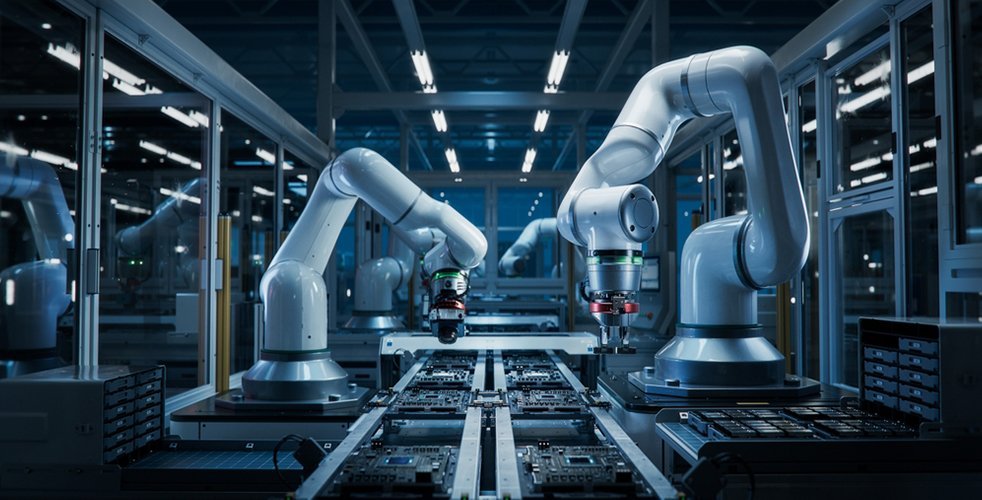

The Importance of Automation

Keeping our long-term goals in mind at all times requires an immense amount of effort. That’s why we’re often sidetracked by short-term wants and needs. Automating certain parts of the investment process is akin to putting guardrails around your financial ability to misbehave … it’ll keep you out of trouble and ensure you stay on track for long-term success.