Gold Rotation Model

The Gold Rotation Model (GRM) helps you determine when gold is a suitable investment, and when bonds are a better alternative.

Investing in gold can be a profitable, yet frustrating venture. Gold is seen as an alternative currency, a store of value and an insurance policy during periods of social or economic unrest. As such, it can play an important role within an overall portfolio. But gold’s benefits come with certain drawbacks.

Gold does not pay any dividends or interest, negating the effects of compounding, and it has historically underperformed nearly all other asset classes.

Find Out How to Use the GRM to Manage Your Investments

For these reasons Model Investing does not recommend having a significant portion of your total assets in gold. However, we recognize that gold can be used effectively to balance out portfolios, and we are cognizant that a portion of the investing community is very interested in owning gold, considering it the only real currency.

As a result, we have created the Gold Rotation Model (GRM). The GRM uses similar logic to that of our other investment models.

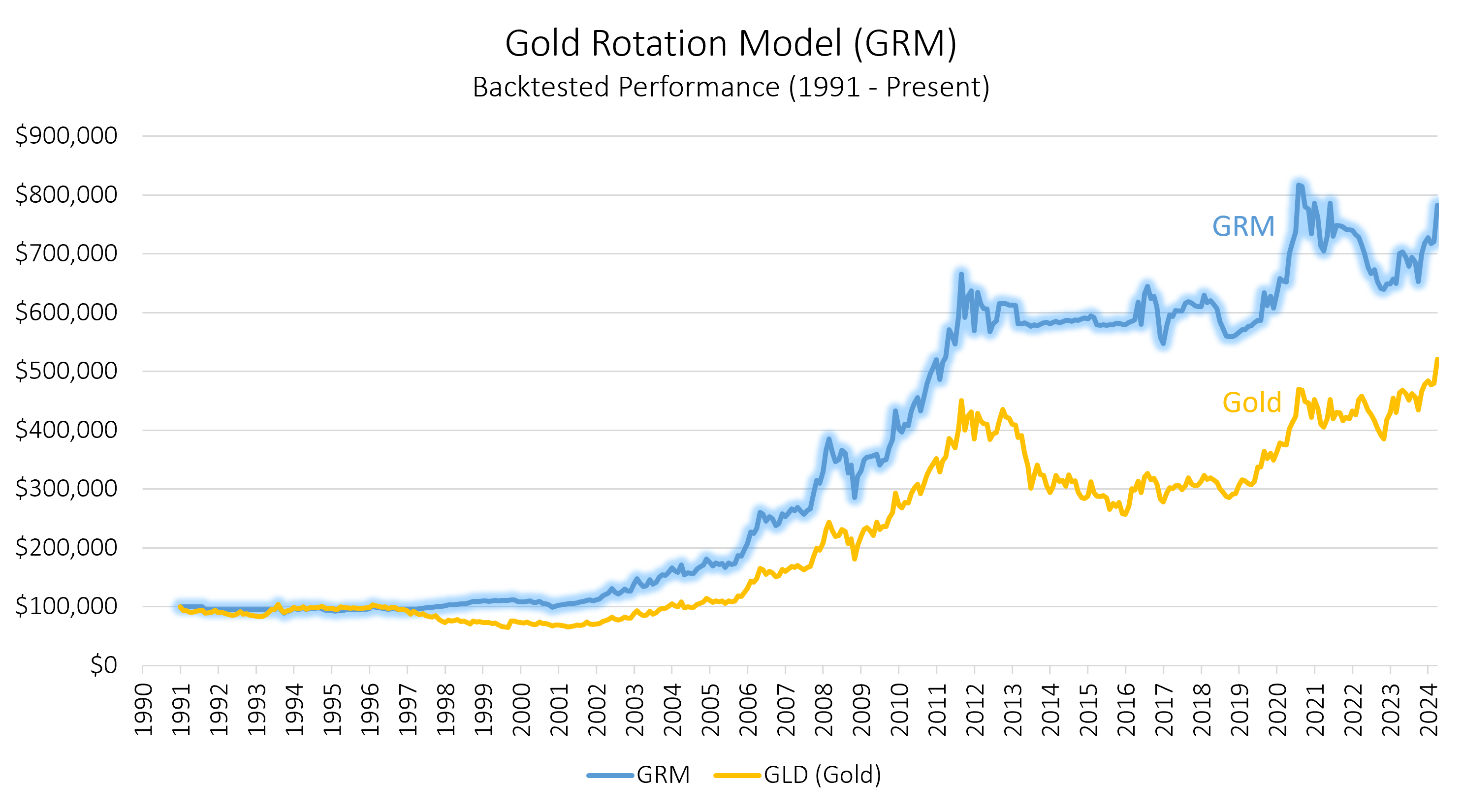

The chart below shows the backtested performance of the GRM over the last 32 years. As you can see, the GRM was able to avoid the price declines in gold during both the early and late ’90’s. When the price of gold began to rise swiftly during the early 2000’s, the GRM recognized the change in trend and shifted into gold. That position was maintained until the end of 2012, when the model shifted back to bonds. Recently, the GRM has again been capturing the gains from a rising gold price.

Model performance represents total returns and includes reinvestment of dividends and interest. No management fees or transaction costs are included. Historical performance is not an indication or guarantee of future performance.

The Gold Rotation Model determines its position monthly, selecting between gold and short-term bonds, and shifts its investment accordingly. When a position in gold is recommended, the SPDR Gold Shares exchange-traded fund (ETF) GLD is used to establish the position.

Moving in and out of gold strategically results in greater returns and less risk than a typical buy-and-hold approach. The table below contains a series of performance metrics allowing you to compare the GRM against a buy-and-hold approach to owning gold.

| Gold Rotation Model (GRM) Performance Metrics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Strategy | Compound Annual Return | Alpha1 | Beta2 | Standard Deviation | Maximum Drawdown | Sharpe Ratio | Sortino Ratio | Treynor Ratio |

| GRM | 6.02% | 2.06% | 0.08 | 11.76% | -25.83% | 0.35 | 0.53 | 0.55 |

| GLD (Gold) | 4.66% | 0.00% | -0.08 | 14.41% | -42.91% | 0.22 | 0.23 | -0.41 |

| Data for 32-Year Period (1991 – 2022) 1 Benchmarked against GLD 2 Benchmarked against the S&P 500 | ||||||||

Key Performance Highlights:

- Over the last 32 years the GRM’s compound annual return has strongly outpaced that of owning gold.

- The GRM has experienced less volatility (risk) and lower magnitude losses than utilizing a buy-and-hold approach.

- The enhanced returns and reduced volatility provide for notably higher risk-adjusted returns, as evidenced by the Sharpe, Sortino and Treynor Ratios.

As stated earlier, large positions in gold are not recommended. However, if you are going to invest in gold, the GRM can help you take advantage of rising prices, while sidestepping major losses.

The GRM utilizes two exchange-traded funds (ETFs), which are listed below.

| Gold Rotation Model (GRM) Investment Options | ||

|---|---|---|

| ETF | Description | Asset Class |

| GLD | SPDR Gold Shares ETF | Gold |

| BSV | Vanguard Short-Term Bond ETF | Bonds |

The current GRM selection and ongoing monthly updates are accessible with a premium subscription. Updated recommendations are provided on the first trading day of each month. Sign up today for access to the Gold Rotation Model and all of our other models.

Find Out How to Use the GRM to Manage Your Investments