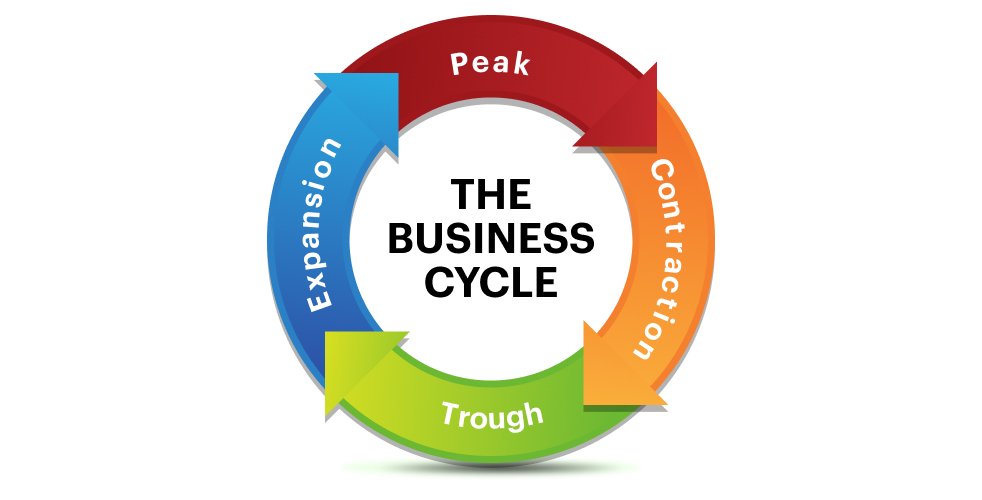

In the quest to become a savvy investor, one of the most important concepts you must understand is that of the business cycle. This periodic ebb and flow of our economy exerts tremendous influence not just on asset prices, but on everything from interest rates to the availability of jobs. Since nearly every aspect of your financial life will be influenced in some way by the business cycle, it pays to have a basic conceptual understanding.

Whether we like it or not, the value of our portfolios depends heavily on the behavior of financial markets, which, in turn, are intertwined with the economy. Therefore, how and where we invest are dictated in large part by our expectations of future economic growth. As the U.S. and other G7 economies slow, it’s going to permanently change the investment landscape.