Your 401(k) is one of the most powerful tools you have for building long-term financial security. But the impact it has on your retirement depends largely on how you invest the money inside it.

With dozens of fund options and a mix of confusing terms, it’s easy to feel unsure about what’s best for you. Should you pick a target-date fund and call it a day? Go all-in on stocks? What about bonds? The truth is not all 401(k) investment options are created equal.

In this article we’ll walk you through the types of investment choices commonly available in most 401(k) plans. You’ll learn how these funds behave in different market conditions, how to match them to your personal goals, and why a flexible, data-driven strategy can give you an edge especially in uncertain times.

Understanding the Types of Funds in a Typical 401(k)

Most 401(k) plans include a lineup of professionally managed funds along with a series of index funds. While the names and fund families may vary, nearly every plan offers the same basic categories of investments. Understanding what these fund types are and how they respond to changing market conditions is the first step in making smarter decisions.

Here’s a breakdown of the most common 401(k) investment options:

U.S. Stock Funds

These are often labeled as “Large-Cap,” “Mid-Cap,” or “Small-Cap” equity funds.

- What they do: Invest in American companies of varying sizes

- When they perform best: During periods of economic growth and market optimism

- Volatility: Higher (especially small-cap funds), but potential for strong long-term growth

Example fund names in your plan might include:

- S&P 500 Index Fund (large companies like Apple, Microsoft)

- Mid-Cap Growth Fund

- Small-Cap Value Fund

International Stock Funds

Also called “Global” or “Foreign Equity” funds.

- What they do: Invest in companies outside the U.S. (Europe, Asia, emerging markets)

- When they perform best: When the global economy is expanding or when U.S. markets lag

- Volatility: Can be higher due to currency fluctuations and geopolitical risk

Adding international exposure helps diversify your portfolio beyond the U.S. economy. But it’s important to understand that international stocks don’t always move in sync with U.S. markets—and that can either reduce or add to risk, depending on the timing.

Bond Funds (Fixed Income)

Usually labeled as “Total Bond,” “Corporate Bond,” or “Government Bond” funds.

- What they do: Invest in debt issued by corporations or the U.S. government

- When they perform best: During times of economic uncertainty or when interest rates fall

- Volatility: Lower than stocks; helps stabilize your portfolio

Bonds act as the steady anchor in most retirement portfolios. While they don’t offer big returns, they help cushion the blow during market downturns.

Target-Date Funds

You’ll usually see these listed as “[Retirement Year] Fund” (e.g., 2035 Fund, 2050 Fund).

- What they do: Automatically adjust your stock/bond mix based on your expected retirement date

- When they perform best: As a set-it-and-forget-it option for hands-off investors

- Volatility: Starts high when you’re younger, becomes more conservative over time

These funds are popular—and convenient—but they follow a fixed schedule known as a “glide path,” which doesn’t account for real-time market conditions. That means if a market crash hits, these funds won’t protect you unless you’re already well into retirement and the fund mix has shifted heavily towards bonds.

Stable Value or Money Market Funds

Designed to preserve capital, these funds focus on safety over returns.

- What they do: Invest in short-term debt or guaranteed contracts

- When they perform best: During economic crises or periods of high volatility

- Volatility: Very low but so are the returns

These options are often used by those near retirement or those looking to park funds short-term. While they’re not great for growth, they can offer peace of mind when markets are unpredictable.

Quick Tip: Not all funds in your 401(k) are labeled clearly. If you’re unsure what a fund does, look for its benchmark or underlying strategy in the plan’s fund fact sheet. Words like “Index,” “Growth,” “Balanced,” or “High Yield” offer useful clues.

What This Means for You

Understanding the basics of what’s available in your 401(k) is critical, but it’s just the starting point. The real challenge is figuring out how much of each type of fund you should own—and how to adapt that mix over time as markets shift, interest rates change, and retirement approaches.

That’s where we’re headed next: how to match your investment options with your personal goals, and why flexibility—not fixed allocation—is the smarter path forward.

Not sure which funds in your 401(k) are worth using?

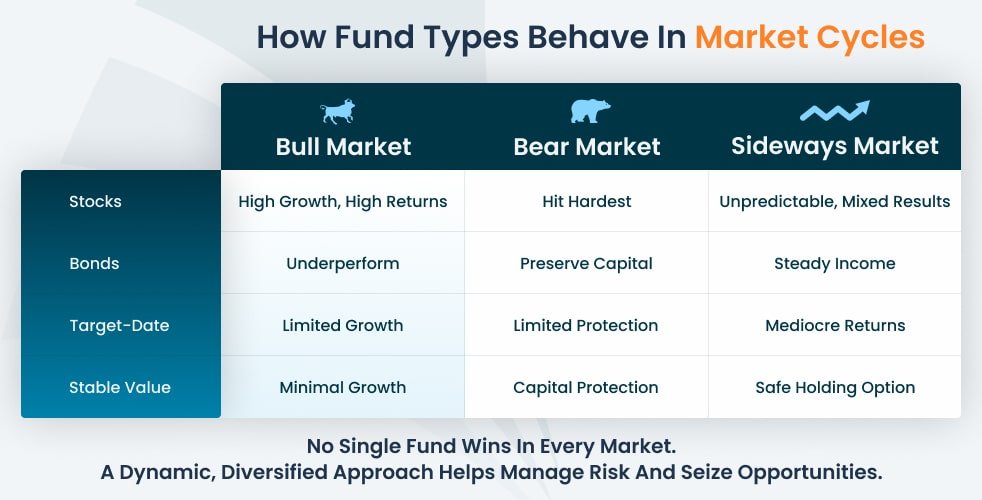

How Different Fund Types Behave in Market Cycles

Once you know what types of investments are in your 401(k), the next step is understanding how they behave during different market conditions. After all, your portfolio isn’t static—the markets certainly aren’t—so the funds you choose will react differently depending on what’s happening in the economy.

This table provides a quick summary of how each type of fund typically performs during bull markets, bear markets, and sideways trends, so you can start making more informed decisions about where to allocate your retirement savings. We’ll go into more detail for each asset type below.

Stock Funds: High Growth, High Risk

Bull Market: Stock funds tend to shine during bull markets, when the economy is expanding, unemployment is low, and consumer confidence is high. During these phases, U.S. large-cap, mid-cap, and even small-cap funds can deliver impressive gains.

Bear Market: In downturns or recessions, stock funds—especially small-cap and international funds—are often hit the hardest. That’s when the volatility becomes most noticeable. Investors who are heavily weighted in stocks without a safety net can see their account balances drop sharply.

Sideways Market: In flat or choppy markets, stocks may move unpredictably. Some sectors might thrive while others stall. A passive stock-heavy portfolio can lag if it’s not adjusted.

What to know: Stock funds are essential for long-term growth, but without a flexible strategy, they can expose you to significant risk during downturns.

Bond Funds: Smoother Ride, Lower Return

Bull Market: Bonds typically underperform when the stock market is booming, especially if interest rates are low or rising. But they still provide a cushion in your portfolio.

Bear Market: Bond funds generally hold up better than stocks during declines, particularly high-quality government and investment-grade bonds. They help preserve capital and reduce portfolio swings.

Sideways Market: In flat or volatile periods, bonds can provide predictable income and help keep your portfolio more balanced.

What to know: Bonds act as your portfolio’s shock absorber. But too much exposure in a growth phase can limit returns.

International Funds: Opportunity + Complexity

Bull Market: When global economies are thriving, international funds can add diversification and enhance returns—especially in regions that outperform the U.S.

Bear Market: Emerging markets and foreign companies tend to fall more sharply in global selloffs. Currency swings can also amplify losses.

Sideways Market: Results can be mixed. Global headlines, currency rates, and trade policies may drive performance more than market fundamentals.

What to know: International exposure adds variety to your 401(k), but should be balanced and monitored closely—especially during geopolitical or economic unrest.

Target-Date Funds: One Path, No Turns

Bull Market: If your target-date fund has a higher equity allocation (common when you’re younger), it will generally track with the broader stock market—but it won’t capitalize on tactical shifts or sector strength.

Bear Market: These funds reduce risk slowly over time, not in response to real-time market conditions. That means you may still have significant exposure to stocks during a downturn, regardless of market signals.

Sideways Market: Performance will depend on how the fund is allocated at that point in your retirement timeline. But remember—these funds don’t adapt dynamically, which can be a disadvantage in uncertain conditions.

What to know: Target-date funds are simple—but that simplicity comes at the cost of flexibility and control.

Stable Value & Money Market Funds: Safety First

Bull Market: These funds lag during periods of growth. While they protect capital, they offer very little upside.

Bear Market: This is where they shine. If markets are falling and volatility is high, stable value funds preserve principal and deliver modest returns—without wild swings.

Sideways Market: They can serve as a temporary holding place for conservative investors or retirees looking to minimize risk.

What to know: These funds are helpful for short-term stability, but not for long-term growth. They work best as part of a broader, diversified strategy.

What This Means for Your 401(k)

Markets don’t move in a straight line. Your investments shouldn’t either.

If your 401(k) portfolio holds the same mix of funds through all market cycles, you’re likely missing opportunities—and exposing yourself to unnecessary risk. A balanced approach is better than going all-in on any one type of fund, but what’s even better than that? A dynamic approach that adapts based on what’s happening in the markets.

Markets change — your portfolio should too.

Let’s explore how to match these fund types to your specific goals, timeline, and risk comfort, and why the old “set it and forget it” approach just doesn’t cut it anymore.

Matching Fund Choices to Your Goals, Timeline & Risk

Now that you know what fund types are available and how they behave in different markets, the next question is: Which ones are right for you?

There’s no one-size-fits-all answer — and that’s the point. The best 401(k) investment options depend on a few key factors:

- How many years you have until retirement

- How comfortable you are with market ups and downs

- How hands-on you want to be with your investment strategy

Let’s walk through how to approach this in a way that supports your long-term success — without leaving your portfolio based on outdated assumptions.

Age & Retirement Timeline

Most 401(k) plans offer generic guidance based on your age. The idea is simple:

- Younger investors (under 40) have time to recover from market drops, so they can afford to take more risk

- Mid-career investors (40–55) may want a blend of growth and safety

- Those nearing retirement (55+) often shift toward stability and capital preservation

This advice isn’t wrong, it’s just incomplete.

What it misses is what the market is doing right now.

Imagine being 30 years old during a market crash. A traditional age-based approach might leave you fully invested in stocks even as your portfolio drops 30–40%. That’s a tough pill to swallow — and many investors panic and sell at the worst time.

If you’re just getting started, here’s another great guide on how to save for retirement through consistent contributions and smart investing.

Risk Tolerance: Know Your Comfort Zone

Risk tolerance is personal. It’s about how much volatility you can stomach without second-guessing your decisions.

Ask yourself:

- How did I feel during the last big market drop?

- Would I stay invested if my portfolio lost 20% in a few months?

- Do I prefer slow-and-steady growth or am I comfortable chasing higher returns?

Your answers will help guide how much of your 401(k) should be in stocks vs. bonds or more stable investments. The key is to find the right balance between growth potential and peace of mind.

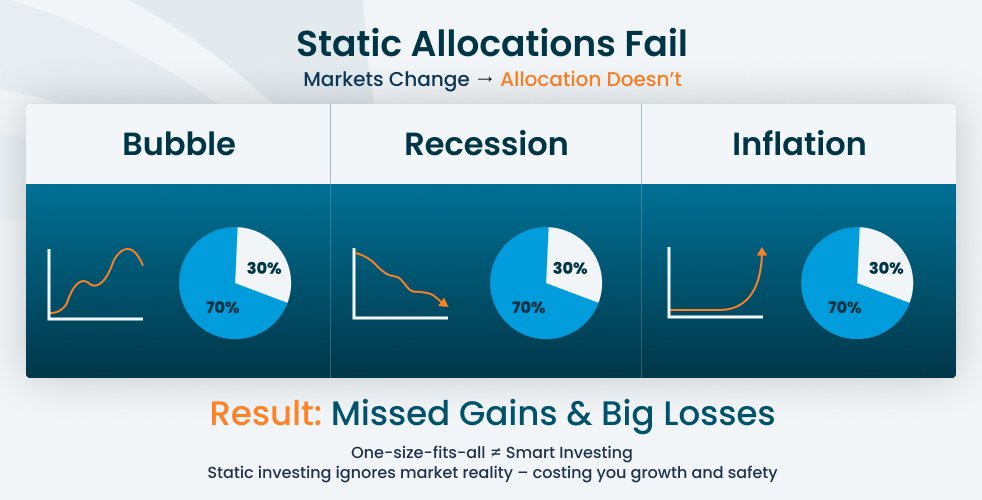

Why Static Allocations Can Be Misleading

A lot of investment advice says, “Just pick a mix of stock and bond funds and stick with it.”

But here’s the problem with that:

- Markets are constantly changing.

- Economic trends shift.

- Interest rates rise and fall.

- Global conditions evolve.

And yet static portfolios — including many target-date funds — don’t adapt to these realities. They follow preset rules, even when those rules stop making sense.

That’s why Model Investing believes in a flexible, data-driven approach. One that adjusts based on what’s happening now, not just your age or a formula written 15 years ago.

A Smarter Way to Align Your 401(k) With Your Goals

Instead of relying solely on your birthday to guide your investments, consider a model that:

- Analyzes market trends regularly

- Adjusts your fund mix monthly to maximize growth and minimize risk

- Helps you stay diversified without overthinking every move

This approach still takes your goals and retirement timeline into account — but it enhances them by adapting to real-world conditions. It’s like upgrading from a paper map to GPS — same destination, just way more responsive.

Let’s take a closer look at why static allocation strategies fall short — and what you can do instead to give your retirement plan the adaptability it deserves.

The Problem with Static Allocations

For years, traditional 401(k) advice has followed a simple formula: Pick a mix of stock and bond funds based on your age, then stick with it.

This strategy — often called “buy and hold” — assumes that markets will smooth out over time, and that staying the course is the best route. While this may sound reasonable, there’s a big flaw:

Markets don’t move in straight lines — and your investments shouldn’t either.

What Static Strategies Get Wrong

Let’s say you’re 45 years old. A typical static allocation might suggest 70% in stocks and 30% in bonds. You rebalance once a year and hope for the best.

But here’s the issue:

- If the stock market is in a bubble, your allocation doesn’t change.

- If the economy is heading into a recession, your allocation doesn’t change.

- If interest rates are spiking or inflation is rising? Still the same.

This lack of responsiveness leaves your portfolio vulnerable to:

- Major drawdowns during bear markets

- Missed opportunities during recoveries

- Inefficient exposure to underperforming assets

In short, static portfolios can be blind to what’s happening around them.

Target-Date Funds: A Popular Example with Limitations

Many 401(k) investors default into target-date funds because they’re easy and automated. These funds shift your stock/bond allocation over time, becoming more conservative as you near retirement.

While this structure provides convenience, it still follows a pre-set glide path that doesn’t adjust for real-time risks. So if a market crash hits just before your planned retirement date, the fund won’t protect you beyond what was already baked in.

That’s not flexibility — it’s false security.

Historical Context: Why Flexibility Matters?

Think back to events like:

- The dot-com crash (2000–2002)

- The financial crisis (2008)

- The COVID shock (2020)

Believe it or not, market declines can actually be a great opportunity for long-term investors.

Investors using static portfolios had no way to reduce risk before the damage hit. They were simply told to “ride it out.”

Meanwhile, flexible strategies — like tactical allocation models, were able to move into safer assets, limit losses, and recover faster.

This is one of the core reasons Model Investing created the 401(k) Allocation Model: to give investors an option that responds to reality, not just theory.

Static investing can cost you growth and safety. It’s time for a smarter approach.

A Better Alternative: Tactical 401(k) Management

Tactical allocation means adjusting your investments proactively — based on market momentum, risk levels, and economic conditions.

Instead of staying locked in a fixed allocation, tactical models:

- Shift toward equities when growth is strong

- Rotate into bonds or stable funds when risk increases

- Rebalance monthly based on performance data — not emotion

It’s not about guessing or chasing trends. It’s about using a rules-based system to make decisions objectively and consistently.

Why This Matters to You

Whether you’re just starting out or close to retirement, your 401(k) deserves more than a one-size-fits-all approach. The right allocation at the right time can help you:

- Grow your portfolio when markets are strong

- Protect it when conditions change

- Stay on track — without second-guessing your moves

Don’t let outdated allocations hold you back.

Let’s break down how tactical allocation works in a 401(k) and how a model-driven strategy can help you invest with more confidence.

How Tactical Allocation Improves 401(k) Performance

If you’ve ever wondered how to take advantage of strong markets while avoiding the worst of the downturns, without constantly guessing or reacting emotionally, tactical allocation may be the answer.

At its core, tactical allocation is about staying flexible. Instead of locking your portfolio into a fixed mix of stocks and bonds, you make smart, strategic adjustments as conditions change. The goal isn’t to time the market perfectly — it’s to make better-informed decisions that reflect what’s actually happening, not what’s supposed to happen.

What Is Tactical Allocation?

Tactical allocation is a data-driven approach to investing that adjusts your portfolio based on:

- Current market momentum

- Economic indicators

- Asset class performance

- Relative strength among available options

In a 401(k) context, this means shifting your allocations monthly, using clear rules — not opinions — to decide which funds deserve more or less weight in your portfolio.

At Model Investing, we’ve built a strategy specifically for 401(k) plans called the 401(k) Allocation Model that uses this tactical approach to help investors grow their retirement savings while managing risk.

How It Works

Each month, the model:

- Analyzes the available asset classes (like large-cap U.S. stocks, mid-cap, international, bonds)

- Ranks them based on performance and risk indicators

- Allocates your 401(k) across the top three options using a 50/30/20 weighting

So instead of holding a static mix of funds regardless of economic conditions — your money flows toward what’s working right now. And when markets shift, your portfolio shifts with them.

No guesswork. No reactionary moves. Just consistent, objective guidance.

Translating the Model to Your 401(k)

ETFs vs. the Funds in Your Plan

If you’ve been reading about tactical investing, you may have come across Exchange Traded Funds (ETFs) with names like SPY, IJH, or AGG. These funds are used in our 401(k) Allocation Model to track different market segments.

But most employer-sponsored 401(k) plans don’t offer ETFs. Instead, they provide mutual funds and index funds that aim to track standard benchmarks. For example:

- SPY is an ETF that tracks the S&P 500. While you won’t see this fund in your plan, your plan will contain some type of “S&P 500 Index Fund”

- AGG is an ETF that tracks the U.S. Aggregate bond market. In your 401(k) this type of fund may appear as a “Total Bond Market Fund”

- EFA is an ETF that tracks international stocks. Your plan will likely contain something called an “International Index Fund”

The funds that you see in your specific 401(k) all behave similarly — they’re just built for 401(k) platforms.

How to Apply the 401(k) Allocation Model to Your Specific Plan

To follow the model using your plan’s available options:

- Access the 401(k) Allocation Model’s current recommendations to see how your 401(k) should currently be allocated.

- Identify the fund’s in your plan that share the same benchmarks (e.g., U.S. large-cap, bonds, international) as the funds used in the model.

- Update your allocations to the use the selected funds and set allocation percentages appropriately (based on model recommendations).

- Prefer low-cost index funds over actively managed ones when possible

Pro Tip: Some plans offer multiple versions of the same fund type. Choose the lowest expense ratio fund to keep more of your money working for you. Even small differences in expense ratios can have a big impact over time — this article explains how fees can quietly eat your returns.

Why This is a Game-Changer for Your 401(k)

Let’s be real: most people don’t have time to watch the markets or rebalance their portfolio every month. But if you leave your 401(k) on autopilot, it can drift off course fast, especially in today’s fast-changing financial landscape.

Here’s how tactical allocation helps:

- Boosts returns by favoring stronger-performing funds

- Reduces volatility by rotating out of riskier assets during downturns

- Minimizes drawdowns in bear markets, helping you recover faster

- Simplifies decisions, so you’re not overwhelmed by 20+ fund choices

In fact, over the past 20+ years, the 401(k) Allocation Model has consistently outperformed traditional static strategies like 60/40 portfolios or target-date funds, while taking on less risk along the way.

Real Results (Not Just Theory)

During major market downturns like the 2000 dot-com crash and the 2008 financial crisis, the 401 Model preserved capital by shifting away from risky assets and into more stable investments. This allowed investors using the model to avoid deep losses and recover faster when markets rebounded.

Compared to the S&P 500 and standard 60/40 portfolios, the 401 Model delivered:

- Higher long-term returns

- Lower volatility

- Smaller drawdowns during crashes

- A better Sharpe ratio, meaning more return per unit of risk.

These results highlight how a disciplined, rules-based approach can consistently navigate real-world market cycles.

Stop guessing and reacting to markets. Use a proven, rules-based model.

Do I Need to Be an Expert to Use This?

Not at all.

Model Investing provides clear monthly updates that tell you exactly how to allocate your 401(k) based on the model’s analysis. You simply log in to your retirement account and adjust your fund weights accordingly. Most plans allow you to do this in a few clicks.

It’s a simple, repeatable system that helps you take control, without trying to predict the market or become a financial analyst.

Once you know how easy it is to follow, the next step is using a strategy that adapts with the market.

Smarter 401(k) Investing Made Simple

Managing your 401(k) doesn’t have to be hard. Once you understand your fund options and how markets move, the next step is using a strategy that keeps up with real-world changes.

That’s where tactical allocation comes in.

Unlike set-it-and-forget-it plans, a tactical approach adjusts your investments based on what’s working, helping you grow more, protect better, and stay confident through market ups and downs.

Here’s what it gives you:

- Smarter growth by focusing on strong performers

- Less risk when markets get rough

- Clear, monthly guidance — no guesswork

- A simple way to stay on track, no matter your age

Your 401(k) is too important to leave on autopilot. With the right strategy, it can grow, adapt, and protect your future.

Model Investing’s 401(k) Allocation Model helps you do just that, with ease and confidence.

Take Control of Your 401(k) — The Smart, Confident Way

Get monthly, research-backed updates tailored to your plan. Grow your savings with less stress, more clarity, and better results.

Your 401(k) can work harder for you — starting today.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See PricingPosted in