one of the most common is known as the Consumer Price Index (CPI). The CPI measures how much aggregate prices change from one year to the next. If you or anyone in your family has ever received a cost-of-living adjustment based on the CPI, this is done to ensure that their purchasing power remains stable as the dollar continues to erode.

The inflation rate tends to fluctuate over time, but has generally been around 2% in recent years. Part of this is a result of our economy, and part if it is the result of monetary policy decisions by the Federal Reserve. The Federal Reserve is the U.S. central bank, and they have been charged by Congress with two mandates. One of these is so called “price stability,” which the Federal Reserve has defined as maintaining an inflation rate of 2%.

How it Impacts You

The Federal Reserve’s inflation target is a good indication of what average inflation is likely to be over your lifetime. Using 2% inflation, we can plan out exactly how our finances will be impacted down the road. But before we talk about how to do that, I want to give you a good rule of thumb to remember: At 2% inflation, the dollar loses half of its value every 35 years.

Let that sink in for a moment.

This means that 35 years from now, your $6 latte will cost $12. Your $80 pair of shoes will cost $160. Dinner for the family at that nice restaurant you like so much will be $300 instead of $150. You get the point. When you realize that the overall cost of everything is going to double every 35 years, it makes planning for retirement a lot more formidable, right?

In case I haven’t discouraged you enough already, also consider this: If prices double every 35 years, it means that 70 years from now, prices will be 4 times what they are today. That’s $24 for that latte, $320 for that measly $80 pair of running shoes, and $600 just to take your family out to a nice restaurant. All because of 2% inflation …

Okay, now that we’ve identified the problem, let’s talk about how to make sure we’re ready for these price increases as they occur.

Planning for Inflation

Unless you’re a math wiz who loves excel spreadsheets, doing any type of retirement planning is going to require some type of specialized calculator. Luckily for you, the team here at Model Investing has built one for you. In the examples that follow, we’ll be using our Retirement Calculator, which is available here. (Note: It’s also available under “Tools” in the top navigation bar.)

Our Retirement Calculator allows you to plug in a few key variables and get a snapshot of your financial trajectory. You can see exactly what your investments will be worth at retirement, and how long those funds will last once you begin to live off them.

As you might expect, we’ve built in the ability to scenario plan using various levels of inflation. This allows you to see how your future living expenses might differ drastically from their current levels.

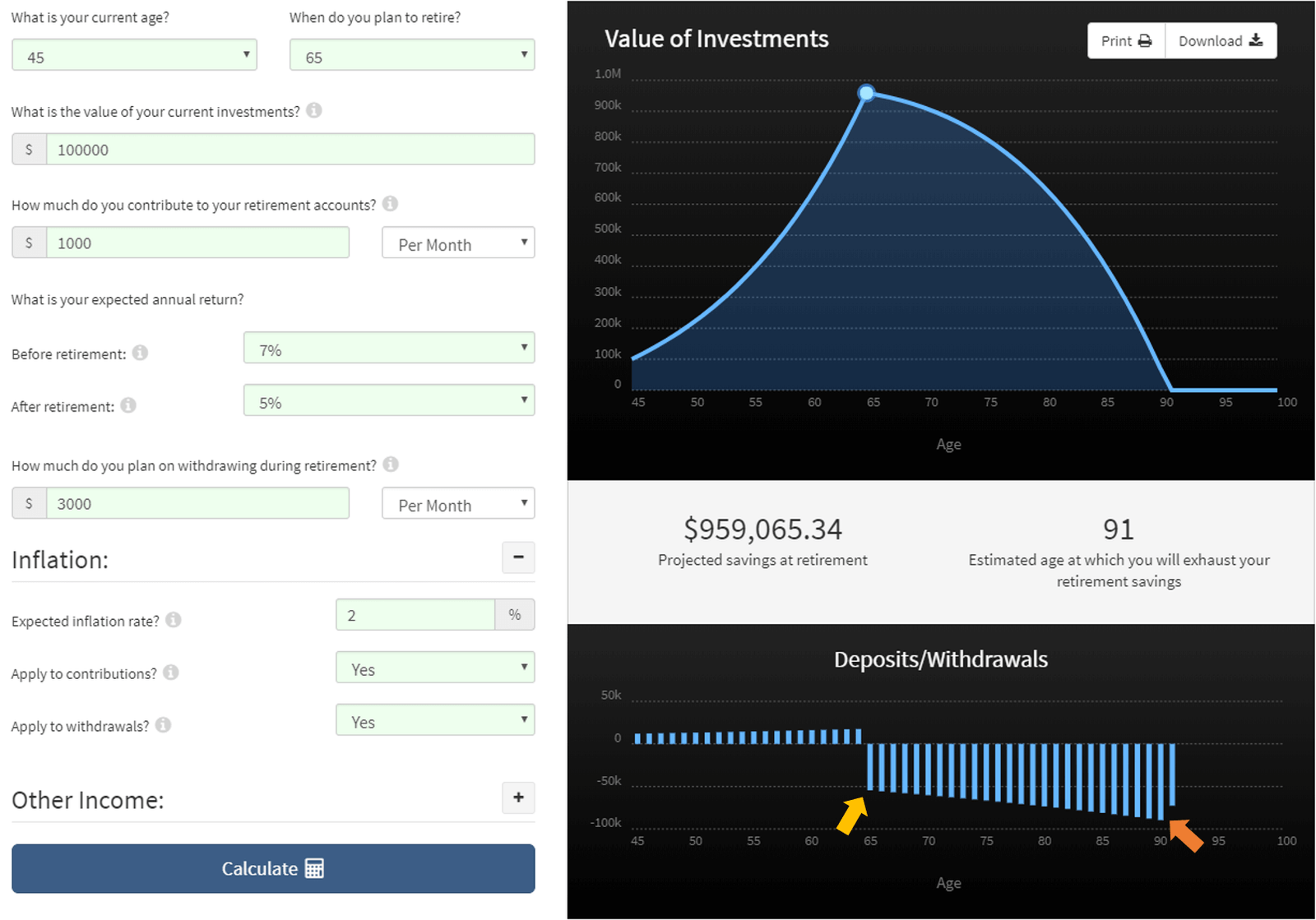

Here’s an example. A friend of mine, let’s call him Justin Case, is 45 years old and wants to retire by age 65. His portfolio is currently worth about $100,000 and he contributes $1,000 to his investments each month. He expects to be able to earn a 7% overall return prior to retirement, and a 5% return during retirement. He’d also like to be able to maintain his current lifestyle during retirement, which costs him $3,000 per month in today’s dollars.

Plugging all of this into the Retirement Calculator, we get the nifty little report below (click image to enlarge).

Now here’s what I want to draw your attention to. In the lower black chart on the right side we can see the deposits and withdrawals that Justin will make to and from his investment accounts over the years.

Notice that at age 65 (the yellow arrow) Justin begins to withdraw funds to support his living expenses. That first year, rather than withdrawing $36,000 (which would be the equivalent of withdrawing $3,000 per month for 12 months), our calculator shows him withdrawing $54,564 … what gives?

As you can probably guess, this is the result of our calculator including the effects of inflation into Justin’s financial trajectory. (Note: You can toggle this effect on or off within the calculator, as well as adjust the specific level of inflation.)

If Justin wants to afford the same lifestyle at age 65 that he currently enjoys now (which costs him $3,000 per month), then he’s actually going to need to withdraw $4,547 per month ($54,564 per year) from his investment accounts. That’s what 2% inflation will do to his living expenses over the next 20 years.

But it doesn’t stop there.

The following year, when Justin is 66, he’ll have to withdraw $4,638 per month ($55,655 per year) for living expenses. And that amount keeps growing indefinitely. Should Justin live to reach the ripe old age of 90 (orange arrow) – which he probably will considering how average lifespans are increasing – he’ll need to withdraw $7,460 per month ($89,518 per year) from his investment accounts just to pay for what $3,000 per month buys him now. Thanks a lot, inflation.

Conclusion

So there you go. The biggest reason why we see investors disappointed when they get to retirement is because by the time they finally get there, everything is so darned expensive. If they haven’t prepared for these rising costs, then those golden years start to look a lot less golden.

I realize that much of this may feel surreal to you, but unfortunately it’s not. Each and every year that goes by, it costs us around 2% extra just to pay for the same things we bought last year. And as unfortunate as this is, this process has been going on for hundreds of years, and it’s not going to stop anytime soon.

In Justin’s case (no pun intended), notice that as a result of his living expenses being higher than initially thought, his retirement funds are projected to run out by age 91. This is what we call the “move back in with the kids date” and it’s probably the worst type of date you could ever go on.

If you haven’t yet, I would suggest taking a moment to go play with our Retirement Calculator to make sure you’re currently on the trajectory that you think you are. If so, great. But at the very least, you’ll be able to see what steps you can take to make those retirement goals a reality.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing