If you’re one of the roughly 75% of investors who are using a target-date fund in your retirement plan, you need to read this. We’ve written about why you should say no to target-date funds before, but new research provides the clearest evidence yet for why these funds must be avoided.

In case you’ve had your head buried in sand, target-date funds (those that include a year in their name such as 2050) propose to offer a one-size-fits-all solution for investors saving for retirement. The idea is simple: As you age, the composition of the fund changes, following a glidepath from mostly stocks in the beginning, to mostly bonds by retirement (see example below).

While seemingly intuitive, this approach is not only based on flawed assumptions, empirical testing shows that in most cases, you’d actually be better off if the fund worked in the exact opposite way! To help you wrap your head around this, we’re going to examine some research from the brilliant folks over at Research Affiliates.

Could They Really Get it This Wrong?

One thing many people fail to realize is that most financial products are invented not for the benefit of consumers, but to enhance the profits of financial companies. Most new “innovations” are merely a means for amassing more assets under management, and collecting the associated fees.

The invention of target-date funds was no different. This somewhat sly way of packaging an old investment concept is sold to investors based on two premises: First, younger investors generally have smaller portfolios and can tolerate stock market volatility better than older people. Second, those approaching or in retirement have more to lose, and cannot withstand a big drop in their portfolio.

This makes sense intuitively, but do target-date funds really deliver on their intended purpose? Or is all of this just a big smoke screen to get you to choose their fund so they can get paid? Let’s find out!

The Research

We all know that the future is filled with uncertainty, and so when it comes to assessing the quality of an investment approach, one of the most logical things we can do is see how a particular strategy would’ve performed in the past.

Rob Arnott, and his team at Research Affiliates, took a look at how the target-date fund approach would have worked over a 141-year period, from 1871 to 2011. They compiled performance data for 101 simulated investors, each of whom began their 40-year working careers one year apart, starting in 1871, and contributed $1,000 (in real terms) to their account each year.

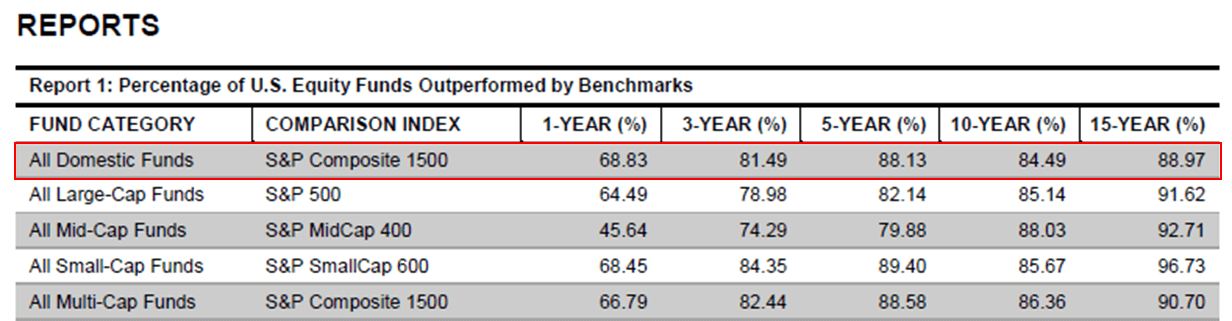

The results of this analysis are included in the table below, under the column labeled “Prudent Polly” (we’ll see just how prudent she really is). For comparison purposes, return data is also provided for two other strategies. The second column of data, labeled “Balanced Burt” shows how a balanced 50/50 portfolio would have performed under the same conditions. The third and final column, “Contrary Connie” shows the results of an inverse target-date fund approach (shifting from bonds to stocks as you age).

There’s a lot of data here, so we’ll go ahead and highlight the important parts. Notice in the first row above that the average ending balance when using a target-date fund approach (the “Prudent Polly” column) is $124,460. Incredibly, this is 9.7% less than the average ending balance of a simple 50/50 portfolio, which came in at $137,870! In other words, a target-date fund strategy would, on average, have performed about 10% worse than a static portfolio made up of 50% stocks and 50% bonds.

While that should already shock you, we can pound a few more nails into the target-date fund coffin. If a target-date fund strategy truly had merit, then it would certainly outperform a fund that worked in the exact opposite way, right?

Well … as you can see in the righthand column above, using a reverse target-date fund approach actually resulted in an average account balance of $152,060. That’s 22.2% higher than the target-date fund approach, and 10.3% higher than a static 50/50 portfolio. So not only did the target-date strategy not outperform a simple balanced portfolio, the opposite approach would have delivered much higher returns!

In light of this simple but effective analysis, you should be just as confused as we are as to why nearly three quarters of investors are currently invested in one of these funds. As Rob notes, “Shockingly, the basic premise on which these billions are invested is flawed.”

It Gets Worse

Actually, to be completely honest, we’re NOT confused as to why so many investors use these funds. The answer is rather simple: Employers, who don’t know any better, dump participants directly into these funds.

Back in 2006, as part of the Pension Protection Act, target-date funds officially became what’s known as a “Qualified Default Investment Alternative” or QDIA. What this means is that if a plan participant does not select an investment, the company can legally direct the participant’s assets into a target-date fund, and not be liable for any potential losses.

In other words, this change in the law allowed companies to automatically select target-date funds for their participants’ investments. That, combined with the fact that most employees have little to no understanding about their investment options, or how to change them, has resulted in the landscape we see today.

In order to understand the magnitude of this problem, consider that according to a recent survey, 85.2% of retirement plans featured a target-date fund as their QDIA in 2017. That means almost 9 out of every 10 investors are being automatically dumped into a target-date fund.

Finally, would you believe that target-date funds actually overcharge you for this privilege of underperformance? According to a recent report from Morningstar, the average expense ratio for a target-date fund was 0.62% in 2018. That compares to less than 0.1% for the average index fund. If you don’t think those extra fees are taking a huge chunk out of your retirement, you need to read this.

Recognizing the Alternatives

Hopefully, by this point you recognize that there is something seriously wrong with both target-date funds, as well as the financial industry in general. Just like we recently explained regarding mutual funds, there is simply no good reason to use a target-date fund. So what are the better alternatives?

To begin, as you can see from the research we looked at, a balanced 50/50 portfolio stands a good chance of outperforming a target-date fund over your working career. This simple approach has been used for decades, and one of the nice features of this strategy is you can use index funds to build your portfolio, thereby minimizing expense ratios.

Another option, recommended by none other than the greatest investor of all time, Warren Buffett, is to simply invest in an S&P 500 index fund and sit tight. To demonstrate how serious he is about this recommendation, Warren has directed the trustee in charge of his estate to invest 90% of his money in the S&P 500 after he passes. How’s that for putting your money where your mouth is?

A third option, and one that we’re obviously biased towards, is to follow our investment models. Our approach is very similar to Mr. Buffett’s recommendation (in that we invest primarily in diversified stock index funds), but we add one additional element to the equation.

Whenever the economy heads into a recession, stocks tend to lose a lot of value. The last two recessions saw the S&P 500 fall in excess of 50%. To guard against losses of this magnitude, we employ some basic predictive analytics to try and identify these periods before they occur. When it looks like tough times are ahead, our models will shift their portfolios to the safety of bonds and cash. Once the outlook brightens, it’s back to those stock index funds.

Regardless of which option you choose, there’s a very good chance that you’ll do much better over the long run than with a target-date fund. So please, take a moment to look over your investments and get yourself on a path to success. Your future self will thank you!

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing