Ready to raise your investing IQ?

Sign up for our Free Newsletter to access the best investment information money can’t buy.

Looking for the best TSP allocation strategy to maximize your retirement savings? The TSP Allocation Model is designed to help federal employees and military personnel optimize their Thrift Savings Plan (TSP) accounts by dynamically adjusting allocations among the G, F, C, S, and I funds based on changing market conditions.

Unlike traditional buy-and-hold strategies, the TSP Model actively reallocates assets to capture growth during economic expansions and shift to safer investments during downturns.

By continuously adapting to economic trends, the TSP Allocation Model ensures your portfolio remains optimized for every phase of the market cycle. Whether your goal is to accelerate growth or safeguard your TSP against volatility, this proven TSP investment strategy keeps you on track for long-term financial success.

Find Out How to Use the TSP Model to Manage your TSP Account

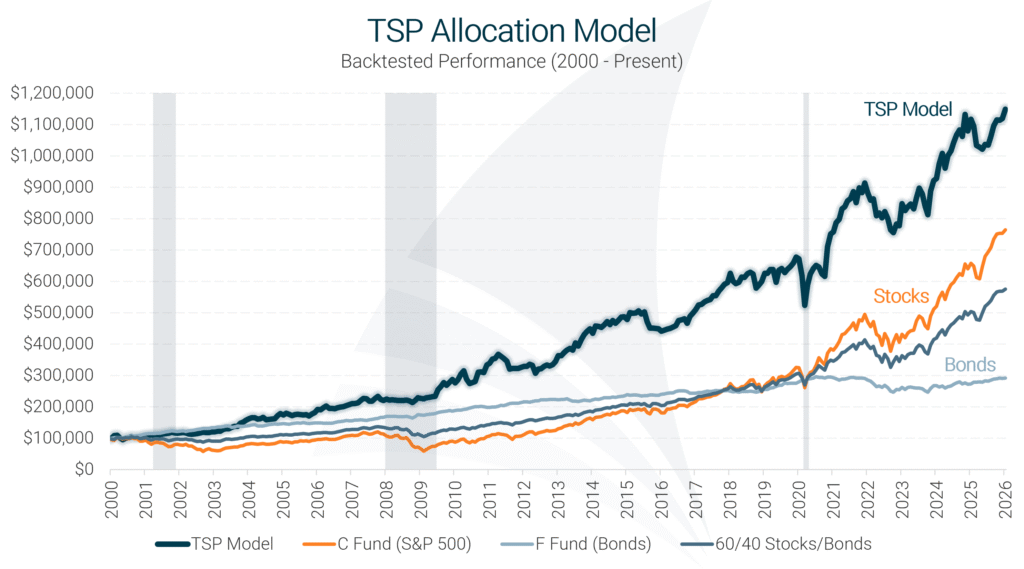

The TSP Model has consistently outperformed stock and bond benchmarks over the past 26 years. The chart below showcases how the TSP Model has achieved higher returns compared to the C Fund (S&P 500), the F Fund (Bonds), and a standard 60/40 mix of those funds. This exceptional performance is driven by its unique ability to dynamically shift allocations based on market conditions.

Model performance represents total returns and includes reinvestment of dividends and interest. No management fees or transaction costs are included. Historical performance is not an indication or guarantee of future performance.

The performance data below showcases how the TSP Model provides strong, reliable returns while keeping risk and volatility under control.

| TSP Model Performance Metrics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Strategy | Compound Annual Return | Alpha1 | Beta1 | Standard Deviation | Maximum Drawdown | Sharpe Ratio | Sortino Ratio | Treynor Ratio |

| TSP Model | 9.73% | 4.90% | 0.44 | 10.8% | -22.8% | 0.77 | 1.68 | 0.19 |

| C Fund (S&P 500) | 8.08% | 0.00% | 1.00 | 18.0% | -50.9% | 0.43 | 0.48 | 0.08 |

| F Fund (Bonds) | 4.19% | N/A | 0.02 | 4.9% | -16.7% | 0.49 | 0.59 | N/A |

| 60/40 Stocks/Bonds | 6.91% | 1.24% | 0.54 | 10.2% | -23.7% | 0.54 | 0.65 | 0.10 |

| Data for 26-Year Period (2000 – 2025) 1 Benchmarked against the C Fund |

||||||||

View Full Explanation of the TSP Model Performance Metrics

The TSP Allocation Model provides clear monthly updates you can follow in your own TSP account, making it a highly effective TSP investment strategy. Here’s how it works:

Designed for both stability and growth, the TSP Model is the best TSP investment strategy you’ll find for managing your account.

Maximize your TSP Growth – Get Started Today!

Many TSP investors rely on static strategies – choosing a fund, setting contributions, and assuming their savings will grow on autopilot. However, this approach rarely leads to the best TSP allocation, often exposing savings to market downturns and causing missed opportunities for higher returns.

The TSP Allocation Model uses tactical asset allocation to solve this problem. It evaluates fund performance and market conditions on an ongoing basis, reallocating across TSP investment options to capitalize on top-performing funds while minimizing exposure to underperforming sectors. It’s proactive, easy to follow, and proven to deliver stronger results than static strategies.

Discover how TSP participants just like you are transforming their retirement strategy with the TSP Allocation Model:

If you’re serious about building a secure retirement, the TSP Allocation Model is the proven strategy you need. Designed specifically for federal employees and military personnel, it provides clear, monthly recommendations that take the guesswork out of investing.

By taking just a few minutes each month to adjust your allocations based on current market conditions, you’ll keep your TSP account optimized for growth and protected from downturns. This approach can accelerate your savings, safeguard your retirement, and help you retire sooner.

Thousands of federal employees are already achieving higher returns and greater security with the TSP Allocation Model. Join them today and take control of your future – because you and your retirement deserve the best.

Take the first step toward smarter retirement investing – join today and unlock your free trial!

The Proven TSP Strategy You Need – Take the First Step!

The TSP Allocation Model (TSP) is our premier Investment Model for Thrift Savings Plan investors. It’s designed to provide a complete portfolio management solution for people investing through their TSP accounts.

The TSP Model dynamically switches between the G, F, C, S and I funds to achieve outstanding returns while exposing your portfolio to significantly less risk than traditional investment approaches.

Any federal government employee or member of the uniformed services who has or is eligible for a TSP account will benefit from following the TSP Allocation Model. The TSP Model will help you keep your investments in sync with changing market conditions.

The TSP Model is a complete portfolio management solution, designed to manage your entire TSP account. If you’re new to Model Investing, consider using it for only a portion of your account to get started. As you become more confident in the TSP Model’s performance, you can begin using it to manage your entire account.

You can view the TSP Model’s historical backtested performance on the TSP Model Overview page. Pay special attention to the table of risk metrics as it’s important to understand that the TSP Model’s outperformance does not come as a result of taking on more risk. In fact, the TSP Model exposes your money to significantly less risk than traditional investment approaches.

The TSP Model uses a completely different approach to investing than traditional portfolio management. Instead of splitting your money between stocks and bonds and staying invested regardless of market conditions, the TSP Model tracks the performance of each of the TSP funds and allocates the portfolio accordingly, transitioning between funds as they take turns leading the way higher.

You can see the latest TSP Model recommendations on the current recommendations page. Access requires a premium subscription.

Using the TSP Model is simple. Each month you will receive an alert when the latest TSP Model recommendations have been posted. Simply log in to your TSP account and make the appropriate changes to your allocations. Click here to see the TSP Model Tutorial.

Yes. People are living longer these days and it’s important that your money continues to work for you during retirement. Because the TSP Model has been able to generate higher returns than both stocks and bonds, and also avoid major losses during market crashes, we feel comfortable recommending it to investors of all ages. For more information on how to de-risk your portfolio during retirement, please see this article.

With the TSP Allocation Model, you only need to review your allocations once per month. The model is designed to adapt to changing market conditions while keeping trading to a minimum. However, recommendations do not always change from month to month, so if the allocation remains the same, no action is required.

No. The Thrift Savings Plan will allow you to change your allocations free of charge.

The TSP Model is able to recognize developing periods of stock market weakness and will typically move the portfolio to the F Fund during the early stages of a crash. This limits losses and is one of the primary benefits of the TSP Model. When the stock market begins to recover, the TSP Model will move back into the C, S, and I Funds.

No. The TSP Model does not use the L Funds. Model Investing recommends that all investors avoid using target date funds due to their inherent problems.

The best TSP allocation depends on where we are in the economic cycle and whether conditions are improving or deteriorating. Generally speaking, during economic expansions the best funds to be in are the C, S, and I Funds. During recessions or periods of market turmoil, the G and F Funds will do a better job of protecting and growing your savings.

We offer a variety of other investment models for use in non-TSP accounts. If you’re investing through a 401(k), please see our 401(k) Allocation Model. For taxable accounts and those who do not have access to an employer-sponsored retirement plan, our Asset Rotation Model is the ideal solution. And for those who want to supplement their portfolio with a faster growth strategy, we offer the Sector Rotation Model.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)