How to Manage Risk as You Age

You probably understand that you should take less risk with your portfolio as you age, but what does that mean in terms of changes to your investments? And for a given age, exactly how much risk should you be taking? These are two of the most important questions when it comes to managing money, and we’ll address each one in this article.

Before we get started, it’s important to understand that the following guidelines are based on an analysis of the historical performance of various financial markets, the results of decades of academic research, and our interactions with thousands of investors over the years.

Our recommendations also account for recent trends such as the shift towards lower economic growth and interest rates, as well as demographic changes such as increases in longevity.

We’ll begin by setting up a basic portfolio-risk framework that accounts for your age, and then we’ll show you how to tailor our recommendations based on your individual preferences.

The 30,000 Foot View

At its core, risk is simply uncertainty. But don’t make the mistake of thinking that uncertainty is always a bad thing. Uncertainty can be a wonderful thing, as in the case of better than expected returns. When we’re young and have most of our working career ahead of us, we can afford to take lots of risk … and we should. We should gobble up risk like it’s Thanksgiving dinner.

But as we age, our commitments become more ingrained, and we must eventually prepare for the day when we will no longer work. On that fateful day, we’ll begin to live off our investment portfolio, which must support us for the rest of our lives. Yikes.

So how do we go about planning and preparing for this? Easy, we use the “bucket” approach.

Understanding Your Risk, and Risk-Free Buckets

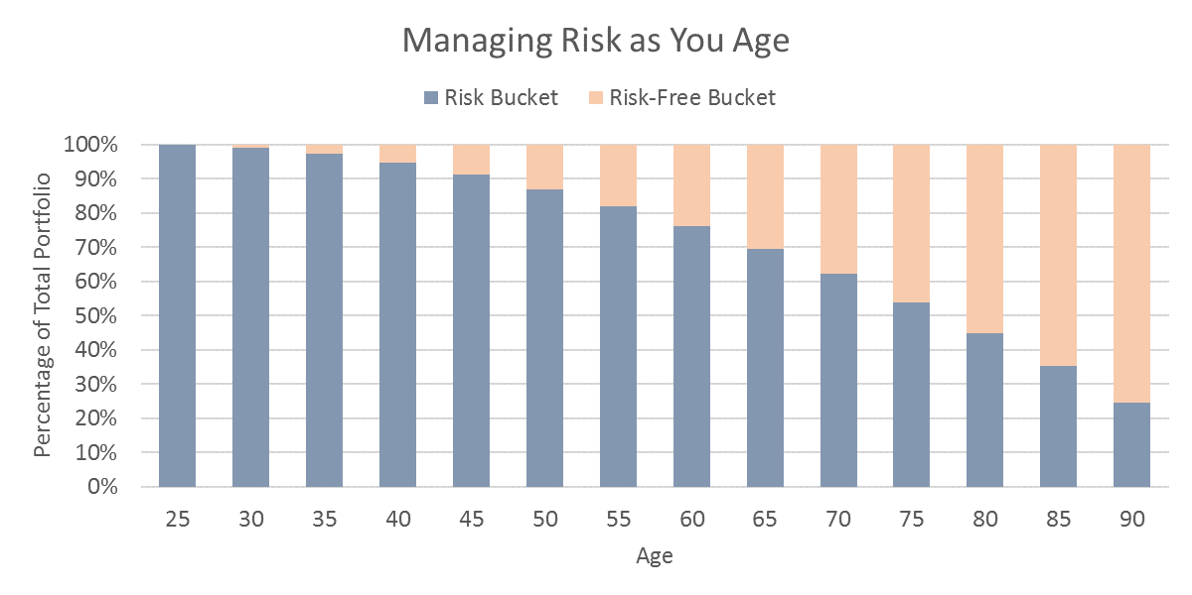

The easiest way to conceptualize what needs to happen in your portfolio as you age is to break your portfolio into two different buckets: a “risk” bucket, and a “risk-free” bucket. These two buckets of your portfolio will always sum to 100%, but they will change with respect to one another over the years.

Specifically, as you age, the percentage of your portfolio allocated to your “risk bucket” will decline, while the portion of your portfolio that comprises your “risk-free” bucket will rise.

In the chart below, you can see our general recommendations for how this process should unfold.

Notice that younger individuals should have their entire portfolio in the risk bucket, while those later in life should have the majority of their portfolio in the risk-free bucket. We’ll discuss how to adjust these levels based on personal factors in a moment, but overall, the levels outlined above should be appropriate for most investors.

One thing to keep in mind about this chart and the concept of risk and risk-free buckets is that this applies to your total portfolio, not just one one or two specific accounts. In other words, the levels outlined above should be applied holistically across your entire asset base. In practice, this often means that 100% of your investment accounts will be allocated to the risk-bucket, because your risk-free assets will come from another source.

Adjusting for Your Personal Risk Preferences

There are three factors unique to each individual that will influence the general guidelines above. In this section, we’ll discuss those factors, and give you our recommendations on how adjust the baseline risk levels outlined in the chart above.

Risk Seeking vs. Risk Averse

Some people are naturally averse to taking risk, while others tend to seek out risk. Depending on where you fit on that spectrum, you may want to make some adjustments to the risk and risk-free levels presented earlier.

If you hate the idea of taking risk, then consider reducing each of the risk-bucket levels above by up to 5%. On the other hand, if you like being aggressive with your portfolio, then consider adding 5%.

You may not find this adjustment to be very large, but this is done on purpose. In reality, your personal preferences toward risk should play a role in determining how much risk you take, but not a large role. This is because other factors that are common to all of us (such as the need to acquire sufficient assets to fund our retirement years) are much more important in dictating how much risk we need to take with our portfolios.

Life Expectancy

This is a touchy subject, but if you have reason to believe that your life expectancy will be shorter than average, then you’re going to want to de-risk your portfolio a bit sooner in life. This means that in comparison to each of the age groups outlined above, you would have a greater portion of your portfolio in the risk-free bucket, and a lower portion in the risk bucket.

On the other hand, if you have a family history of living longer, then you may want to make the opposite adjustment. In this case, you would increase the risk bucket portion of your portfolio to accommodate greater risk-taking, and therefore a greater likelihood of not outliving your portfolio.

Due to the wide spectrum of individual life expectancies it’s difficult for us to provide any guidelines in terms of actual adjustments, but suffice it to say that plus or minus 5% is probably fine here as well. (If you expect to live longer than average increase the risk bucket by 5%, and if you think you may live shorter than average, decrease it by 5%.)

Behind on Saving For Retirement

Ah yes, the stipulation that everyone seems to fall into. If you’re like most people and feel that your investment portfolio is not at the level it should be, then it can be quite tempting to forgo adequate risk control and take on too much risk.

Please don’t do this!

If you’re behind on retirement, it’s okay to take on some additional risk, but this should be done in moderation. If you’re behind, consider increasing the risk bucket of your portfolio by an additional 5% from what’s outlined above.

Which Investments are Risk vs. Risk-Free?

At this point, if you started with the baseline levels we provided, and made adjustments for the three factors outlined above, you should have a good idea of how much of your portfolio to expose to risk, and how much to keep in the risk-free bucket.

The next step is to understand which type of investments are appropriate for each of these buckets. As you can probably guess, the risk bucket is going to hold investments that are exposed to risk (uncertainty) while the risk-free bucket will hold only those investments where the risk of loss is almost nonexistent.

You can see which types of investments qualify as risk vs. risk-free assets in the table below.

| Risk vs. Risk-Free Investments | |

|---|---|

| Risk Assets | Risk-Free Assets |

| Stocks (including all ETFs and Mutual Funds that hold stocks) | Cash |

| Bond Funds | Savings Accounts |

| Corporate Bonds | CDs (Certificates of Deposit) |

| Municipal Bonds | Individual Treasuries (Bills, Notes and Bonds) 1 |

| Options | Annuities |

| Futures | Defined Pension Benefits |

| Currencies | Social Security |

| Gold | G Fund (TSP Investors only) |

1 Treasuries are the only type of fixed income security that are considered risk-free. This is because they are backed by the “full faith and credit” of the U.S. Government. Other types of bonds (corporate, municipal etc.) still contain risk because the issuer could default. Also, all bond funds (even those that contain Treasury securities) are considered risk assets because with bond funds there is no guaranteed return of principal.

Putting it All Together

You should now have a good understanding of both how much risk you should be taking with your portfolio, as well as how to manage that risk as you age. But there is one last consideration that we need to discuss with regard to your portfolio.

Generally speaking, investments that contain little to no risk (those listed above in the Risk-Free Assets column) will provide very low returns. This means that the vast majority of the growth in your portfolio will come from your risk bucket. As a result, choosing which assets to include in that risk bucket, and when, becomes incredibly important.

This is where getting some professional guidance can really come in handy. For example, there are times when it’s beneficial to own stocks, and times when stocks can wreck your portfolio. At the same time, there are periods when bonds provide great returns, and others when bonds lose value for years.

One of the best things you can do as an investor is to find someone who can help you make these types of decisions as conditions change. Whether that means finding a professional money manager, or following our investment models, the choice is yours, but we’ve found that most people do very poorly with this on their own.

Hopefully the information above has helped demystify at least one part of the investment process. If you have questions about any of the topics discussed, we’re always happy to help. Just shoot us a note at support@modelinvesting.com or use the Contact Us portion of the site.