The Ideal toy company came out with a board game in 1963 called Mouse Trap. The game’s premise was simple: cooperate with fellow players to construct a Rube Goldberg-like mouse trap, then turn against them, using the newly constructed trap to ensnare your opponents’ mice.

While the game itself was enjoyable, the real fun came simply from constructing and operating the trap. The turn of a handheld crank would cause a series of events to occur in sequence. When everything worked right (which was rarely the case), an elaborate chain reaction would unfold that would lead to a cage falling on top of your opponent’s game piece. Victory!

What made the mouse trap in the game so enticing was the notion that if set up correctly, a very small input (turn of a crank) would initiate a fully automated process that would win the game for you. It gave you the feeling that you had accomplished a great feat, even though you really didn’t do much other than put the mouse trap together, and set it in motion.

The Benefits of Automation

What Mouse Trap taught us as kids is invaluable for us as adults: specifically, that automation can make our lives much easier, and allow us to reach our goals with little to no effort. Once the “machine” is built, all we have to do is set it in motion, and make sure it keeps running.

In other words, financial success isn’t about luck, or slaving away to get that next promotion; it’s about engineering. It’s about creating a machine that can take a small input (your current income) and accomplish your primary goal (creating an investment portfolio that will pay for your retirement) with little to no effort on your behalf.

Building this machine is actually rather simple, considering the host of tools we have available to us these days, but before we get into that, let’s get serious for a moment.

What we’re really doing when we automate our finances is this: We’re putting systems and processes in place that limit undesirable short-term behavior, and promote desirable long-term behavior.

Keeping our long-term goals in mind at all times requires an immense amount of effort. That’s why we’re often sidetracked by short-term wants and needs. Automating certain parts of the investment process is akin to putting guardrails around your financial ability to misbehave … it’ll keep you out of trouble and ensure you stay on track for long-term success.

The unfortunate reality is that left to our own devices, we find it all to easy to come up with short-term “needs” for money that works its way into our pockets. Whether it’s the vacation we haven’t had in years, or the amazing sale we couldn’t pass up, we’re all experts at rationalizing unnecessary discretionary spending. With automation, that’s no longer a factor.

The Basic Automation Flowchart

You can take the concept of financial automation as far as you want, but you’ll find that just covering the basics is more than enough, and will give you incredible peace of mind. So how do we set up a basic level of automation? I’m glad you asked.

For our purposes here, we’re going to discuss automating the part of the process that takes your income and disperses it to your investment accounts. Once the money is in your investment accounts, you can use another automated process, such as following our Investment Models, to ensure that your balance grows safely over time.

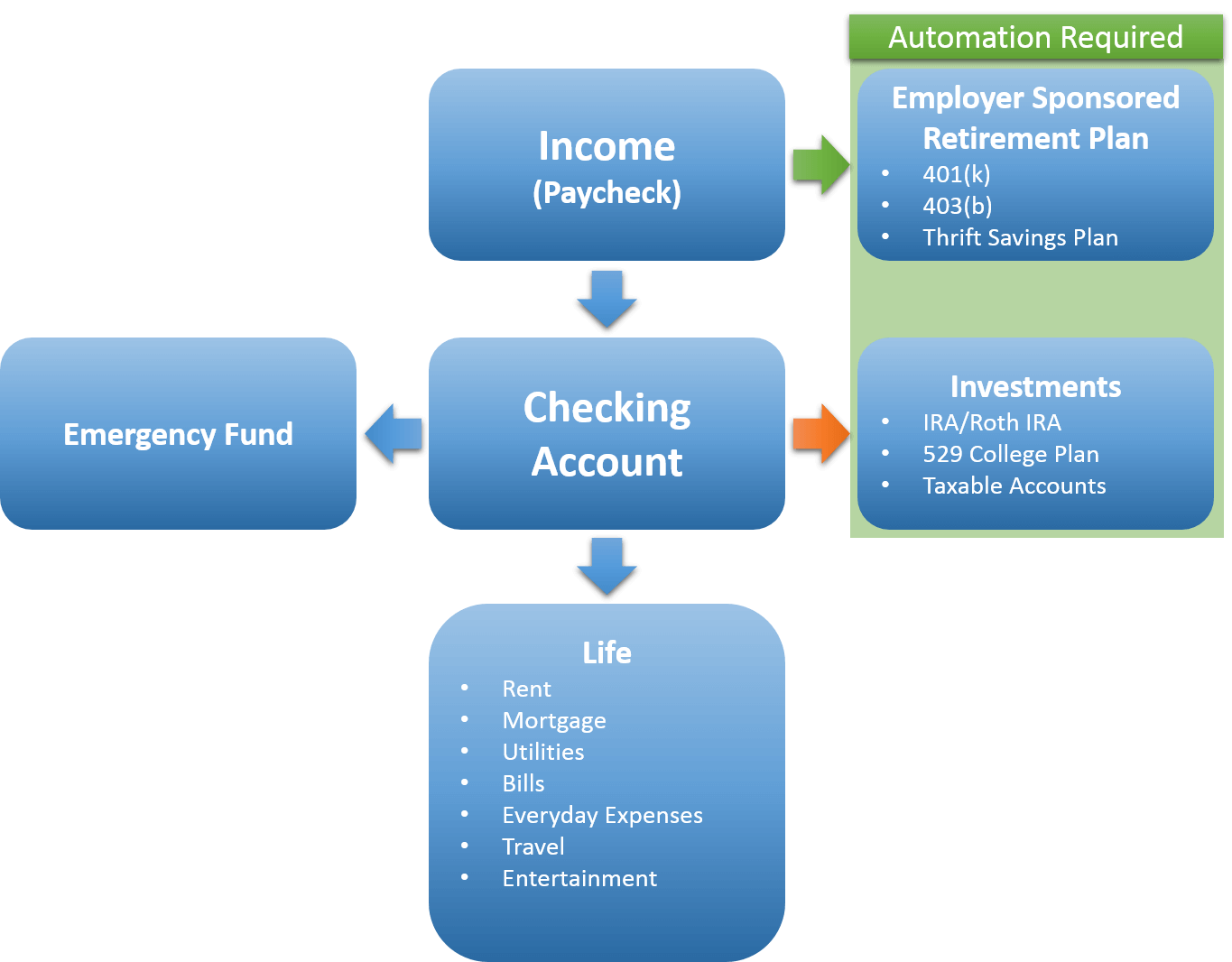

The flowchart below outlines how money should generally flow through your accounts. The first step in automating the process of saving for retirement is easy … enroll in your employer sponsored retirement plan, if available. These types of plans have different benefits and drawbacks, but one of their primary benefits is that they’re already automated for you. Once you enroll in your company’s plan, the company will transfer money into your retirement account automatically every pay period.

If you have access to an employer sponsored retirement plan and you’re not using it, you’re making a poor decision. This is especially true if your company offers any type of match. If they do, then not only are you not taking advantage of an automated retirement plan, you’re leaving free money on the table. Hopefully you’re not in this situation, but if so, it’s the first item you should address.

Once you’ve set up and are contributing at least enough to your employer sponsored plan to receive their full match, the next step is to do the same with regular investment accounts. In this case, the funds will come directly from your primary checking account.

Notice in the diagram above that “Investments” are at a higher level of the flowchart than “Life.” This is exactly where most people get into trouble. The vast majority of us spend what we need to on living expenses, and then invest the rest. The problem with this approach is that there is rarely anything left over at the end.

Our expenses have a natural tendency to rise to match our income. If we don’t prioritize and set aside our investment funds first, there’s a very good chance we’ll have nothing left over to invest. This is the whole idea behind “paying yourself first.” The first accounts that get paid are your investment accounts … then, we deal with life.

If you can approach saving this way you’ll find that it has a dramatic effect on your overall behavior. For example, you’ll never feel any guilt spending money on daily pleasures because you know that you’ve already paid yourself! You’ll also develop a tremendous amount of confidence as you see your savings increase month, after month, after month.

Setting Up Automated Deposits

Before you can set up automatic deposits, you’re going to need to open the right type of investment accounts. While that’s beyond the scope of this article, and will be covered separately, the good news is that once those accounts are in place, the automation becomes very simple.

Most brokerage accounts and custodians have features in their platforms that allow you to set up recurring deposits directly from within their system. You provide your checking account information and then determine both the cadence for the deposits (weekly, monthly etc.) as well as the amount. Ongoing deposits are typically made in the form of ACH transfers, and are almost always free.

Even if you feel like you’re not in a position where you can contribute much to retirement accounts beyond your employer’s plan, I would encourage you to still set up the accounts, as well as the ongoing transfers. You can set the transfer amount to something small like $10 per month; the point is to get the automation in place! You can always increase your contributions later. (Note: if you’d like to see how much money to need to set aside each month to reach different retirement goals, please see our Retirement Calculator.)

As you’re hopefully starting to realize, all we’re trying to do here is put in some basic plumbing that connects your primary checking account with your retirement accounts. Once that plumbing is in place, you can flow as much money through the pipes as you want. The point is that once this is set up, that process happens automatically without you ever having to think about it. Your mouse trap is complete!

Additional Tools to Help You Automate

It’s rare, but possible that you will find yourself in a situation where the company that holds your investment accounts does not offer the ability to setup recurring deposits directly through their system. If that’s the case, keep in mind that you may be able to accomplish the same thing by using the “bill pay” feature of your checking account.

Most banks and credit unions now offer the ability to pay bills automatically by setting up the same type of recurring ACH transfers outlined above. In addition to paying bills, this feature can be used to “push” funds from your checking account into your investment accounts. In this case, the recurring deposit schedule would be managed through your bank or credit union, rather than through the firm that holds your investment accounts.

Recurring ACH transfers remain one of the easiest and best ways to automatically fund your investment accounts, but new tools are being developed that take a novel approach to this. Firms like Qapital, Acorns, Digit and Stash offer various ways of “forced” saving though things like rounding purchases up to the nearest dollar and depositing that in an investment account, or setting up events (such as the purchase of a latte), that trigger contributions.

These types of apps don’t do much other than gamify the process of saving, and often charge fees that can eat away at your balance, but if that’s what it takes to get folks to automate their savings, then we’re all for it.

Whichever route you decide to go, keep in mind that the more “out of sight” and “out of mind” the savings process is, the more likely you are to stick with it. So take some time now to set up those recurring transfers, then sit back and relax… As long as you don’t disrupt that process, you can rest assured you’ll wind up with a healthy retirement and some peace of mind to boot!

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing