Ready to raise your investing IQ?

Sign up for our Free Newsletter to access the best investment information money can’t buy.

Looking for the best 401(k) allocation strategy to maximize your retirement savings? The 401(k) Allocation Model is designed to help investors optimize their 401(k) plans by dynamically adjusting allocations based on market conditions and economic trends.

Unlike traditional static 401(k) strategies, which leave investors vulnerable to market downturns, the 401 Model actively shifts assets to capitalize on strong market performance and preserve capital when risks increase.

By continuously adapting to financial conditions, the 401 Model ensures your portfolio remains optimized for every stage of the market cycle. Whether your goal is to accelerate growth or protect your portfolio from volatility, this proven 401(k) investment strategy helps you stay on track for long-term financial security.

Find Out How to Use the 401 Model to Manage your 401(k)

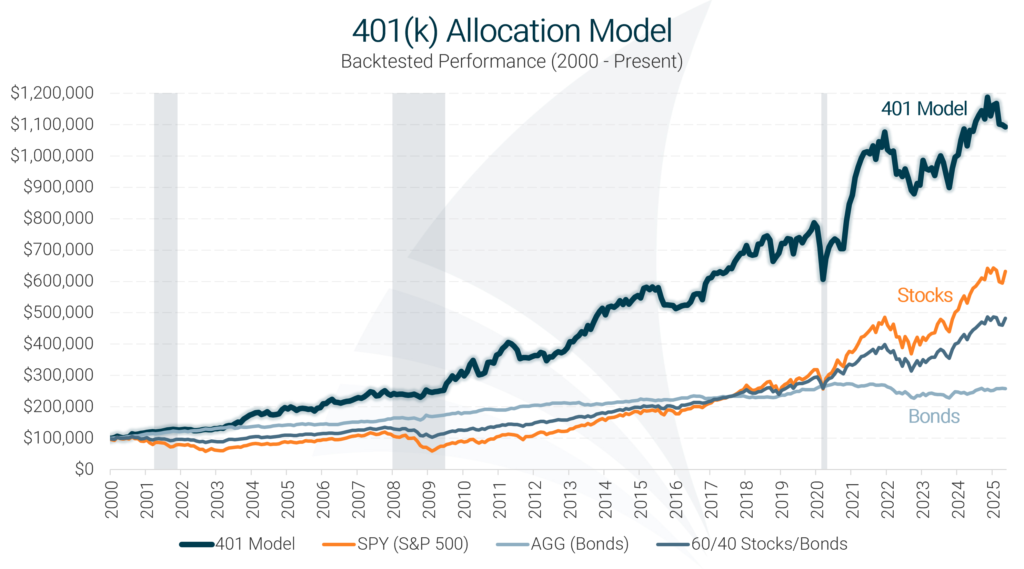

The 401(k) Allocation Model has consistently delivered stronger performance than traditional stock and bond benchmarks over the past 22 years. The chart below illustrates how the model has outperformed the S&P 500, the Aggregate Bond Index, and a standard 60/40 portfolio. This exceptional performance is achieved through tactical 401(k) asset allocation, which dynamically shifts investments based on market conditions.

Model performance represents total returns and includes reinvestment of dividends and interest. No management fees or transaction costs are included. Historical performance is not an indication or guarantee of future performance.

The table below illustrates the model’s ability to provide stable, high-quality returns while proactively controlling risk and volatility.

| 401 Model Performance Metrics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Strategy | Compound Annual Return | Alpha1 | Beta1 | Standard Deviation | Maximum Drawdown | Sharpe Ratio | Sortino Ratio | Treynor Ratio |

| 401 Model | 10.18% | 5.86% | 0.41 | 11.2% | -22.9% | 0.79 | 1.80 | 0.22 |

| SPY (S&P 500) | 7.61% | 0.00% | 1.00 | 18.2% | -50.8% | 0.41 | 0.46 | 0.07 |

| AGG (Bonds) | 3.75% | N/A | 0.00 | 4.9% | -17.1% | 0.41 | 0.50 | N/A |

| 60/40 Stocks/Bonds | 6.44% | 1.07% | 0.54 | 10.2% | -23.9% | 0.50 | 0.61 | 0.09 |

| Data for 25-Year Period (2000 – 2024) 1 Benchmarked against the S&P 500 |

||||||||

View Full Explanation of the 401 Model Performance Metrics

The 401(k) Allocation Model simplifies investing by providing clear, monthly updates tailored to your 401(k) plan. Here’s how it works:

Balancing growth and security, the 401 Model stands out as the best 401k investment strategy for long-term success.

Take Charge of Your 401(k) – Get Started Today!

A traditional 401(k) strategy often involves static allocations. This severely hampers performance because the portfolio can’t react to changes in the economic environment. The result? Suboptimal performance and increased vulnerability during market downturns.

The 401 Model utilizes a tactical 401(k) allocation strategy that continuously evaluates fund performance and economic trends. By proactively adjusting your portfolio, it redirects investments toward high-performing sectors while minimizing exposure to weaker ones. This hands-on approach delivers 401(k) advice that ensures your portfolio remains resilient in any market environment.

Discover how 401(k) investors just like you are transforming their retirement strategy with the 401(k) Allocation Model:

If you’re serious about building a successful retirement and maximizing growth in your 401(k), the 401 Model is the strategy you need. Designed specifically for 401(k) investors, it provides clear, actionable monthly recommendations tailored to your plan, making portfolio management simple and effective.

By taking just a few minutes each month to adjust your allocations based on current market conditions, you’ll keep your money working as efficiently as possible. This can accelerate your savings growth, help you retire sooner, and give you the financial freedom to enjoy the lifestyle you’ve always envisioned.

Thousands of investors are already using the 401 Model to achieve higher returns and greater financial confidence. Take control of your future today – because your retirement deserves nothing less than the best.

Take the first step toward maximizing your retirement – sign up today and start your free trial!

Join Thousands Optimizing their 401(k) – Take the First Step!

The 401(k) Allocation Model (401) is our premier investment model for 401(k) investors. It’s designed to provide a complete portfolio management solution for people investing through their employer-sponsored 401(k) plans.

The 401 Model actively adjusts between stock and bond funds based on market conditions. It shifts into high-growth investments during strong markets and moves to safer assets when risks increase, helping your portfolio stay ahead of market changes.

Anyone who invests through a 401(k) plan will benefit from following the 401(k) Allocation Model. The 401 Model will help you keep your investments in sync with changing market conditions.

The 401 Model is a comprehensive portfolio management solution designed to manage your entire 401(k) account. If you’re new to Model Investing, you may start by allocating only a portion of your account. As you gain confidence in the 401 Model’s performance, you can gradually transition to using it for full account management.

You can review the 401 Model’s historical backtested performance on the 401 Model Overview page. Be sure to check the risk metrics table, which highlights how the 401 Model’s strong performance is achieved without taking on additional risk. In fact, it reduces risk exposure compared to traditional investment strategies.

The 401 Model takes a fundamentally different approach to investing than traditional portfolio management. Rather than maintaining a fixed split between stocks and bonds regardless of market conditions, it actively monitors the performance of various stock and bond funds and adjusts allocations accordingly, shifting into the strongest-performing funds as market trends evolve.

You can see the latest 401 Model recommendations on the current recommendations page. Access requires a premium subscription.

The 401 Model is simple to use. First, you’ll need to identify which funds in your 401(k) plan align with those in the 401 Model – but don’t worry, this is a one-time setup, and we’ll take care of it for you. After that, you’ll receive a monthly alert when new 401 Model recommendations are available. Just log in to your account and update your allocations accordingly. For more information please see the 401 Model Tutorial.

Yes. People are living longer these days and it’s important that your money continues to work for you during retirement. Because the 401 Model has been able to generate higher returns than both stocks and bonds, and also avoid major losses during market crashes, we feel comfortable recommending it to investors of all ages. For more information on how to de-risk your portfolio during retirement, please see this article.

The 401(k) Allocation Model requires updates once per month to keep your portfolio aligned with market trends. Since the model is designed to limit unnecessary trades, your allocations may stay the same for multiple months. If there is no change in the recommendation, you can leave your investments as they are.

In general, no. Your 401(k) plan should allow you to make changes to your investment allocations free of charge as long as you do not violate your plan’s excessive trading policy. You should research your specific plan’s policy regarding this before beginning to use the 401 Model. Learn More

The 401 Model is able to recognize developing periods of stock market weakness and will typically move the portfolio to bonds during the early stages of a crash. This limits losses and is one of the primary benefits of the 401 Model. When the stock market begins to recover, the 401 Model will move back into stocks.

No. The 401 Model does not use target date funds. Model Investing recommends that all investors avoid using target date funds due to their inherent problems.

The best allocation for your 401(k) depends on where we are in the economic cycle. During expansions, stock funds typically offer the highest growth. In recessions or market downturns, bond and stable-value funds provide better protection. The 401 Model adjusts dynamically to keep your portfolio optimized.

We offer a variety of investment models for use outside of employer-sponsored 401(k) plans. If you’re a federal government employee or part of the military, please see our TSP Allocation Model. For taxable accounts, IRAs, and 529 plans, we recommend the Asset Rotation Model. And for investors looking for maximum growth we offer the Sector Rotation Model.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)