Dear Clients,

Amid the ongoing COVID-19 epidemic, and the tremendous volatility in the financial markets, we wanted to provide you with a market update and some suggestions on how to manage your portfolio through this crisis.

While this letter will focus on the financial and economic impact of COVID-19, we would like to take a moment to address the human side of the crisis. We recognize that nearly everyone around the globe has been or will be impacted by this unprecedented event, and our thoughts and prayers are with you.

We stand in awe and appreciation of the healthcare workers, local communities and governments around the world that are working to contain the virus. It is during our darkest times that the resilience and compassion of humanity shines through, and we expect this time to be no different.

The Importance of Staying Calm

Before we get into the state of the markets and our suggested response, we need to take a moment to emphasize the importance of remaining calm throughout this ordeal. The next three-to-six months are going to test your patience, and how you react (emotionally vs. non-emotionally) will play a large role in how successfully you and your portfolio make it through this period.

This is particularly important now because of the level of volatility we’re seeing in the markets. One-day moves in the 5-10% range are indicative of extreme uncertainty and a market that is searching frantically for direction. In many cases the moves are being exacerbated by high-frequency algorithmic trading, which makes up a significant portion of daily volume and can cause the market to shift very quickly in one direction or another.

It is absolutely okay to feel nauseous and sick to your stomach from this behavior, but it’s not okay to make drastic changes to your portfolio as a result of those feelings. You joined us here at Model Investing for a reason, and that is because our approach relies on making objective, data-driven investment decisions, as opposed to subjective, emotional ones.

We are monitoring the situation closely as it evolves and will be here for you throughout this ordeal. As you can imagine, we are receiving many inquiries from clients, so our response times are a bit longer than usual, but we are here to help.

Current State of the Markets

In order to set the stage, it’s important to recognize that both the U.S. and Global economy were on solid footing prior to the beginning of this pandemic. The U.S. economy was continuing to add roughly 200,000 jobs every month, jobless claims (a key leading economic indicator) were near 50-year lows, and the unemployment rate remained steady at 3.5%.

In addition, market-based surveys suggested that businesses were not only doing fine but were experiencing a mild uptick in demand. The Institute for Supply Management’s Services PMI (a key, survey-based measure of economic conditions that leads changes in the U.S. economy) registered 57.8% in February, which signaled the fastest rate of expansion for the services sector (which represents about 80% of economic activity) in about a year.

That, of course, all began to change over the last few weeks. In an attempt to mitigate the effects of the spreading coronavirus, governments and business have begun increasing containment measures. The sad catch-22 of this epidemic is that containment measures are inversely related with economic activity: the stronger the efforts at containment, the worst the effect on the global economy.

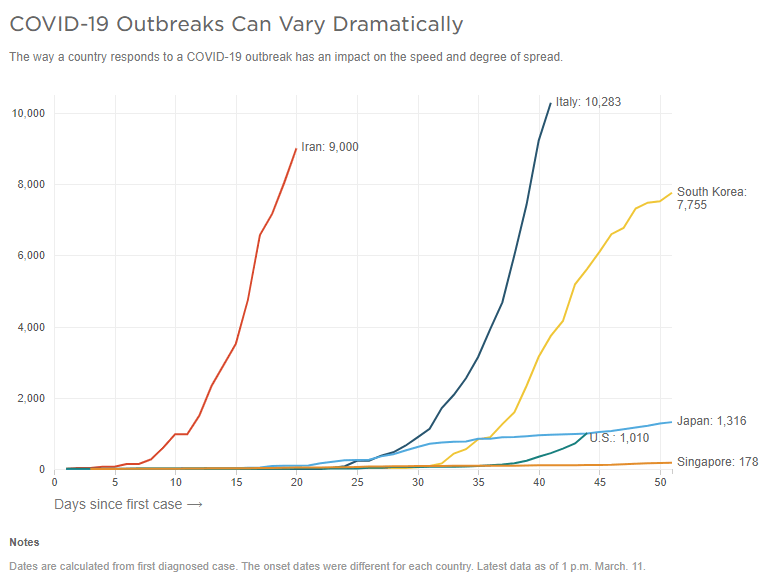

Thus far, some countries such as Italy and Iran, who erred on the side of preserving economic activity, found themselves way behind the curve as infections grew rapidly. Other countries, such as Singapore and Japan that implemented draconian containment measures immediately, have been able to contain the spread of the virus, but those efforts have cratered economic activity.

At present, the sad truth of the matter is that the global economy is experiencing the most abrupt and widespread cessation of economic activity in history. While many economic data points do not yet reflect this fact, some survey-based measures do.

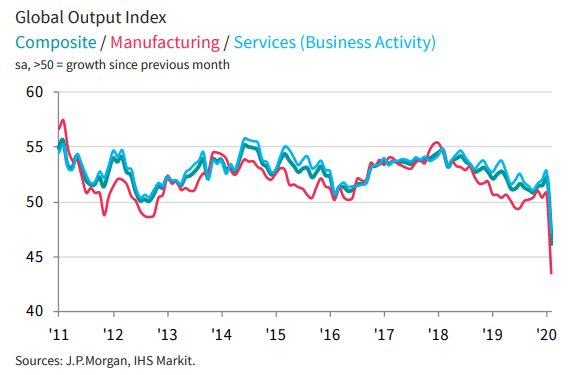

The chart below shows the J.P. Morgan Global Composite PMI (Purchasing Managers Index), which provides an inside look at evolving business conditions around the world. In this chart, the red line represents manufacturing, the light-blue line represents services, and the green line shows the composite (both manufacturing and services). Readings above 50 represent expansion, and readings below 50 represent contraction.

As you can see, both manufacturing and services have taken a big hit. The latest reading for the composite index was 46.1, which marks the lowest reading in 129 months and signals that economic activity is contracting.

What makes this situation so fluid and difficult to predict are the various levels of success that governments are having in containing the outbreak. As you can see in the following chart, some countries see cases go parabolic, while others are effective at containment.

At this point, making an accurate forecast regarding the spread of this pandemic is nearly impossible, and unfortunately, the value of asset prices in the short-term depends almost entirely on how this plays out.

Adding insult to injury, a recent breakdown in coordination between OPEC and Russia has led to a steep decline in oil prices, which has left oil trading beneath the level that most U.S. shale companies need to break even. Depending on how long oil prices are suppressed, this could cause a host of additional issues here in the U.S. involving failing oil companies and financial strain on those institutions that provided financing.

Altogether, in the last few weeks we’ve seen a flurry of punches to the global economy that will take some time to recover from. However, at the same time we’re also seeing unprecedented steps taken in terms of government support. The Federal Reserve has already provided an emergency rate cut and just recently (as of Sunday night) cut its benchmark rate to zero and launched a $700 billion quantitative easing program.

The Federal Government is also beginning to formulate a strong fiscal response and has enacted measures to ensure that businesses have the cash they need to avoid major disruptions from the virus. Ensuring that the vast majority of workers who need to take leave will be paid during their time off will also go a long way in helping to curb the overall decline in spending.

One additional item to keep in mind is that right now, with interest rates on most U.S. Treasuries sitting below 1%, the U.S. government has little restraint in terms of the costs of deficit spending. We believe they will do whatever is necessary to prop up the airlines, cruise companies, travel and leisure companies, and any other sector that comes under undue strain.

These are unique and uncertain times, but we will get through them, and we will be stronger as a result.

Suggested Changes to Your Portfolio

At this time, we believe the proper course of action regarding your portfolio is to continue following our investment model recommendations. The big declines that we’re seeing in the markets are likely to be reversed as conditions improve and government support begins to take effect.

While our recommendation is to maintain course, we realize that with all the fear and uncertainty out there, many of you may be tempted to shift some or all of your portfolio out of the stock market. This gut response is completely understandable, but we’d like to highlight some of the dangers of making a move like this.

Financial markets are forward-looking in nature, and discount approaching economic conditions as new information arrives. As a result, the stock market tends to bottom out when the outlook is the absolute worst. Unfortunately, this is also the time many individual investors capitulate and sell their holdings.

With travel restrictions in place, airlines cancelling flights, cruise ships remaining docked, professional sports suspending their seasons, schools across the nation closing, and most Americans being asked to work from home, it’s valid to wonder whether the outlook right now is as dire as it will get.

The problem with making an emotional decision to liquidate stocks is twofold. First, the decision to sell locks in losses that could be temporary and fleeting. Second, in order for the sell decision to have made sense, you must be able to get back into the market at lower prices than those which you sold at.

In the context of a typical economic cycle, where underlying economic fundamentals change incrementally, this is feasible. But in a market that’s moving as violently as this one is, where the outlook changes drastically every single day, that can be very hard to pull off.

If you absolutely cannot take the pain of being exposed to the market, consider moving a small portion of your portfolio (perhaps around 20%) to cash, a money market fund, or a short-term bond fund (such as BSV or the G Fund), and following our investment models with the remainder of your account.

On the other hand, if you have cash on the sidelines that was not invested, now is a great time to begin putting that money to work. As Warren Buffett says, “Widespread fear is your friend as an investor because it serves up bargain purchases.”

Our Outlook Moving Forward

As we stated earlier, both the U.S. and global economy were gaining momentum prior to the coronavirus taking hold. We are in the midst of a large exogenous shock that will require government intervention, but the economy will recover from this, and could recover quickly.

While comparisons between COVID-19 and the flu are generally very lacking, many of the top virologists believe that COVID-19 may display a seasonal pattern similar to that of the flu, with cases declining during spring and summer months. If that turns out to be the case, and containment efforts achieve some level of success, it’s possible that global economic activity could begin rebounding very soon.

In addition, interest rates have fallen to historic lows, and that will place upward pressure on stock valuations (and therefore prices). Once this panic has subsided, investors will go back to valuing stocks based on the present value of future cash flows. In making that calculation, lower interest rates imply a higher present value, and so we should see strong support for stocks moving forward.

Altogether, we believe that the stock market will begin to gather itself shortly and that prices will be notably higher by mid-to-late summer. We know that seems like a long time from now but hang in there. As the saying goes, this too shall pass.

Throughout all of this, we will continue monitoring incoming data closely and will provide updated analysis and recommendations as appropriate. In the meantime, we are here to answer any questions that you may have about evolving economic conditions, the market, or any adjustments to your portfolio. Please direct those questions to our support staff at support@modelinvesting.com.

Thank you for your continued support, and we wish you the best during these uncertain times.

– The MI Team

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing