The Thrift Savings Plan (TSP) is one of the best retirement plans in existence, offering federal employees and military personnel a tax-advantaged way to build wealth. Contributing regularly to your TSP is essential, but how you allocate those contributions and manage your existing investments can have an even greater impact on your long-term results.

Markets are dynamic, and your TSP allocations shouldn’t remain static. By updating your allocations regularly, you can optimize your portfolio to take advantage of growth opportunities and protect your hard-earned savings during downturns. Whether you’re using a strategy like the TSP Allocation Model or customizing your approach, knowing how to adjust your TSP account on TSP.gov is a critical step in actively managing your retirement.

In this article, we’ll walk you through the exact process of updating your TSP allocations, ensuring your investments are aligned with your financial goals and market conditions. Let’s get started!

Updating Your Allocations

Step 1: Log in to your account

Head on over to tsp.gov and log in to your TSP account.

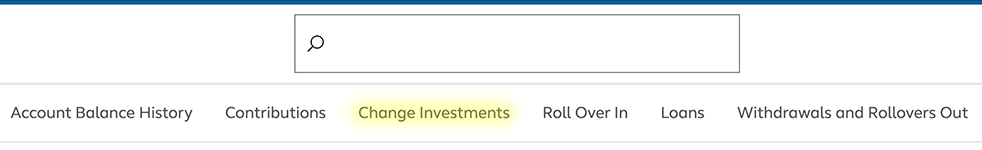

Step 2: Click on “Change Investments”

On the top menu bar click on Change Investments.

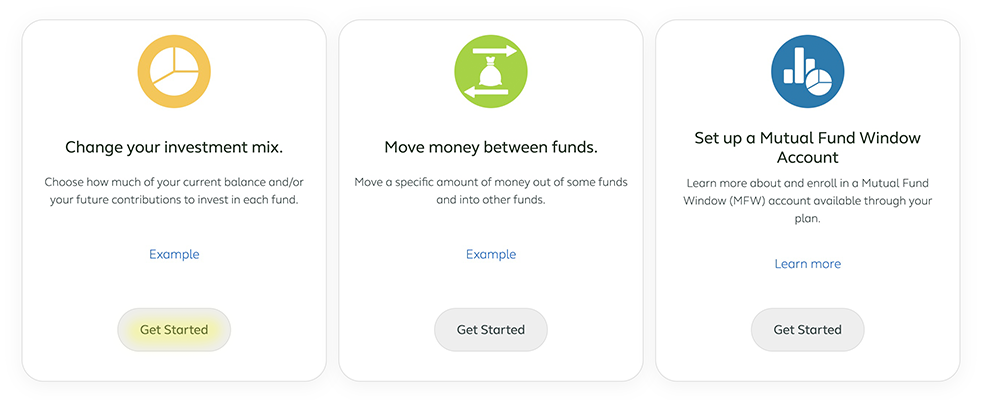

Step 3: Select “Change Your Investment Mix”

Find the option that says, “Change your investment mix” and click on the Get Started button beneath that option.

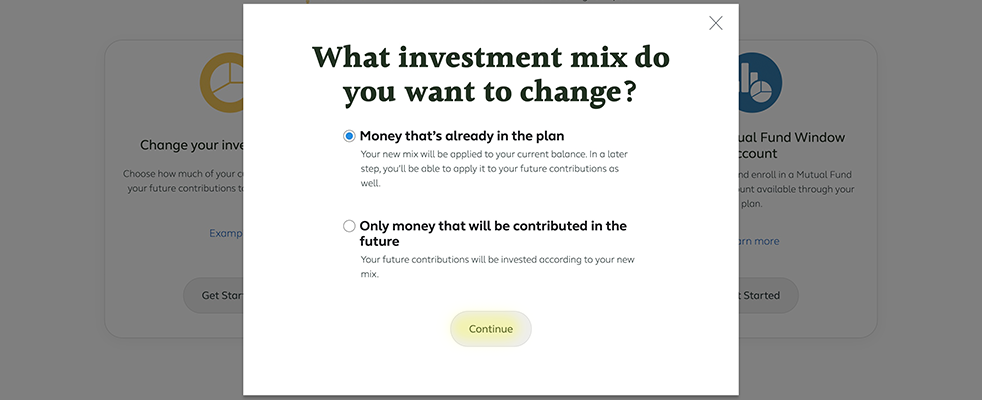

Step 4: Choose “Money that’s already in the Plan”

When the pop-up appears, select the option for Money that’s already in the plan and click Continue.

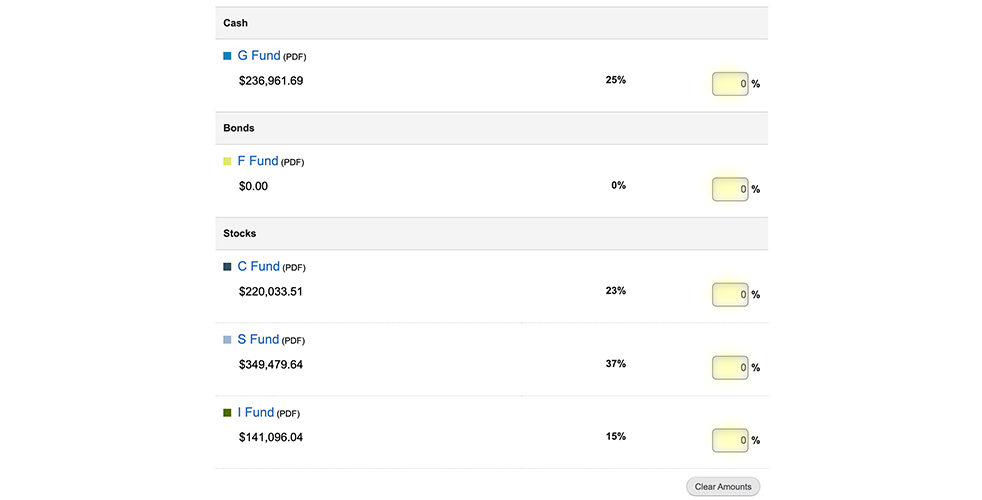

Step 5: Choose Your New Fund Mix

The next page will allow you to choose your new fund mix. It contains a table that lists each fund and allows you to enter a percentage next to it. This is where you’ll enter the allocation percentages from the TSP Model Current Recommendations (or whichever strategy you’re using). Keep in mind that the total allocation percentage must equal 100%. Leave the allocations for any funds not included in the TSP Model recommendations at 0%. Once finished, click Continue at the bottom.

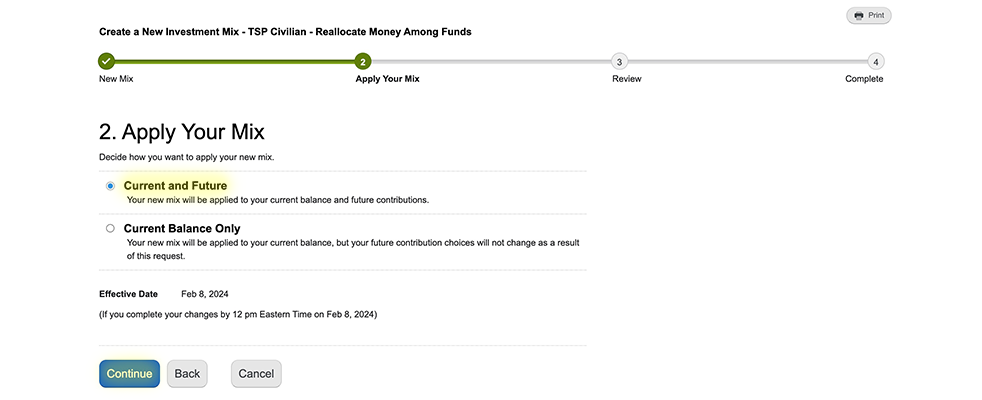

Step 6: Apply Changes

Select the Current and Future option to apply changes to your current balance and future contributions, and then click Continue.

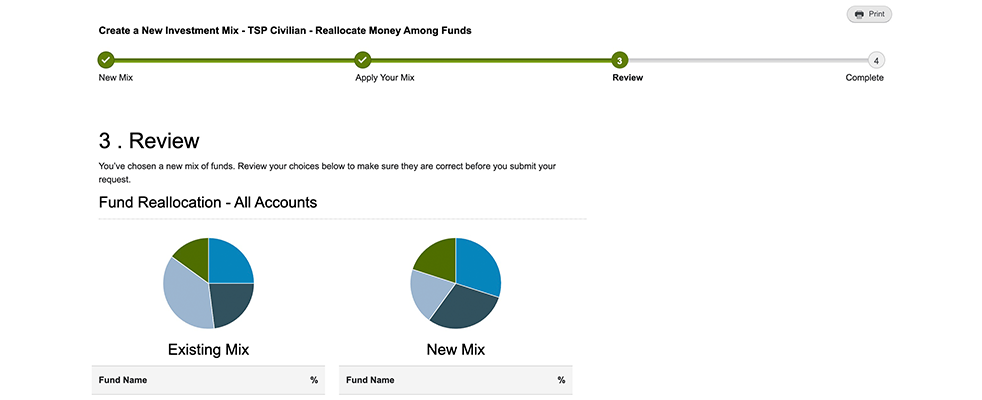

Step 7: Review and Submit

You’ll now be asked to review your new allocations. Carefully make sure that the New Mix matches the TSP Model recommendations, and then click Submit.

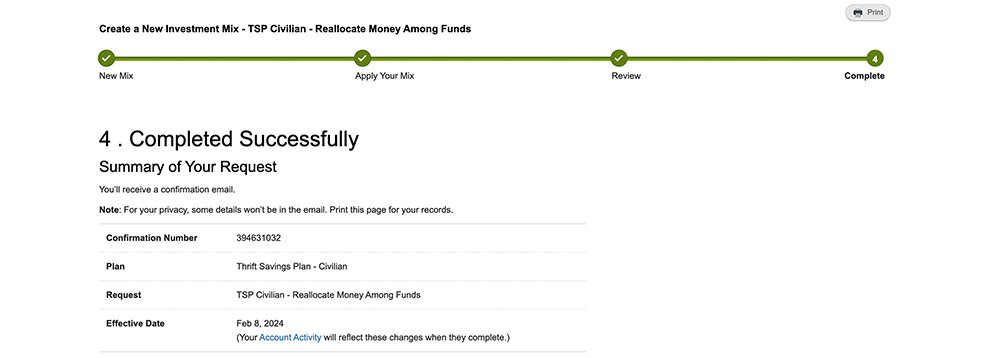

Step 8: Receive Confirmation and Celebrate

On the next page you should see confirmation that the request was processed successfully. You should also receive a confirmation email from TSP.gov once the process is complete.

Congratulations! That’s it, your updated allocations will typically take effect the following business day and you have successfully completed the interfund transfer.

A Few Things to Keep in Mind

The Two Interfund Transfer Limit: TSP participants are allowed only two interfund transfers (IFTs) per calendar month. This means you can redistribute your existing account balance between funds twice during a given month. Any subsequent transfers within the same month are restricted to moving funds into the G Fund (Government Securities Investment Fund) only. This rule is in place to discourage excessive trading, so it’s essential to plan your transfers carefully and follow your strategy with discipline.

To make the most of your two IFTs:

- Wait for the latest TSP Allocation Model recommendations or other trusted strategies before making changes.

- Combine adjustments for all funds into a single transfer whenever possible to avoid wasting one of your two monthly IFTs.

Timing Matters: TSP transactions, including interfund transfers, are processed at the end of the business day. This means any changes submitted before 12:00 PM Eastern Time will be processed the same day, and changes submitted after that time will be processed the following business day. Be sure to account for this processing window, especially if you’re aligning with specific market events or strategy updates.

Staying Consistent with Your Strategy: Successful TSP management is about consistency. Whether you’re following the TSP Allocation Model or another approach, it’s important to stick to your plan. Avoid making emotional decisions based on short-term market fluctuations, and rely on your chosen strategy’s recommendations to guide your allocations.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See PricingPosted in