Over the last 20 years, August has been one of the worst months for stocks. It has produced the lowest average monthly return on Wall Street, as measured by the S&P 500, with stocks dropping an average of 1.2%. For reference, that’s four times as bad as the average loss in the second-worst month, which is September.

To be sure, seasonal trends do not always play out, but they do more often than not. Considering that we’ve already experienced some mild volatility thus far in August, and are in a seasonally weak period, we thought it was a good time to discuss some of the mental challenges that investors face year round.

In particular, this article will focus on the mental resilience that investors need to cultivate, in order to stomach the fluctuations that come with being a successful investor. In other words, we’re going to frame out what “normal” behavior looks like in the financial markets, so that you have a better idea of when to panic, and when not to.

When it comes to stock market action, there are three concepts that should always be at the forefront of your mind. Whenever the bottom falls out of the market, and your nerves start getting rattled, remember these three things:

Volatility is Normal

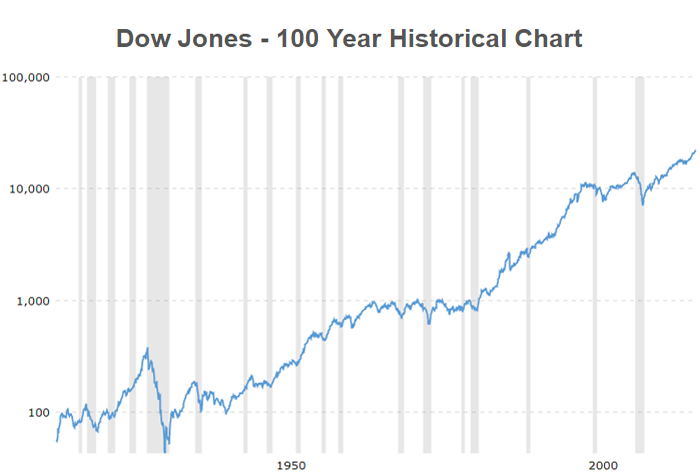

This cannot be overstated. Volatility is a natural part of financial markets. If you don’t believe me, take a look at the chart below.

This chart shows how the Dow Jones Industrial Average has performed over the last 100 years. The vertical gray bars mark recessions, as defined by the National Bureau of Economic Research.

At first glance, you should notice that this chart looks like a polygraph chart… Translation: Market do not rise in straight line fashion.

As you can see, every move higher is followed by either a period of consolidation, or a correction. Consolidation refers to periods when prices tend to trade sideways, as markets “digest” their recent moves. A correction, on the other hand, refers to a pull back in prices after they have run too far in a short period of time.

What you need to remember here is that this ebb and flow is the normal process through which markets move higher. So whenever you see the stock market sell off, think to yourself, “don’t worry folks, it’s all part of the show…”

While we’re on the topic of corrections and stock market volatility, I want to mention another common mistake that can get you into deep trouble. This doesn’t apply to you if you’re using a data-driven approach to investing, as we do here at Model Investing, but for the average retail investor, it’s a big problem.

Study after study shows that when the stock market rises, investors put more money into it. And when it goes down, they pull money out. This is akin to running to the mall every time stores raise their prices, and then returning that merchandise once it’s on sale… Over the long-term this is a losing proposition that causes investor returns to substantially underperform market indexes.

The reason for this counterintuitive behavior is simple: People become greedy when everyone else is getting rich (the markets are rising) and frightened whenever the markets are in decline. This fear response can be incredibly difficult to overcome, and it frequently causes people to sell at the worst time, locking in losses that otherwise would have recovered.

Getting out of this mental paradox requires some retraining of your mind. Specifically, you need to begin seeing market selloffs the same way you’d see a sale at your favorite store: as a discount on good quality merchandise. Whenever the markets have a sale, you need to train yourself to be in buying mode, not selling.

Before we move on, I want to try and add some perspective to this whole concept of volatility.

On any given day, a market move of 1% is not uncommon. Think about what that means in terms of the fluctuations in a portfolio. If the market falls 1%, a portfolio worth $100,000 loses $1,000. An investor with a larger portfolio of, say, $1,000,000 would see their account balance drop by $10,000 that day.

That’s enough to nauseate many people, and get them to hit the sell button. But once again, this is normal behavior, and you need to become accustomed to it. If you don’t have the mental resilience to see your portfolio lose 5, 10 or even 20% without becoming panic stricken, then you’re frankly not going to do well as a long-term investor. It’s that simple.

Now, at this point you may be wondering how we can be so confident in stating that corrections should not alarm you, and that they should almost always be viewed as buying opportunities. The answer to that has to do with our next big takeaway:

The Stock Market Has an Upward Bias

Take another look at the chart above. Notice any patterns? Perhaps you made the astute observation that over the last 100 years, market prices have had a tendency to rise. Right off the bat that should intrigue you, but let’s take this a bit further. If we looked at the 100-year period prior to what’s shown in the chart, which way to you think market prices trended? I hope you said “up” because that’s what happened.

But it goes further… Take a look at a long-term chart of any developed country’s stock market and the trend is always the same: UP. Over time, stock prices move from the lower left corner to the upper right.

Rather than explain to you why this happens in our words, we’re going to let famed investor Warren Buffet do the talking. Warren attributes the massive advances that society has made and the tremendous wealth it has created for shareholders to “economic dynamism.” In particular, he notes that, “Above all, it’s our market system – an economic traffic cop ably directing capital, brains and labor – that has created America’s abundance.”

He continues: (emphasis ours)

Early Americans, we should emphasize, were neither smarter nor more hard working than those people who toiled century after century before them. But those venturesome pioneers crafted a system that unleashed human potential, and their successors built upon it.

This economic creation will deliver increasing wealth to our progeny far into the future. Yes, the build-up of wealth will be interrupted for short periods from time to time. It will not, however, be stopped. I’ll repeat what I’ve both said in the past and expect to say in future years: Babies born in America today are the luckiest crop in history.

America’s economic achievements have led to staggering profits for stockholders. During the 20th century the Dow-Jones Industrials advanced from 66 to 11,497, a 17,320% capital gain that was materially boosted by steadily increasing dividends. The trend continues: By year end 2016, the index had advanced a further 72%, to 19,763.

American business – and consequently a basket of stocks – is virtually certain to be worth far more in the years ahead. Innovation, productivity gains, entrepreneurial spirit and an abundance of capital will see to that. Ever-present naysayers may prosper by marketing their gloomy forecasts. But heaven help them if they act on the nonsense they peddle.

Okay, but what about those inevitable economic recessions and bear markets that threaten to evaporate our wealth? Warren’s got a positive outlook on those too:

Many companies, of course, will fall behind, and some will fail. Winnowing of that sort is a product of market dynamism. Moreover, the years ahead will occasionally deliver major market declines – even panics – that will affect virtually all stocks.

During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy. It will also be unwarranted. Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do well.

There’s no way we could have said it better, and frankly, it carries more weight when Warren says it anyway… But the message here should be clear: Over time, stock markets are biased to the upside. If you can live through the temporary corrections, recessions and bear markets that are a natural part of investing, you will be rewarded in the long run with a plush and prosperous retirement … and maybe even some money to leave for the kids.

We’re getting long-winded here so let’s get on to the last of our big three takeaways:

Nearly All Gains Come From “Outliers”

You may not realize it, but a very small number of days account for the vast majority of stock market returns. Consider this rather unique example:

If you had invested in an S&P 500 index fund throughout the 20-year period ending in 2013, you would have earned an annualized return of 9.22%. That would have turned a 100,000 investment into $583,520. But, had you missed the five best-performing days during that 20-year period, your annualized return would shrink to 7.00%. This means that your initial $100,000 investment would only be worth $387,100. That’s a big difference.

It gets worse. If you had missed the 10 best-performing days, your annualized return would drop to 3.02%. Miss the top 40 days (in a 20-year period, mind you) and your initial $100,000 investment would have lost $18,510. Rather striking, right?

So what does this mean?

This example serves to highlight the importance of time in the market. Because it’s virtually impossible to know when these big days will occur, it’s critical to always maintain exposure to the stock market whenever economic conditions are favorable.

That last caveat is extremely important. Study the markets long enough, and you’ll quickly recognize that there are times when it is prudent to have very little exposure to stocks (think dot-com collapse or financial crisis, where stocks lost over half their value).

These times coincide with periods during which business conditions are deteriorating, and the economy is either approaching or in recession (see chart at top). Outside of these temporary downturns in the business cycle, it’s very important to maintain constant exposure to the stock market so that you’re positioned appropriately when these “outlier” returns occur.

Conclusion

You may not have realized it when you were just getting started, but investing is very much a mental game. It requires an intellectual toughness and fortitude that is not only uncommon, but very difficult to develop. To that end, one of the best things you can do whenever the market is making you nauseous, is to remember the three key takeaways from this article.

Specifically,

- Volatility is a natural part of the financial markets.

- Over the long-term stock markets are biased to the upside (they will always recover).

- Time in the market (excepting those periods when the business cycle has turned negative) is your best friend, as it will allow you to capture those outlier gains that heavily influence overall stock market returns.

If you can keep these three concepts in mind, making it through the next bout of volatility should be a breeze. Not only that, you should be able to sleep better at night, and wind up with a much more substantial nest egg down the road.

Always remember that investing is a long-term proposition. Making decisions that satisfy your short-term emotional needs (such as selling because you can’t stomach the pain of natural market corrections) can easily derail long-term success. Be smart, be prudent, and don’t let your emotions get the best of you.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing