TSP Allocation Model

The TSP, or Thrift Savings Plan, is a defined contribution retirement savings and investment plan for Federal employees and members of the uniformed services. It is one of the most effective retirement plans in use today, but it must be managed on an ongoing basis if you expect it to be a primary source of retirement funding.

Many Thrift Savings Plan investors are lulled into a sense of complacency by the simplicity of their TSP accounts. They are led to believe that they can simply choose a fund, set up a contribution amount, and their retirement will grow on autopilot. However, this is not the case. TSP members are encouraged to update their allocations frequently, but few take the time to do this, and even fewer know how to do this strategically.

Find Out How to Use the TSP Model to Manage Your TSP Account

If you are enrolled or are eligible to enroll in the TSP, the TSP Allocation Model (TSP Model) can help you earn higher returns while taking on less risk. The TSP Model is designed to keep your account allocated to the strongest performing funds, while still maintaining adequate diversification. Like all of our investment models, the TSP Model contains a built-in mechanism for moving to a position of safety during severe market declines.

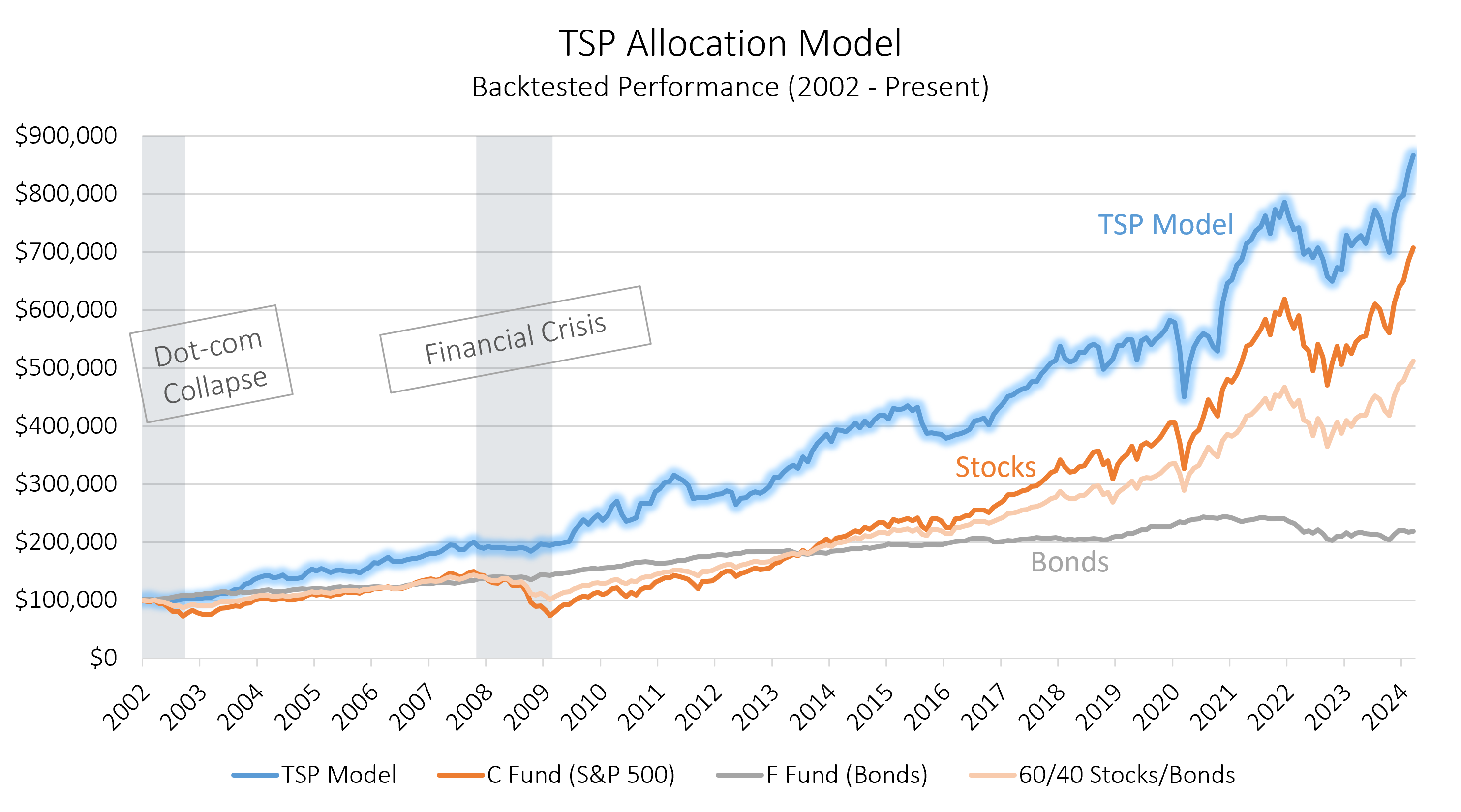

The chart below shows the backtested performance of the TSP Model over the last 21 years (since the TSP’s current incarnation). For comparison, the performance of the C Fund (an index fund that tracks the performance of S&P 500), the F Fund (an index fund that tracks the Barclays U.S. Aggregate Bond Index), and a 60/40 blend of those two fund are included in the chart. Make sure to read this entire page to understand how the results below were achieved and how you can apply these results to your own portfolio.

Model performance represents total returns and includes reinvestment of dividends and interest. No management fees or transaction costs are included. Historical performance is not an indication or guarantee of future performance.

Notice that the TSP Model was able to largely avoid the losses associated with the dot-com collapse and the financial crisis. This was achieved by dynamically reallocating investments into the F Fund during these periods of market turmoil. When the other funds resumed their ascent, the TSP Model shifted back into the market to capture the growth in those funds.

Not only was the TSP Model able to outperform various allocation strategies, as well as the broader market, it did so with less portfolio volatility and overall risk. The table below contains a series of performance metrics that allow you to compare the TSP Model against several benchmarks.

| TSP Model Performance Metrics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Strategy | Compound Annual Return | Alpha1 | Beta1 | Standard Deviation | Maximum Drawdown | Sharpe Ratio | Sortino Ratio | Treynor Ratio |

| TSP Model | 9.47% | 4.77% | 0.48 | 11.75% | -22.78% | 0.76 | 1.80 | 0.18 |

| C Fund (S&P 500) | 8.03% | 0.00% | 1.00 | 18.26% | -50.92% | 0.47 | 0.58 | 0.09 |

| F Fund (Bonds) | 3.58% | N/A | 0.05 | 4.95% | -16.75% | 0.50 | 0.66 | 0.51 |

| 60/40 Stocks/Bonds | 6.66% | 0.75% | 0.63 | 11.69% | -29.48% | 0.52 | 0.67 | 0.10 |

| Data for 21-Year Period (2002 – 2022) 1 Benchmarked against the C Fund | ||||||||

Key Performance Highlights:

- Over the last 21 years the TSP Model’s compound annual return has significantly outpaced that of both stocks and bonds, as well as a blended portfolio.

- When compared to stocks, the TSP Model generates strong excess returns (alpha) while experiencing significantly less volatility (risk).

- The reduced volatility and enhanced returns provide for notably higher risk-adjusted returns, as evidenced by the Sharpe, Sortino and Treynor ratios, and a positive alpha.

- Stocks lost over half their value during the financial crisis. The TSP Model was able to sidestep those losses by repositioning the portfolio into the F Fund.

The TSP Model utilizes the five individual funds below to achieve its high risk-adjusted returns. Please note that the TSP Model does not use the Lifecycle Funds (L Funds) because target date funds are not a suitable option for TSP investors. For more information on why investors should stay clear of target date funds, including the L funds, please click here.

| TSP Investment Options | |||

|---|---|---|---|

| TSP Fund | Description | Objective | Benchmark |

| Domestic | |||

| C Fund | Common Stock Index Investment Fund | Match the performance of the S&P 500 Index | S&P 500 |

| S Fund | Small-Cap Stock Index Investment Fund | Match the performance of the DJ U.S. Completion TSM Index | DJ U.S. Completion TSM Index |

| International | |||

| I Fund | International Stock Index Investment Fund | Match the performance of the MSCI EAFE Index | MSCI EAFE Stock Index |

| Fixed Income | |||

| G Fund | Government Securities Investment Fund | Maintain a higher return than inflation without risk | N/A |

| F Fund | Fixed Income Index Investment Fund | Match the performance of the Barclays U.S. Aggregate Bond Index | Barclays U.S. Aggregate Bond Index |

The specific TSP Model performance seen above is based on the following criteria and allocations:

- The performance of each TSP fund is analyzed monthly and the portfolio is reviewed and adjusted on the first trading day of each month.

- The portfolio balance is allocated to the top 3 ranked funds, based on the following allocation percentages:

| TSP Model Allocations by Rank | |||

|---|---|---|---|

| Fund Rank: | 1 | 2 | 3 |

| Allocation | 50% | 30% | 20% |

- If any of the top 3 ranked funds do not meet specific performance criteria, that allocation is placed in the F Fund.

The end result is an innovative strategy that achieves steady growth, while protecting investors from major losses associated with market crashes. Regardless of how much you currently have or contribute to your TSP account, the TSP Model can help you achieve better returns with less overall risk.

The current TSP Model selections and ongoing monthly updates are accessible with a premium subscription. Updated recommendations are provided on the first day of each month. Sign up today for access to the TSP Allocation Model and all of our other models.

Find Out How to Use the TSP Model to Manage Your TSP Account