Even if you don’t consider yourself to be a savvy investor, chances are you’ve heard about diversification. The age-old idea of not having all your eggs in one basket is considered timeless wisdom, but could it be working against you?

In truth, diversification is a double edged sword. The benefit that it provides comes at a mighty cost. When it comes to investing, most individuals aren’t aware of the hidden price they pay for this so-called “free lunch.”

In this article we’re going to look at some of the finer aspects of diversification, and discuss its role in an investment portfolio. Whether you’re risk-averse, or risk-seeking, you’ll benefit from understanding the trade-off you make every time you adjust your investment portfolio.

What is Diversification?

You know what diversification is from a philosophical standpoint, but when it comes to investing, exactly what is diversification? And how do we measure it?

At it’s core, diversification is the concept of including multiple investments in a portfolio in an attempt to reduce overall portfolio volatility (risk), while still maximizing returns. This risk management technique attempts to eliminate unsystematic risk (more on this in a moment) by allowing the positive performance of some investments to neutralize the negative performance of others.

The key to diversification lies in what are called non-correlated assets. These are assets (think stocks, bonds, real-estate, gold) that generally move opposite the direction of other assets in the financial markets. By including these types of assets in a portfolio, a “buffering” effect can be achieved whereby when one asset is declining, another tends to be rising.

While this all sounds great in theory, effective use of diversification still remains a challenge for the majority of individual and institutional investors. This is because most investors don’t realize the massive changes that have taken place in financial markets over the past few years.

The Benefits

Earlier I mentioned that diversification attempts to eliminate unsystematic risk (also known as “specific risk” or “diversifiable risk”). These are the company or industry-specific hazards that are part of every investment.

If you want a perfect example of unsystematic risk, think of Enron. Those who owned Enron as part of, say, an S&P 500 index fund that invests in the top 500 U.S. companies, barely noticed the implosion. Those who held larger individual positions were hurt badly.

Unsystematic risk is not constrained to individual companies either, it can affect entire industries. Other examples of unsystematic risk include new competitors, regulatory changes, management shakeups, or product recalls.

This notion of being able to diversify away company or industry-specific risk leads many investors to adopt a “more is better” mentality. They figure the more assets they add to their portfolio, the better protected they’ll be. Unfortunately, that’s not the case. Adding new investments to a portfolio can actually reduce your level of diversification. To understand why, we’ll need to dig a bit deeper.

Understanding Correlations

The degree to which two items vary together, such as stock returns and bond returns, can be measured by looking at their correlations. Correlation coefficients range from +1 to -1, with +1 representing perfect correlation, zero representing no correlation, and -1 representing perfect inverse correlation (they move opposite directions).

Diversification only provides a benefit if the new investment you are adding is not correlated with the other assets in your portfolio. If your portfolio and the new investment ARE highly correlated, then you’ll be adding little value, and could actually be harming your overall portfolio.

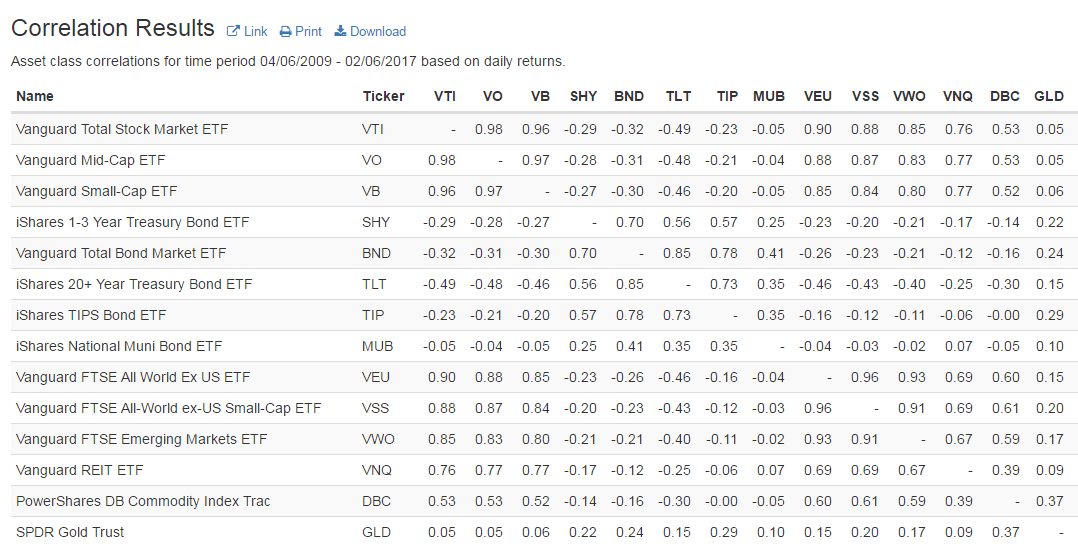

The table below shows correlation coefficients over the last 8 years for major market segments. You can use it to get a feel for how correlated different markets are. To read it, find the intersecting value for the two funds (market segments) that you are interested in.

One important thing to notice in the table above is that bonds have a negative correlation with the overall stock market. This is why traditional portfolio management advocates splitting a portfolio between stocks and bonds … when one is declining, the other should be rising.

But think about what that means for a moment …

The Drawbacks

If a properly diversified portfolio implies that different investments will always be moving in different directions, then what does that mean for the overall portfolio? If you said lower returns, pat yourself on the back.

Think about it this way: If you had an absolute perfectly diversified portfolio, it would never change value. Every time one of your investments went up, another would go down, leaving your balance unchanged. Sure, you’d essentially have a risk-free portfolio, but how beneficial is that? The whole point of investing is to accumulate wealth.

What I’m getting at here is simple, there is a trade off between risk and reward. As we diversify our portfolio further and further, we reduce our risk (portfolio volatility) but we also reduce our expected returns. Thus, diversification should be viewed as a sliding scale, as depicted below.

On one side we have high diversification, which is accompanied by low risk and consequently, low returns. On the other side of the spectrum we have low diversification, which implies high risk and high returns. Somewhere in the middle is an optimal range, which represents a balance between the returns we seek, and the amount of risk we are willing to take.

The optimal range is of course different for everyone, but interestingly, it’s not as different as you might expect. This is because the requirements placed upon each of us in terms of saving for retirement are quite similar. We all face the same situation. We must save during our working years, earn a high enough rate of return to be able to retire comfortably, and then keep those investments growing through retirement as we live off of them.

This, by definition, entails a certain level of risk, and tends to put a lower bound on the level of expected return we can accept. On the other side, we find that because a minimal level of diversification produces such a profound reduction in risk (relative to its effect on return), that this too has a logical lower bound.

So in sum, we can’t accept too much diversification because our returns will be nonexistent, and we can’t accept too little diversification because we’d be foolish not to allow a basic level of diversification to eliminate unsystematic risk.

The trick is to find the “right” level of diversification that eliminates the most risk with the least effect on overall returns. So how do we do that?

Finding the Right Balance

While we’d love to give you some formula to figure out how diversified your portfolio should be, the fact is we can’t. There are just too many complexities involved. The near-infinite number of investment options, account types, and changing correlations (yes, did we mention correlations don’t remain static and are constantly changing?) make this nearly impossible.

But what we can do is provide some guidelines, and show you how we approach this issue here at Model Investing.

In our experience, most people understand intuitively that having a stock portfolio with just a few stocks in it is a bad idea. In this case, mathematical models show that by including around 25-30 stocks, most of the unsystematic risk can be removed. As the number of stocks you own rises above that level, the diversification benefits continue to improve, but at a much smaller rate.

These days, with the advent of Exchange Traded Funds (ETFs), which are our preferred investing method, it’s easy to own baskets of stocks in whatever industry or segment of the market you like.

The bigger issue, in our opinion, is how most investors are approaching diversification at the asset class level. This is the fundamental decision regarding how much of your portfolio to have in stocks vs. bonds vs. cash at any given time.

Most schools of thought suggest that investors always split their investments between stocks and bonds due to the negative correlation between the two asset classes. But if you think about it, this means that over the course of your life, one major component of your portfolio will always be dragging down your overall returns. That underperformance can be very significant and can sabotage long-term financial goals.

At Model Investing, we use a different approach called Performance Based Investing, in which we tactically adjust portfolio allocations based on how the economy and financial markets are doing. Once we’ve determined which asset classes are expected to outperform, we diversify our investments in those particular asset classes, but do not invest any portion of the portfolio into other non-correlated asset classes that have negative expected returns.

We’ve found that this approach allows for more targeted investing, and vastly eliminates the performance drag associated with maintaining exposure to underperforming asset classes.

Famed investor Warren Buffett once said, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.” We think that’s a bit harsh, but the essence of what he’s saying is correct, and investors would do well to heed this advice.

If you don’t know what you’re doing, then by all means diversify, diversify, diversify. But if you understand how different asset classes and investments perform based on changes in the business cycle, then consider focusing your investments in the areas of the market that you expect to outperform.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing