Ready to raise your investing IQ?

Sign up for our Free Newsletter to access the best investment information money can’t buy.

The Asset Rotation Model (ARM) is a dynamic asset allocation model designed to help investors maximize wealth beyond traditional 401(k)s and the Thrift Savings Plan. Using a strategic, low-turnover approach, the ARM dynamically shifts between stocks and bonds based on market conditions – enhancing growth, reducing risk, and optimizing tax efficiency.

Perfect for taxable accounts, 529 plans, and IRAs, the ARM adapts to market trends in real time, helping investors capture stronger returns while limiting drawdowns. With its disciplined, data-driven strategy, the ARM provides a smarter, more resilient way to build and protect wealth outside employer-sponsored plans.

Find Out How to Use the ARM to Manage your Accounts

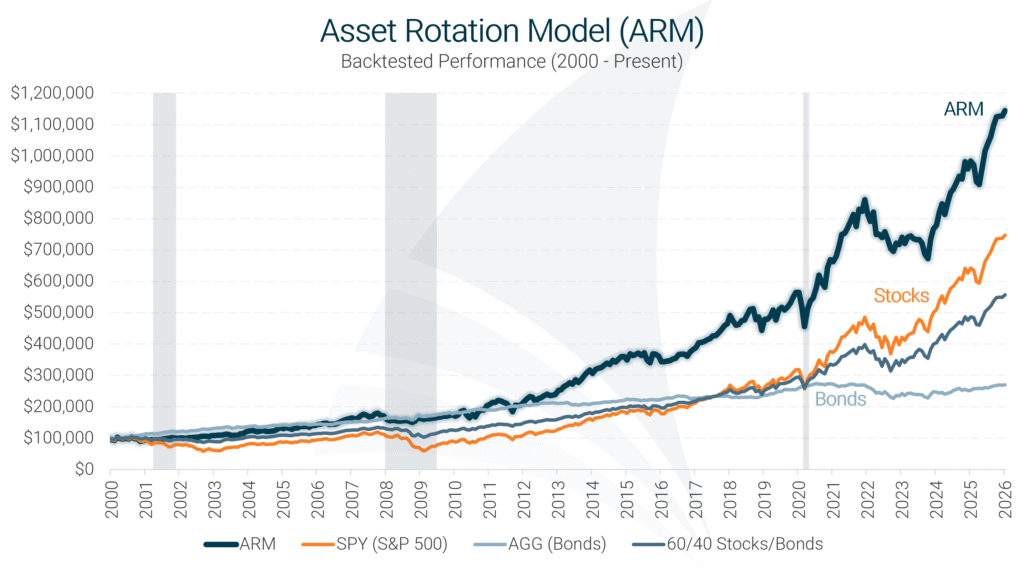

The Asset Rotation Model has consistently outperformed traditional stock and bond benchmarks over the past 26 years. This outstanding performance is driven by a tactical asset allocation strategy that actively adjusts investments in response to changing market conditions. The chart below illustrates how the ARM compares to SPY (S&P 500 index fund), AGG (Aggregate Bond Index fund), and a standard 60/40 portfolio.

Model performance represents total returns and includes reinvestment of dividends and interest. No management fees or transaction costs are included. Historical performance is not an indication or guarantee of future performance.

The results below highlight the model’s strength in delivering consistent, high-quality returns while effectively managing risk and limiting volatility.

| Asset Rotation Model (ARM) Performance Metrics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Strategy | Compound Annual Return | Alpha1 | Beta1 | Standard Deviation | Maximum Drawdown | Sharpe Ratio | Sortino Ratio | Treynor Ratio |

| ARM | 9.77% | 4.56% | 0.51 | 11.7% | -21.9% | 0.72 | 1.25 | 0.17 |

| SPY (S&P 500) | 7.99% | 0.00% | 1.00 | 17.9% | -50.8% | 0.43 | 0.48 | 0.08 |

| AGG (Bonds) | 3.88% | N/A | 0.00 | 4.8% | -17.1% | 0.43 | 0.51 | N/A |

| 60/40 Stocks/Bonds | 6.78% | 1.17% | 0.54 | 10.2% | -23.9% | 0.52 | 0.64 | 0.10 |

| Data for 26-Year Period (2000 – 2025) 1 Benchmarked against the S&P 500 |

||||||||

View Full Explanation of the ARM Performance Metrics

The ARM provides clear, monthly recommendations designed to keep your portfolio aligned with market conditions while maintaining tax efficiency. Here’s how it works:

With a simple, data-driven approach, the ARM keeps your investments optimized, making it an ideal solution for retirement asset allocation without requiring constant management.

Take the Guesswork Out of Investing – Start Now!

Many investors rely on strategic asset allocation, a set-it-and-forget-it approach that determines allocations based on age rather than market conditions. The Asset Rotation Model (ARM) offers a smarter, more adaptive strategy, making real-time adjustments based on market conditions to keep portfolios optimized for growth and stability.

By dynamically reallocating to safer assets during market downturns, the ARM helps limit losses and accelerate recovery, reducing long-term risk exposure. Meanwhile, its low-turnover approach minimizes short-term capital gains taxes, making it an ideal choice for taxable accounts.

With clear, easy-to-follow monthly recommendations, the ARM eliminates the complexities of active trading – allowing investors to maintain strong performance with minimal effort.

See how other investors are using the Asset Rotation Model to transform their portfolios:

If you have access to a 401(k) or TSP, those tax-advantaged accounts should be your top priority – use our 401(k) Allocation Model or TSP Allocation Model to maximize those investments. However, if you’re looking to grow wealth outside of employer-sponsored accounts, the ARM is the perfect solution for:

By dynamically adjusting to market conditions, the ARM helps protect your portfolio from major downturns while seizing opportunities for compounding wealth. Whether your goal is to safeguard your savings or accelerate growth, the ARM provides a disciplined, data-driven strategy that keeps you ahead of market fluctuations.

With the ARM, you’re no longer at the mercy of unpredictable markets – you have a proven strategy to keep your investments on track and ensure long-term financial success.

Take control of your investments today – sign up and start your free trial!

Higher Returns Start Now – Let the ARM Guide You!

The Asset Rotation Model (ARM) is our premier investment strategy, offering a complete portfolio management solution for investors looking to grow wealth beyond employer-sponsored plans like 401(k)s and the Thrift Savings Plan. Designed for dynamic market conditions, the ARM helps you maximize returns while managing risk with precision.

The ARM dynamically adjusts between stocks and bonds, optimizing returns while significantly reducing risk compared to traditional investment strategies. By adapting to changing market conditions, it keeps your portfolio positioned for growth and stability in any environment.

The ARM is perfect for investors managing assets outside employer-sponsored retirement plans like a 401(k) or TSP. With low turnover, it’s an excellent choice for taxable accounts, IRAs, 529 plans, and HSAs. If your 401(k) offers a brokerage option, you may benefit from following the ARM instead of the 401 Model to maximize flexibility and returns.

The Asset Rotation Model is built to be the foundation of your investment portfolio, delivering strong performance with a low-risk profile. By allocating the majority of your investments to the ARM, you create a stable core, allowing you the flexibility to take a more speculative approach with your remaining funds.

You can explore the ARM’s historical backtested performance on the ARM Overview page, with a detailed breakdown of key risk metrics. Pay close attention to these figures – the ARM’s superior returns aren’t the result of taking on more risk. In fact, the model strategically reduces risk exposure while outperforming traditional investment approaches.

The ARM takes a radically different approach to investing compared to traditional portfolio management. Instead of maintaining a fixed stock-and-bond allocation regardless of market conditions, the ARM dynamically shifts between stocks and bonds – strategically positioning your portfolio based on current market trends and future performance expectations.

You can view the latest ARM recommendations on the current recommendations page. A premium subscription is required for access.

Using the ARM is simple. Each month, you’ll receive an alert when the latest ARM recommendations are posted. Just log in to your brokerage account and update your investments accordingly. For step-by-step guidance, see the ARM Tutorial.

Yes. With longer life expectancies, it’s crucial that your money keeps working for you in retirement. The ARM has historically outperformed both stocks and bonds while avoiding major losses during market downturns, making it a strong choice for all investors. For strategies to de-risk your portfolio in retirement, see this article.

With the Asset Rotation Model (ARM), you only need to update your asset allocations once per month. The model is designed to minimize trading while keeping your portfolio aligned with current market conditions. However, allocations do not always change from one month to the next, so if the recommendation remains the same, no action is needed.

Most likely, no. The ARM is designed to use low-cost ETFs and minimize trades each year, keeping expenses low. Plus, most brokerage accounts no longer charge commissions on trades, making it even more cost-effective. Over time, reducing costs can have a significant impact on your investment growth.

The ARM detects early signs of stock market weakness and typically shifts the portfolio to bonds at the onset of a downturn, limiting losses. This defensive approach is one of the ARM’s key benefits. When the market rebounds, the model reallocates back into stocks.

Yes, the ARM provides indirect international exposure when invested in stocks. It does this by using the SPY ETF, which tracks the S&P 500. Since S&P 500 companies generate between one-third and one-half of their revenue from overseas, the ARM indirectly benefits from global market growth.

The best asset allocation strategy is one that adapts to changing market conditions while balancing growth and risk. Unlike traditional strategies that maintain a fixed allocation between stocks and bonds, the Asset Rotation Model (ARM) dynamically shifts between the two based on market trends and future performance expectations.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)