Your 401(k) isn’t just a retirement account! It’s the engine driving your future financial security.

But here’s the catch: Simply putting money in isn’t enough. Over time, markets shift, winners keep winning, losers lag behind, and your portfolio quietly drifts off course.

That drift may seem harmless, but it can expose you to more risk than you’re comfortable with or slow your growth when you can least afford it.

That’s where rebalancing comes in.

Think of it as a tune-up for your 401(k): it brings your investments back in line, keeps your risk under control, and ensures your money is working toward your goals instead of wandering off track.

Why Rebalancing Your 401(k) Matters

When you first set up your 401(k), you likely chose a mix of investments, maybe 70% stocks and 30% bonds, or something similar. That mix is called your asset allocation, and it’s designed to match your goals and risk tolerance.

But here’s the challenge: markets don’t stay still. If stocks have a strong year, that 70% stock allocation might grow to 80% or more, leaving you exposed to more risk than you planned.

On the flip side, if bonds underperform, you could be under-invested in assets that help protect you during downturns.

Rebalancing corrects this natural drift, bringing your portfolio back to your intended mix so you stay on course.

Did you know? Traditional age-based allocations don’t account for inflation, interest rates, or recession risk. That’s why more investors are shifting from static strategies to tactical allocation, which is a flexible approach that adjusts based on real-world conditions.

Benefits of Rebalancing Your 401(k)

Rebalancing your 401(k) is one of the most effective ways to keep your retirement strategy on track. Check out these amazing benefits:

1. Keeps Your Portfolio Aligned With Long-Term Goals

Over time, market changes can push your portfolio away from your original risk and return targets. Regular rebalancing brings allocations back in line so your investments continue to match your retirement timeline.

2. Reduces the Risk of Major Losses During Market Downturns

Without rebalancing, you may end up overweight in stocks right before a recession or too conservative during a bull market. By using either a schedule or automatic portfolio rebalancing, you can limit exposure to risky assets when the market turns volatile.

3. Builds Discipline and Removes Emotional Investing

Many investors panic-sell during downturns or chase performance after rallies. Rebalancing 401(k) accounts on a rules-based system ensures adjustments are based on data and not emotions. This helps you stick to your plan even in uncertain times.

4. Improves Long-Term Growth Potential

Knowing how to rebalance investments properly means capturing gains when markets rise and protecting capital when they fall. This balance gives your money the best chance to grow steadily over decades, without constant guesswork.

In short, rebalancing is like routine maintenance for your financial future. Just as you wouldn’t drive your car for years without a tune-up, you shouldn’t let your 401(k) drift too far without bringing it back into balance.

Now that you understand why rebalancing matters, the next step is to get clear on what it actually means in practice. That way, you’ll not only see the value but also know exactly how the process works inside your 401(k).

What Does It Mean to Rebalance My 401(k)?

Rebalancing your 401(k) simply means adjusting your investments back to the mix you originally chose (or to a new mix that reflects your updated goals or factors in changing market conditions).

Think of your portfolio like a recipe.

If you start with 70% vegetables and 30% grains, but over time the vegetables keep growing faster, your plate might suddenly be 85% vegetables and only 15% grains.

It’s no longer the balanced meal you intended.

Rebalancing is like scooping some veggies off and adding more grains back in so the meal stays aligned with your health goals.

In your 401(k), this means:

- Selling some of the investments that have grown beyond their target percentage.

- Buying more of the ones that have fallen behind.

This process may feel counterintuitive (selling winners and buying laggards), but it keeps your risk level consistent. Without it, your portfolio could become overly aggressive or too conservative without you realizing it.

How Often Should I Rebalance My 401(k)?

Wondering how often you should rebalance your 401(k)? You’re not alone.

The right timing is critical: Rebalancing too frequently can trigger unnecessary stress or costs. But if you wait too long, your portfolio could drift far from your intended risk level, potentially exposing you to downturns or slowing your long-term growth.

That’s why financial experts recommend setting clear rules instead of reacting emotionally to every market move.

There are two different approaches when it comes to rebalancing:

- Time-based rebalancing: Rebalance on a consistent schedule, like monthly, quarterly, or semi-annual.

- Threshold-based rebalancing: Rebalance only when your asset mix drifts beyond a certain level, typically 5% or more off target.

These methods will help you stay disciplined, manage risk, and avoid second-guessing every market move.

Let’s walk through exactly how to do it.

How to Rebalance Investments: A Step-by-Step Guide

Rebalancing sounds complicated, but in practice, it’s more about consistency than complexity. Here’s a simple roadmap you can follow when rebalancing your 401k.

1. Review Your Target Allocation

Start by reminding yourself what mix of stocks, bonds, and other investments you originally wanted. For example, maybe you decided on 70% stocks and 30% bonds. This target is your anchor. It reflects your risk tolerance, time horizon, and personal goals.

Something important to consider:

Many traditional target allocations are based almost entirely on age, for example, “subtract your age from 100” to get your stock percentage. While this age-based approach works as a starting point, it completely ignores real-world conditions like inflation, interest rates, or recession risk.

That’s the shortcoming of static allocations — they stay the same no matter what the markets are doing. This can be problematic, especially in today’s fast-changing economic environment.

If you want your allocation to reflect both your goals and market realities, it’s worth exploring the difference between Strategic Vs. Tactical Allocation to help you understand how combining both can give you an edge.

2. Check Current Percentages

Look at your most recent 401(k) statement. You’ll often see that one category has grown much larger than intended. If stocks were meant to be 70% but now sit at 82%, you’re more exposed to market swings than you planned.

3. Decide If It’s Time to Rebalance

Most experts recommend rebalancing your 401k either:

- On a schedule (monthly, quarterly, or semi-annual), or

- When allocations drift too far (usually by 5% or more from target).

This avoids constant tinkering while still keeping your risk in check.

4. Adjust Your Portfolio

Here’s where you take action:

- Sell a portion of investments that are overweighted.

- Redirect into areas that are underweighted.

For example, if stocks have grown too much, sell some shares and buy more bonds until you’re back near your original plan.

5. Automate When Possible

Many 401(k) plans now offer automatic portfolio rebalancing. This feature quietly adjusts your mix at set intervals (quarterly or annually), so you don’t have to remember or worry. If your plan offers it, switching it on can save you time and stress.

Caution! Automatic rebalancing only works if your target allocation is still right for your current goals and the current economic environment. If you haven’t updated your mix in years, automation could lock you into an outdated strategy. Or if the economy is beginning to enter a new phase, those target allocations might not be ideal. Always review your allocations first before turning auto-rebalance on.

Make your rebalancing simple, let our 401(k) Allocation Model do the heavy lifting.

Now that you know the steps, it’s just as important to be aware of the pitfalls. Even with a good plan, many investors stumble when rebalancing their 401(k). Let’s look at the most common mistakes and how to avoid them.

Common Mistakes People Make When Rebalancing a 401(k)

Even with the best intentions, many investors fall into traps that quietly hurt returns or increase risk. Here are the most frequent mistakes and how to avoid them.

Mistake 1: Ignoring Market Shifts

Some investors set their allocation once and leave it untouched for decades. While this feels “safe,” it can leave you overexposed to assets that are struggling (like stocks during a long recession).

Better approach: Review at least once a year, even if you prefer a long-term strategy. The market changes, and your mix should still match your goals.

Mistake 2: Reacting Emotionally to News

Market dips trigger panic-selling, while sudden rallies tempt people to chase performance. These emotional moves often mean selling at the wrong time and missing rebounds.

Better approach: Use rules, not feelings. Tactical investors rely on data-driven signals to adjust allocations, a process that keeps emotions out of the equation.

Mistake 3: Misjudging Your Risk Tolerance

It’s easy to say you’ll stick with a plan until a 25% drop actually happens. If the stress causes you to bail out, the damage is worse than if you’d chosen a more conservative path.

Better approach: Test your comfort level before committing. Ask yourself how you’d react if your portfolio lost a quarter of its value. If the answer is “not well,” adjust your allocation now rather than later.

Mistake 4: Over-Diversifying or Under-Diversifying

Putting money into too many funds can water down returns. But concentrating in just one or two areas can expose you to big risks.

Better approach: Aim for balance. Diversify across asset classes, but keep focus where growth is likely to come from.

Mistake 5: Confusing Activity with Progress

Constantly tinkering with your account may feel like you’re “doing something,” but without a clear strategy, frequent moves can mean higher costs and lower results.

Better approach: If you want tactical flexibility, tie changes to objective signals — not gut instinct.

Still feeling unsure about when or how to rebalance? Don’t worry! You’re not alone. Many investors face the same confusion, which is exactly why Model Investing exists.

Do you worry about not having the right 401(k) allocations?

Stop second-guessing your 401(k) moves, let our rules-based models guide you

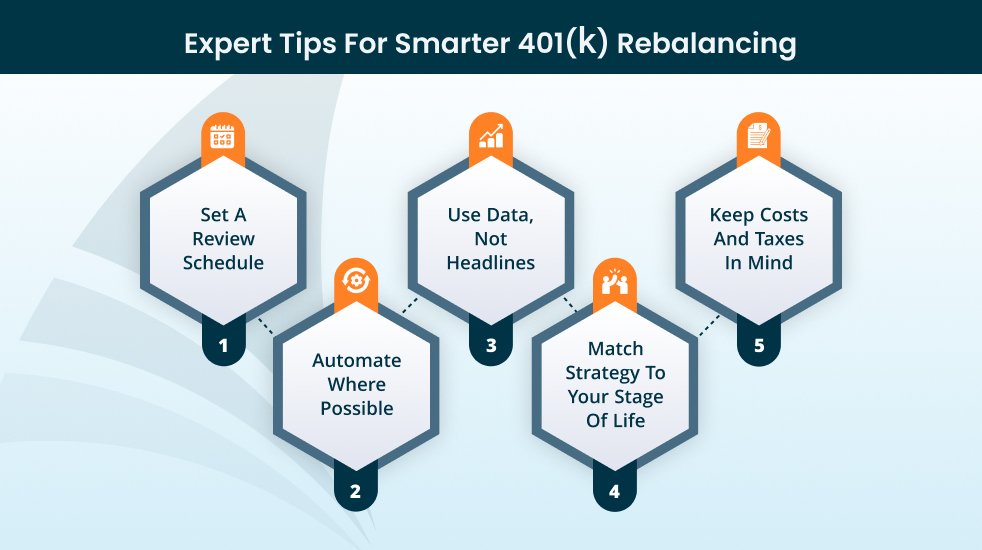

Expert Tips for Smarter 401(k) Rebalancing

Knowing the mistakes is still half the battle. The other half is building habits that protect your portfolio and give you steady growth. Here are expert-backed tips to help you rebalance your 401(k) account with confidence.

1. Set a Review Schedule (and Stick to It)

Don’t wait for panic headlines to decide when to rebalance. Choose a consistent schedule monthly, quarterly, or semi-annual — and stick with it. This avoids knee-jerk reactions and ensures your portfolio always aligns with your goals.

If “should I rebalance my 401k” crosses your mind only after a crash, you’re already behind. A steady schedule prevents this.

2. Automate Where Possible

Most retirement plans now offer automatic portfolio rebalancing tools. This feature realigns your account to your chosen mix at set intervals, no extra work needed.

Why it matters: Automation keeps you disciplined and prevents emotion-driven mistakes, while saving you time.

3. Use Data, Not Headlines

Headlines are designed to grab attention, not to guide investment choices. Instead, rely on objective signals: market trends, moving averages, or economic indicators.

Example: Instead of reacting to a one-day market dip, look for broader shifts like a prolonged downtrend or rising interest rates.

4. Match Strategy to Your Stage of Life

Rebalancing looks different at 30 vs. 60.

- Younger investors can stay heavier in growth assets and use rebalancing to stay aggressive but balanced.

- Nearing retirement, rebalancing shifts focus to protecting capital while keeping some growth exposure.

This is where tactical adjustments shine, helping you dial risk up or down as your needs change.

5. Keep Costs and Taxes in Mind

While most 401(k) and TSP participants can change their allocations without fees or tax consequences, the same isn’t always true for other accounts.

If you rebalance inside a taxable brokerage account or IRA, trades may trigger capital gains taxes or incur transaction costs, which can quietly reduce your returns over time.

Pro tip: Fewer, smarter adjustments are better than constant tinkering, especially outside of tax-advantaged accounts.

Not sure you’ll stick to all these habits on your own? Even with the best advice, rebalancing can be tough in practice. Model Investing makes it easier by handling the details for you so your portfolio stays balanced automatically.

How Does Model Investing Make This Easier?

Managing a 401(k) means keeping up with markets, deciding when to rebalance, and trying not to let emotions drive your decisions. That’s easier said than done.

Model Investing’s 401(k) Allocation Model takes the uncertainty out of the process. Each month, you receive clear allocation recommendations that show you exactly how to position your account. These recommendations are built on disciplined, expert-designed strategies — so your portfolio adjusts smoothly without constant oversight.

Instead of asking yourself, “Should I rebalance my 401(k) now?”, you follow a consistent process that keeps your investments aligned with market trends and long-term goals.

The outcome: Your retirement plan stays on track with less effort, freeing you to focus on life while your 401(k) quietly works in the background.

Take the stress out of rebalancing, let our 401(k) Allocation Model do the work for you.

FAQs:

1. What does it mean to rebalance my 401(k)?

Rebalancing your 401(k) means adjusting your investments back to the original mix of stocks, bonds, and other assets you chose. Over time, market changes can shift your portfolio away from that target. For example, if stocks grow faster than bonds, your account may become to heavily weighted toward stocks.

2. How often should I rebalance my 401k?

Most experts suggest rebalancing either on a schedule (monthly, quarterly, or semi-annual) or when your asset allocation drifts more than 5% from your target. Rebalancing too often can create unnecessary costs, while waiting too long can expose you to risk. A steady, rules-based approach helps you stay consistent without overthinking every market move.

3. Should I rebalance my 401(k) during a market downturn?

Yes, but carefully. Market downturns can push your allocation out of balance, often leaving you with more bonds and fewer stocks than you originally planned. Rebalancing during a downturn may mean adding back to stocks at lower prices, which feels counterintuitive but helps you stay aligned with your long-term plan. The key is to rebalance with discipline, not emotion, so you don’t sell out of fear or miss future recoveries.

4. What is the best way to rebalance 401(k) investments?

The best approach depends on your plan options and goals. Common methods include:

- Selling overweighted assets and buying underweighted ones.

- Redirecting new contributions into the weaker areas until balance is restored.

- Using automatic portfolio rebalancing if your plan offers it.

For many investors, combining automation with a clear review schedule gives the most reliable results.

5. Is automatic portfolio rebalancing a good idea?

It can be if your chosen allocation still matches your goals. Automatic portfolio rebalancing adjusts your account at set intervals (quarterly or annually), so you don’t have to remember. It’s simple and prevents emotional mistakes. However, it resets to fixed percentages and doesn’t consider market trends. If you want a smarter approach, tactical rebalancing strategies like those used by Model Investing go further by adapting to market cycles.

6. Can I rebalance my 401(k) without selling investments?

Yes. Instead of selling, you can direct future contributions and employer matches into the underweighted areas of your portfolio. Over time, this brings your account back into balance without triggering sales. This method works well if your drift is small, but if allocations are far off, selling and re-buying may be necessary to reset quickly.

7. What happens if I never rebalance my 401(k)?

If you never rebalance, your portfolio will drift off course over time. This often leaves you too heavily invested in whichever asset has been performing well recently — usually stocks. While that may boost returns for a while, it also increases your risk. On the other hand, in long bear markets, you may end up too conservative, which limits growth. Rebalancing avoids both extremes and keeps you on track for long-term success.

8. Is tactical 401(k) rebalancing better than traditional rebalancing?

Short answer: Yes. Traditional rebalancing simply resets your 401(k) back to fixed percentages at set intervals, regardless of what the market is doing. Tactical rebalancing — like the strategies used by Model Investing — adjusts your allocation based on economic trends and market signals.

This approach keeps you invested when conditions are favorable, but reduces risk when markets turn volatile. For most investors, that means a more effective balance between growth and protection.

9. Can I automate rebalancing across multiple accounts (401(k), IRA, brokerage)?

Most 401k plans only allow rebalancing within that account. If you have multiple retirement accounts, you’ll need to coordinate manually or use an investment platform that manages across accounts.

10. What’s the smartest way to start rebalancing my 401(k) today?

Start by reviewing your current allocation and comparing it to your target mix. If you’re off by more than 5%, take steps to bring it back in line — either through trades, adjusting contributions, or using your plan’s auto-rebalance feature. If you don’t want to manage it yourself, Model Investing’s 401(k) Allocation Model will provide you with monthly allocations that factor in current market conditions.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See PricingPosted in