If you’ve ever worked with a financial planner or investment advisor, there’s a good chance you’re using an investment strategy known as strategic asset allocation. While you may not know it by that name, you’re probably familiar with how it works.

What you may not be of aware of, however, are how recent changes in financial markets have made this approach to investing more dangerous than ever before. Those following this approach are destined to suffer major setbacks on their journey toward and after retirement.

Our aim in this article is to make you aware of the risks of strategic asset allocation, and provide some valuable insight on the alternative approach top investors are turning to.

What is Strategic Asset Allocation?

At it’s core, this approach to investing involves setting target allocations for various asset classes (stocks, bonds etc.) and periodically rebalancing the portfolio based on the varying performance of each asset class. With strategic asset allocation, the target allocations are based on factors such as risk tolerance, time horizon and investment objectives. As those items change, the target composition of the portfolio will change.

While this sounds good in theory, the resulting portfolio nearly always follows a preprogrammed approach that goes like this: When an investor is young, the majority of their portfolio is allocated to stocks. As they age, the portfolio is slowly transitioned out of stocks and into bonds. And by retirement, the portfolio’s largest component is bonds, with smaller amounts in stocks and cash.

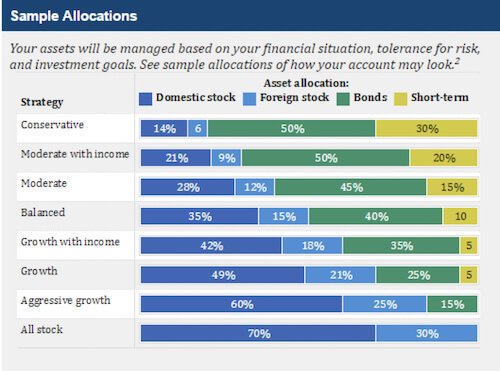

Here’s an example of typical allocations using a strategic asset allocation approach. Chart is courtesy of Fidelity.

One aspect of strategic asset allocation that is critical to understand is that it’s akin to a buy-and-hold strategy. When determining allocations, the current or expected performance of any asset class is not considered. Investments are spread across various asset classes without regard to financial conditions or economic outlook.

Ultimately, strategic asset allocation suggests that investors will benefit most by always staying invested in the markets, regardless of conditions, and adhering to target allocations that reflect characteristics of the investor, rather than the performance of various investments.

We disagree completely, and to understand why, we need to explore why this approach was adopted in the first place.

Why it’s Become the Status Quo

Strategic asset allocation has become the dominant approach to investing because of its congruence with two particular academic theories: the Efficient Market Hypothesis (EMH) and Modern Portfolio Theory (MPT). Let’s examine each of these in turn.

Eugene Fama, an American economist who is often called “The Father of Finance,” won a Nobel prize for his work many decades ago on the Efficient Market Hypothesis. Simply put, this theory suggests that asset prices always reflect all available information, and thus it’s impossible to “beat the market.” Said differently, stocks, bonds, and all other types of investments always trade at fair value; they are never under or over-valued. As a result, the only way an investor can improve returns is by taking on more risk.

The implications of this theory are that it’s a fool’s errand to try and actively pick or time investments, because the outcome is entirely based on luck. Thus, the best alternative is simply to acquire assets whenever possible and hold on to them over a long time horizon (buy-and hold).

Harry Markowitz is another American Economist who also won a Nobel prize for his pioneering work on Modern Portfolio Theory. This theory proposes the idea of an efficient frontier, in which an optimal portfolio allocation can be developed that maximizes returns for a given level of risk. Key to this theory is the notion of diversification, as various investments can be combined in a fashion that either enhances or reduces the overall performance characteristics of a portfolio.

Together, these two theories suggest that the best approach is simply to buy and hold a diversified portfolio because a) no one can effectively time the market or make investment decisions that enhance returns and b) a diversified portfolio will always present the best trade-off between risk and reward.

If all this sounds pretty good to you, you’re not alone. The widespread adoption of these theories many decades ago has resulted in the financial planning landscape that we see today, where nearly everyone follows this approach. But as you’re about to see, both of these theories have fatal flaws which render them, and the approach to investing they advocate, outdated and dangerous.

What Changed?

Both the EMH and MPT were developed in the 50’s and 60’s, before the advent of modern computing. Since then, we’ve developed a completely different understanding of how modern financial markets operate. These dominant, award-winning theories now have a tremendous amount of empirical evidence stacked up against them.

With regard to EMH, the idea that markets always trade at fair value is one that is relatively easy to disprove, both anecdotally and empirically. First, consider the idea of market crashes, which we tend to see every 5-10 years. Huge market swings are inconsistent with the idea that prices reflect all available information. If they did, markets would react to changing environments ahead of time, instead of all at once.

Second, from an empirical perspective, there are hundreds of research papers that identify so called “market anomalies” in the action of asset prices. These anomalies are patterns in the financial markets that would not exist if markets were efficient. Momentum is perhaps the most well-known example of this. If you’d like to read more about these market anomalies, check out the academic research section of our website.

If you need yet another reason to doubt the validity of the EMH, consider the performance of savvy investors such as Warren Buffett. If EMH were valid, investors such as Mr. Buffett, who are able to consistently beat the market year after year, simply would not exist. Nor would we, for that matter. Mr. Buffett has repeatedly argued against the efficient market hypothesis, saying, “I’m convinced that there is much inefficiency in the market … In fact, market prices are frequently nonsensical.”

If you need yet another reason to doubt the validity of the EMH, consider the performance of savvy investors such as Warren Buffett. If EMH were valid, investors such as Mr. Buffett, who are able to consistently beat the market year after year, simply would not exist. Nor would we, for that matter. Mr. Buffett has repeatedly argued against the efficient market hypothesis, saying, “I’m convinced that there is much inefficiency in the market … In fact, market prices are frequently nonsensical.”

Moving on to Modern Portfolio Theory, this longstanding approach to portfolio management has also proven inadequate in a variety of ways. In order to understand why, we must look at the underlying assumptions of MPT.

Modern Portfolio Theory examines the past returns and volatility of various asset classes, as well as their correlations, in order to determine an optimal portfolio that achieves the highest return for a given level of risk. That sounds great in practice, but in reality the assumptions on which these allocation decisions are based do not hold up.

For example, with MPT, stocks are assigned a certain static level of risk, as are bonds. These risk levels are assumed to be constant over time. Because stocks have historically exhibited both higher returns and higher volatility, they are viewed as always being riskier than bonds.

This is why strategic asset allocation suggests that investors put a majority of their investments in stocks while young (they can handle extra risk) and move those investments towards bonds as they age.

The problem is that the risk levels of different asset classes are NOT constant. They fluctuate wildly over time. A perfect example of this was the recent financial crisis. From 2007 – 2008 the risk level of the stock market increased substantially. Owning stocks during that period was a completely different proposition than owning stocks during other years.

MPT also makes the implicit assumption that bonds are “safe” because they typically exhibit low volatility. Well, those who don’t know about the dark history of bonds may believe that, but in reality, bonds have suffered tremendous losses and collapsed in stock-like fashion on multiple occasions. In the U.S., bonds provided a negative total real return from 1940 – 1981, over four decades straight!

MPT also relies on correlations between different asset classes in order to achieve an “optimal” portfolio. The problem is that over the last decade, correlations have been breaking down, especially during periods of market turmoil.

Altogether, the failures of EMH and MPT have resulted in a vast population of investors who believe they’re using a “tried and true” method for investing, but in reality are taking far more risk than they understand, and settling for subpar returns.

Dangers of Using Strategic Asset Allocation

At this point you probably have a pretty clear picture of why using strategic asset allocation will lead to unsatisfactory results over time, but let’s make sure. The biggest problem with strategic asset allocation ultimately boils down to this: Your exposure to each asset class remains fixed, regardless of performance or market conditions.

Think about the implications of this. A look back over the past hundred years of financial market data shows that all asset classes go through cyclical periods of rising and falling prices. By using a strategic asset allocation approach, you’re guaranteeing that you participate in each and every one of these downturns, no matter how severe they are. The buy-and-hold approach that underpins strategic asset allocation ensures this.

Stocks lost over half their value during both the dot-com collapse and the financial crisis. Those who maintained their exposure to the market during these periods saw their stock portfolios collapse by a similar amount. The unfortunate result is those same individuals had to earn over a 100% return just to get back to even! That can take years, if not decades, and illustrates how important it is to avoid major setbacks.

The other drawback of strategic asset allocation has to do with performance drag. Because MPT suggests that investors always remain diversified, one portion of a portfolio is nearly always underperforming another. Typically we see that during economic expansions, stocks tend to outperform while bonds drag down overall performance. During recessions, this dynamic shifts and stocks become the performance sapping portion of the portfolio.

You may not think this performance drag accounts for much, but consider this: Over a 30-year period, an investor with a $100,000 balance who earns a 6% return instead of an 8% return will wind up with $432,000 less than they otherwise would have. All that from missing out on a measly 2% return.

When you consider that historically, stocks have outperformed bonds by over 3% per year, and that stocks vastly underperform bonds during recessions, you start to wonder about the wisdom of always keeping a portion of your investments allocated to underperforming assets.

At this point you’re probably wondering: If strategic asset allocation is such a bad way to invest, what’s the alternative? I’m glad you asked.

The Solution: Tactical Asset Allocation

When the Efficient Market Hypothesis was first introduced during the 1960’s, it came as a huge relief to investors. If markets were efficient, then there was no longer any need to worry about market timing or investment selection. There was no need to do any research on companies, the economy, or the regulatory environment. Prices always reflected all available information and were never under or over-valued, so investors were free to buy whatever they wanted, whenever they wanted, as long as they stayed diversified (per MPT).

Well, unfortunately, market behavior over the last few decades has shown us that markets are in fact not efficient. Assets across the board go through wild price swings in which there are major gaps between price and value. Not only that, it has been shown that solid research, combined with the exploitation of market anomalies, does allow certain investors to consistently outperform the market.

The recognition of these shortcomings led to the development of a different style of investing, called tactical asset allocation. This approach uses active management to shift the percentage of assets held in various categories in order to take advantage of market pricing anomalies and market distortions. The move to tactical asset allocation stems from the realization that a buy-and-hold strategy is no longer appropriate in today’s financial environment.

Why the retail investing community has not caught onto this sooner is anyone’s guess. Sometimes particular ideas gain so much traction that they are assumed to be valid and go unquestioned for years. But while the concept of tactical asset allocation remains widely unknown by the public, professional and institutional investors have been relying on this strategy for years.

Speaking to the board of CALPERS, California’s giant public pension, Dr. Andrew Lo, Professor of Finance at MIT and Director of MIT’s Laboratory for Financial Engineering (LFE), said, ” … it’s the height of irresponsibility to keep a static portfolio.” He continued, “This notion of tactical risk management is going to become more important than ever before.”

We sincerely hope investors begin to acknowledge the drawbacks of using a strategic asset allocation approach to investing. While the alternative involves a much more active approach to portfolio management, investors will find significant value in keeping their investments in tune with changing financial conditions.

If you’d like to learn more about tactical asset allocation and what it can do for you portfolio, check out our investment models. In less than 15 minutes per month you can enjoy market-beating returns that would impress even the likes of Fama and Markowitz.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing