Ready to raise your investing IQ?

Sign up for our Free Newsletter to access the best investment information money can’t buy.

The stock market is divided into 11 sectors, each representing a key area of the economy. At different times, certain sectors outperform others, making them the best places to invest. Instead of holding broad-market funds, you can use a sector investing strategy to achieve faster growth.

The Sector Rotation Model (SRM) is designed to help you do just that. It uses dynamic sector rotation to reallocate your portfolio to the best-performing sectors each month, keeping your investments focused on high-growth areas of the market.

Due to its higher turnover, the SRM works best in tax-advantaged accounts like IRAs and Roth IRAs, where frequent adjustments won’t trigger short-term capital gains taxes. If you’re looking for a proven way to outperform the market, the SRM offers a strategic edge over traditional buy-and-hold investing.

Find Out How to Use the SRM to Manage your Accounts

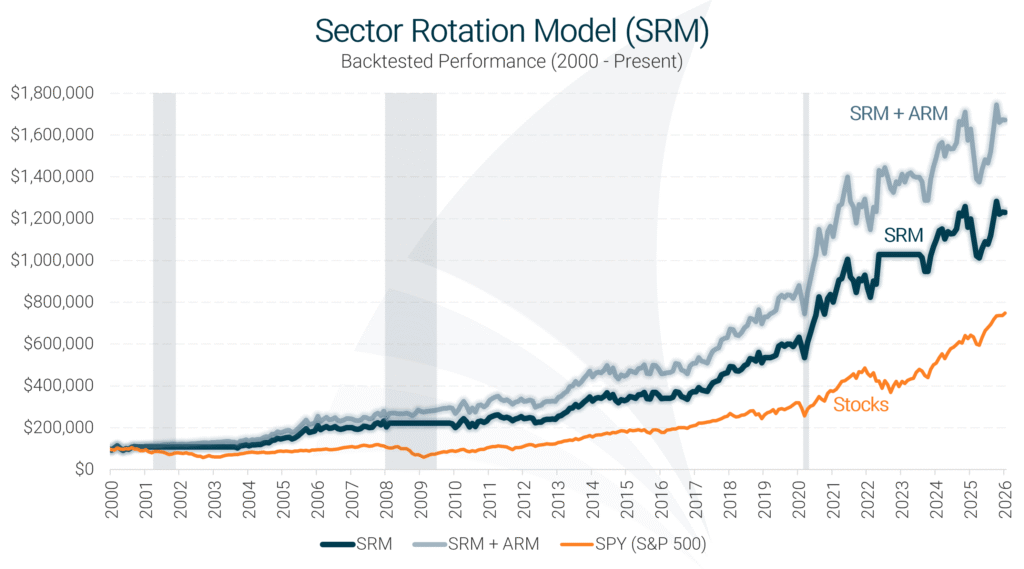

The Sector Rotation Model is our highest-performing investment model, delivering exceptional long-term performance and significantly outpacing the S&P 500 over the past 26 years. This success is driven by its ability to identify and allocate to the strongest-performing sectors each month. The chart below shows how the SRM has performed compared to SPY (an S&P 500 index fund).

Model performance represents total returns and includes reinvestment of dividends and interest. No management fees or transaction costs are included. Historical performance is not an indication or guarantee of future performance.

The data below highlight why the SRM is a superior strategy for investors seeking market-beating growth without taking on additional risk.

| Sector Rotation Model (SRM) Performance Metrics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Strategy | Compound Annual Return | Alpha1 | Beta1 | Standard Deviation | Maximum Drawdown | Sharpe Ratio | Sortino Ratio | Treynor Ratio |

| SRM | 10.14% | 6.71% | 0.27 | 12.3% | -19.6% | 0.71 | 2.51 | 0.32 |

| SRM + ARM | 11.44% | 8.32% | 0.22 | 11.5% | -19.6% | 0.87 | 5.25 | 0.45 |

| SPY (S&P 500) | 7.99% | 0.00% | 1.00 | 17.9% | -50.8% | 0.43 | 0.48 | 0.08 |

| Data for 26-Year Period (2000 – 2025) 1 Benchmarked against the S&P 500 |

||||||||

View Full Explanation of the SRM Performance Metrics

The SRM provides clear, monthly recommendations, helping you strategically allocate your investments using one of the most effective sector rotation strategies available. Here’s how it works:

Whether you’re looking to maximize equity returns or protect against downturns, the SRM keeps your portfolio aligned with current market conditions for superior performance.

Experience the Thrill of Higher Returns – Starting Today!

Unlike traditional buy-and-hold investing, the SRM continuously reallocates capital to the strongest-performing sectors of the market. This precision targeting allows for higher growth potential, while avoiding the drag of underperforming sectors. When market conditions worsen, the SRM shifts to cash for protection, minimizing risk and enhancing portfolio stability.

This model isn’t just about keeping pace with the market – it’s designed to outperform it. Whether you’re looking to maximize growth, reduce risk, or maintain a disciplined investment strategy, the SRM provides a proven, data-driven approach to help you take control of your financial future.

Discover how other investors are using the Sector Rotation Model to transform their portfolios:

The Sector Rotation Model (SRM) is designed for investors who want more than just average market returns. By consistently reallocating to the strongest-performing sectors of the S&P 500, the SRM serves as an effective ETF sector rotation strategy, offering an active, results-driven approach that seeks to outperform traditional buy-and-hold strategies.

While the SRM carries a higher-risk profile, its long-term performance speaks for itself. For investors seeking growth, flexibility, and an edge over static market strategies, the SRM offers a proven path to superior returns. Don’t settle for average returns – take control of your portfolio with the SRM today.

Step up your sector rotation strategy today – sign up now and start your free trial!

Watch Your Portfolio Grow Faster than Ever – Start Now!

The Sector Rotation Model (SRM) is a high-performing ETF Sector Rotation Model designed to identify and invest in the strongest-performing sectors of the stock market. By dynamically reallocating investments each month, the SRM ensures your portfolio remains focused on sectors with the highest growth potential.

During periods when stocks are rising, different sectors of the market take turns leading the way higher. The Sector Rotation Model (SRM) analyzes each sector independently to identify and invest in the strongest performing sectors of the market. Learn More

The Sector Rotation Model (SRM) is ideal for investors seeking higher returns by actively allocating to the strongest market sectors. Suitable for all investors, it can be a valuable addition to any portfolio. The SRM is designed for those willing to take on slightly more risk in exchange for the potential for greater long-term growth.

When compared to the Asset Rotation Model, the SRM achieves higher returns at the expense of additional volatility. As a result, we recommend using the ARM (or our 401 Model or TSP Model) for the majority your portfolio, and using the SRM for the balance. This ensures adequate diversification while still enhancing your portfolio’s growth potential.

You can view the SRM’s historical backtested performance on the SRM Overview page. Be sure to review the risk metrics table, where you’ll see that the SRM’s sector investing strategy has consistently outperformed the S&P 500 while exposing the portfolio to significantly less risk. This highlights the model’s ability to deliver superior returns without unnecessary volatility.

The SRM’s sector allocation strategy leverages proprietary technology to continuously identify and invest in the top-performing sectors as they cycle through periods of strength. By dynamically reallocating capital to the strongest sectors, the SRM captures market upside more effectively than traditional strategies. When broader market conditions deteriorate, the SRM can shift to cash, helping to protect your portfolio from major downturns.

You can view the latest SRM recommendations on the current recommendations page. A premium subscription is required for access.

Using the SRM is simple. Each month, you’ll receive an alert when the latest SRM recommendations are posted. Just log in to your brokerage account and update your investments accordingly. For a step-by-step guide on implementing the model, visit the SRM Tutorial.

Absolutely. With longer life expectancies, it’s essential that your investments continue to grow throughout retirement. The Sector Rotation Model (SRM) has historically outperformed both stocks and bonds while also avoiding major losses during market downturns. This makes it a strong option for retirees looking to preserve and grow their wealth. For more information on how to de-risk your portfolio during retirement, please see this article.

In most cases, no. The Sector Rotation Model (SRM) is designed to use low-cost ETFs with minimal trading, and most brokerage firms no longer charge commissions on ETF trades. This means you can follow the SRM’s recommendations without worrying about extra costs, allowing you to keep more of your returns and maximize long-term growth.

The Sector Rotation Model (SRM) is designed to detect early signs of market weakness and typically moves to cash before major downturns unfold. This proactive approach helps protect your portfolio from significant losses. When the SRM shifts to cash, we recommend following the Asset Rotation Model (ARM) with those funds until the SRM signals a reentry into the stock market.

Yes, to a degree. The Asset Rotation Model (ARM) and Sector Rotation Model (SRM) complement each other by aligning their stock market exposure. When the ARM signals an investment in stocks, you can use the SRM to identify and allocate to the top-performing sectors for maximum growth. Conversely, when the SRM moves to cash, the ARM can help determine whether bonds provide a more stable alternative for that capital, ensuring your portfolio remains optimized in any market environment.

This refers to a combined strategy that leverages both the Sector Rotation Model (SRM) and the Asset Rotation Model (ARM) to optimize returns while managing risk. Specifically, it means following the SRM when it is invested in the stock market to capture sector-based growth and switching to the ARM when the SRM moves to cash.

Many factors can influence this, but in bull markets, sectors like Technology, Consumer Discretionary, and Financials often lead as economic growth boosts spending and corporate profits. In bear markets, defensive sectors such as Utilities, Consumer Staples, and Health Care tend to be more resilient due to steady demand. Since no sector consistently outperforms, the SRM continuously analyzes market trends and reallocates to the strongest-performing sectors each month.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)