Starting January 2026, the Thrift Savings Plan will allow Roth in-plan conversions, moving money inside your TSP from traditional (pre-tax) to Roth (after-tax). That may sound technical, but it’s a big deal for federal employees and service members: you’ll have a new way to shape how your retirement income is taxed.

This guide explains what changes with TSP Roth conversion 2026, how a TSP Roth conversion works, common mistakes to avoid, and a simple way to decide how much to convert.

What Is a Roth In-Plan Conversion?

A Roth in-plan conversion lets you move dollars inside the TSP from your traditional balance (pre-tax) to your Roth balance (after-tax). You’ll owe income tax on the amount you convert in that calendar year. If you don’t already have a Roth balance, your first conversion creates one.

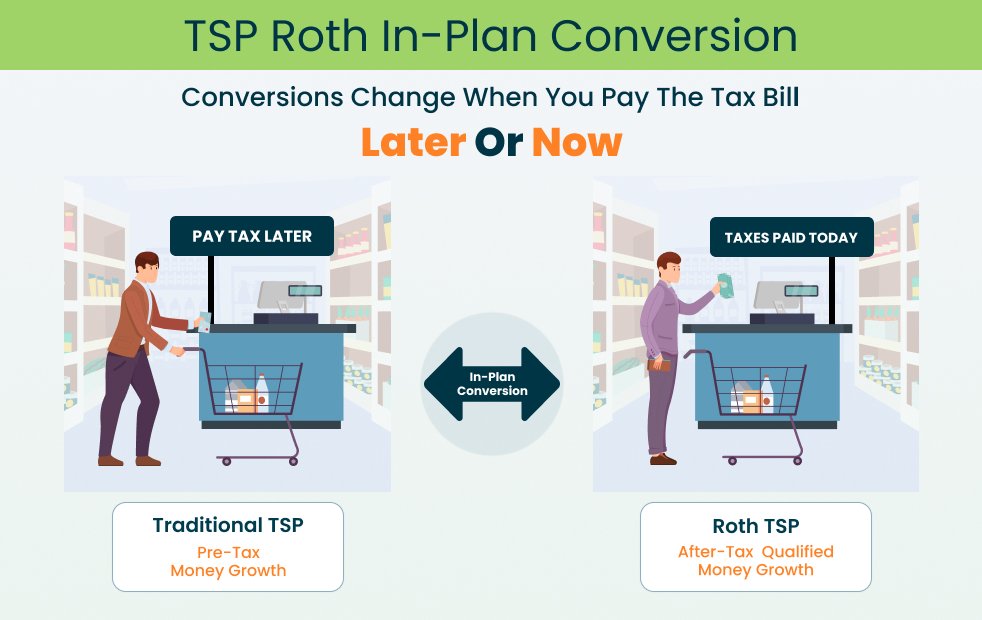

Think of it like shopping at a store:

- Traditional TSP (pay later): It’s like taking your items to the checkout and leaving without paying today. You’ll get the bill later when you retire, and you’ll have to pay whatever the tax “price” is at that time.

- Roth TSP (pay now): It’s like paying for your items upfront at today’s prices. Once paid, you walk out and never owe anything again. Future qualified withdrawals are completely tax-free.

This way, even someone brand new to the TSP or retirement accounts can immediately see the difference: Traditional = pay taxes later, Roth = pay taxes now.

Conversions change when you pay the tax bill—now or later. Of course, while conversion timing affects taxes, your fund allocation affects growth. Managing both matters.

Our TSP Model manages exposure across G, F, C, S, and I funds month-to-month, adjusting tactically as market conditions shift. Taxes and fund choices are separate levers, and coordinating both can lead to stronger long-term outcomes.

Plan smarter: align your TSP Roth conversion with a rules-based market strategy.

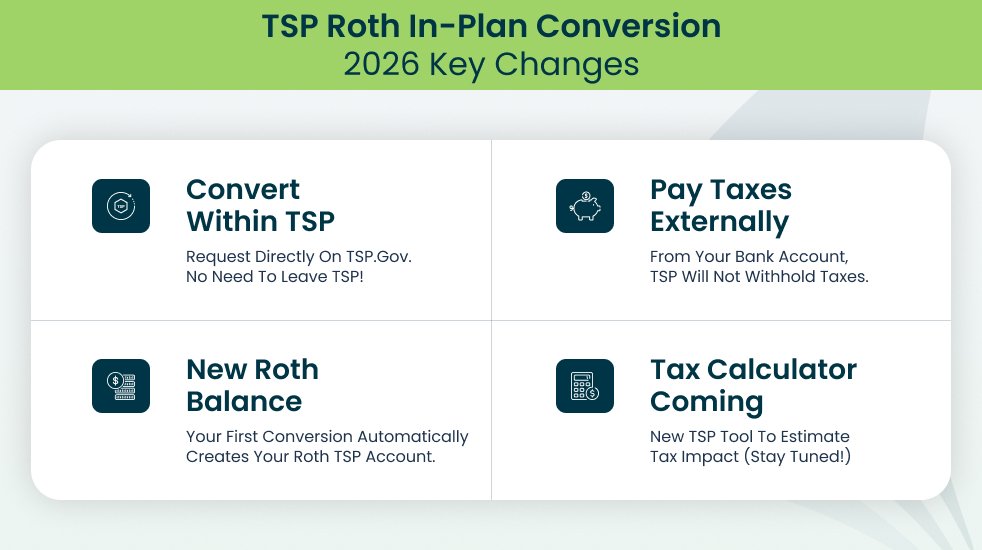

What Changes in January 2026 with the TSP Roth Conversion?

- You’ll be able to request a TSP Roth conversion within the TSP.

- Taxes due on the conversion must be paid from personal funds (not pulled from the TSP).

- The TSP has said a calculator is coming to help estimate the impact.

- If you’ve never had a Roth TSP, convert once, and the Roth balance is opened automatically.

Why this matters: Until now, many participants rolled money out to a Roth IRA to convert. In 2026, you can convert without leaving the TSP.

Quick Comparison: Traditional TSP vs Roth TSP

| Feature | Traditional TSP | Roth TSP |

| Tax timing | Pay tax later at withdrawal | Pay tax now; qualified withdrawals are tax-free |

| Contributions | Pre-tax | After-tax |

| RMDs | Yes | No (Roth TSP balances are not subject to RMDs) |

| Best fit (general) | Expect a lower tax rate later; need deduction today | Expect same/higher tax rate later; value tax-free income |

For a deeper dive into how Roth and Traditional accounts compare beyond TSP, including IRAs, check out our guide: Roth vs. Traditional IRAs, A Practical Guide.

Taxes, Rules, and Timing for a Roth In-Plan Conversion

If you’re looking at a TSP Roth conversion in 2026, here’s what a Roth in-plan conversion involves and how to avoid common mistakes.

1. The tax rule (what gets taxed)

When you convert a traditional TSP to Roth, the amount you move counts as taxable income this year.

Example: Convert $10,000 → your taxable income increases by $10,000 for that year.

This is the core idea behind a TSP Roth conversion: you pay the tax now so future qualified Roth withdrawals can be tax-free.

2. How you pay the tax (where the money comes from)

You must pay the tax bill from outside funds (cash in savings/checking). The TSP will not take part of the conversion amount to cover taxes.

Tip: Before you request the conversion, set aside money for taxes so you’re not scrambling later.

3. The 5-year “clock” (when Roth earnings become tax-free)

For the earnings in your Roth TSP account to be tax-free, two conditions must be met:

- Five tax years must have passed, starting January 1 of the year of your first Roth contribution or conversion, and

- You meet a qualifying event (most commonly age 59½).

Timeline example: First Roth amount in 2026 → the five tax years are 2026–2030 → earnings can be qualified starting 2031, if you’re also 59½.

Note: Contributions are always accessible from your Roth balance; the 5-year clock mainly applies to earnings.

4. RMDs (Required Minimum Distributions)

Roth balances in the TSP aren’t subject to RMDs, helping you avoid forced taxable income in retirement.

Common Mistakes to Avoid

- Over-converting in one year

Converting too much money in a single year can push you into a higher tax bracket, raise Medicare IRMAA premiums, or reduce certain credits or deductions. Many people convert just enough to fill their current bracket.

- No cash set aside for taxes

You’ll need liquidity, so plan the tax payment before you convert the TSP to a Roth TSP.

- Ignoring the 5-year clock

Converting right before you need the money may not give the earnings enough time to become qualified.

- Confusing “rebalancing” with “converting”

Rebalancing changes your fund mix (G, F, C, S, I). A TSP Roth conversion changes the tax status of dollars, not the investments themselves.

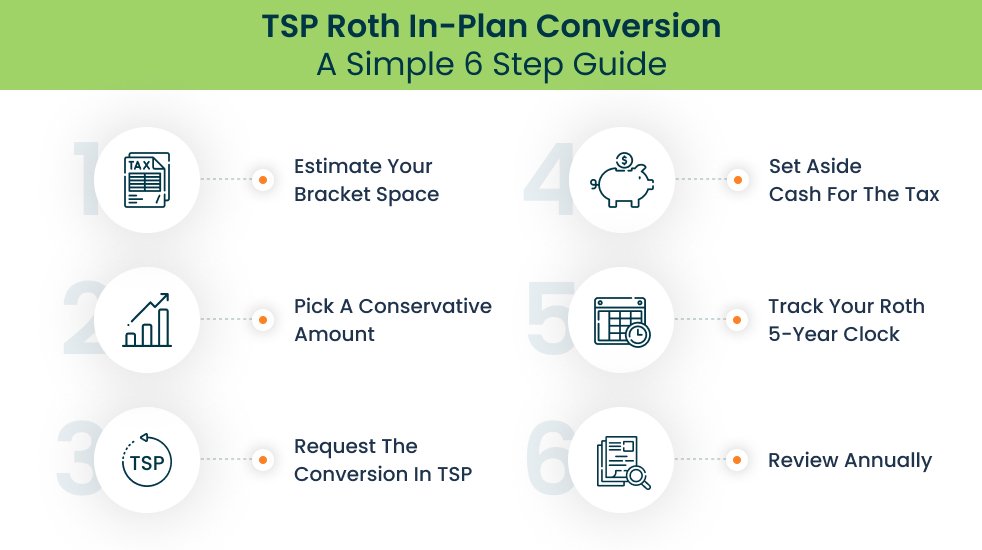

How to Convert TSP to Roth TSP: A Simple Guide

Once the TSP launches the Roth conversion feature in 2026, you can follow these six steps to plan your move effectively and avoid last-minute tax surprises.

1. Estimate your bracket space

Start by checking how much room you have left in your current tax bracket. Look at your projected income for the year and calculate how much you can convert without spilling into a higher bracket. This helps you plan your conversion with minimal tax impact.

2. Pick a conservative amount

It’s often smarter to start small. Many investors convert just enough to “fill” their existing tax bracket rather than pushing into a new one. A gradual approach allows you to learn how the tax cost fits into your budget and gives you flexibility to adjust next year.

3. Set aside cash for the tax

You’ll need to pay the taxes from outside funds, so prepare early. Setting aside cash in a savings account ensures you’re ready when the tax bill arrives in April. That way, your conversion doesn’t create financial stress or force withdrawals from other investments.

4. Request the conversion in TSP (once live)

Once the in-plan conversion tool goes live, submit your request directly within your TSP account. Keep a copy of the confirmation for your records, as you’ll need it for tracking your Roth timeline and filing taxes correctly.

5. Track your Roth 5-year clock

Each Roth conversion starts its own 5-year countdown for tax-free earnings. Mark your first conversion year and keep it in your financial notes. Staying aware of this timeline helps you avoid withdrawing earnings before they qualify for tax-free treatment.

6. Review annually

Make this part of your year-end financial routine. Review your income, tax bracket, and TSP allocations each year to decide whether another small conversion makes sense. Consistent reviews help you stay strategic instead of reactive.

Our rules-based TSP Allocation Model adjusts automatically as market conditions change. If you’re thinking about doing Roth conversions, this strategy helps you balance long-term growth with smart tax planning.

Ready to put a plan in motion?

Stay aligned with our rules-based TSP allocations while planning your Roth conversion strategy.

Who Should Consider a Roth In-Plan Conversion?

If you’re thinking about a TSP Roth conversion, here’s a simple way to decide whether a Roth in-plan conversion fits you right now.

Good candidates include

Low-income years

If this year’s income is lower than usual because of a sabbatical, early-retirement gap years, unpaid leave, or a smaller bonus, converting adds less to your tax bill.

Why it helps: You pay tax at a lower rate today and let Roth dollars grow for future tax-free withdrawals.

Pre-RMD planners

If you want smaller required withdrawals later, converting some of your traditional TSP balance now can reduce future RMDs and the taxes they create.

Think of it as: Paying a bit of tax now to avoid taxable income later.

Long time horizon

If you have five or more years before you’ll touch the money, your Roth earnings have more time to grow tax-free.

Simple rule: The more years until retirement, the stronger the case for a TSP Roth conversion.

Think twice or go slow (it may not fit yet)

Close to a higher tax bracket

A large Roth conversion can push you into a higher bracket, raise Medicare IRMAA premiums, or reduce certain credits and deductions.

Safer approach: Convert traditional TSP funds to Roth in smaller chunks that “fill” your current bracket but don’t spill into the next.

No cash set aside for taxes

You must pay conversion tax using outside funds (such as savings). If that strains your emergency fund, convert a smaller amount or wait.

Guideline: Never risk your safety net just to fund a conversion.

Short time horizon

If you’ll need the money soon, the 5-year clock may prevent your earnings from becoming tax-free in time. Converting right before withdrawals often won’t deliver the full Roth benefit.

Bottom Line: Conversions work best when you can leave the money alone for years.

Planning the Amount: Small Annual Conversions vs. One-Time Moves

“Bracket filler” approach (simple and steady):

Convert a modest amount each year to stay within your current bracket. This spreads taxes over time and avoids unpleasant surprises.

“RMD reducer” approach:

Convert more aggressively in the years before RMDs begin, shrinking your future taxable withdrawals.

“Lump sum” approach:

If you expect an unusually low-income year (such as a gap year before retirement, a career change, or a business loss) you may choose to convert a large amount all at once to take advantage of the temporary lower tax rate.

Timing tip:

Some prefer converting during or just after a down market year—this lets you move more shares at lower values, giving future growth more room inside the Roth bucket.

Wrapping Up

The new Roth in-plan conversion feature gives TSP participants more control over when they pay taxes and how much tax-free income they accumulate for retirement. You don’t have to convert everything (or anything) right away.

Start with a plan: estimate your bracket space, choose a manageable amount, set aside cash for taxes, and review yearly. Stay disciplined with your fund allocations while you make those tax moves.

Keep your portfolio on track while you plan your Roth conversion.

FAQs About Roth TSP In-Plan Conversions

1. What is a Roth in-plan conversion in the TSP?

A Roth in-plan conversion lets you move money inside the TSP from traditional (pre-tax) to Roth (after-tax). You pay income tax on the amount you convert in that year. It changes tax status, not your fund choices.

2. When does the TSP Roth conversion feature begin?

TSP participants can begin in-plan Roth conversions beginning January 2026.

3. How do I convert traditional TSP Funds to Roth?

Request an in-plan conversion through your account on tsp.gov (when live). Choose an amount, and keep cash ready to pay the taxes. The money moves from your traditional balance to your Roth balance inside the TSP.

4. Can I convert a portion of my traditional TSP to Roth?

Yes. You can convert a portion each year. Many people convert just enough to fill their current tax bracket.

5. How are taxes handled for a TSP Roth conversion?

The amount converted is added to your taxable income for that year. You must pay the tax from outside funds (savings/checking), not from your TSP balance.

6. What is the Roth 5-year rule for TSP?

Roth earnings are tax-free only once five tax years have passed, starting January 1 of the year of your first Roth contribution or conversion, and you meet a qualifying event (usually age 59½). Contributions are always accessible; this rule mainly applies to earnings.

7. Do Roth TSP balances have RMDs?

No. Roth money in the TSP is not subject to RMDs, which can help lower forced taxable income later.

8. Who is a good candidate for a Roth in-plan conversion?

People in lower-income years, planners who want to reduce future RMDs, and anyone with a long time horizon, giving Roth earnings more time to grow tax-free.

9. Who should wait or go slow on converting?

Those close to a higher tax bracket, those without cash set aside to pay taxes, or those with a short time horizon until withdrawals.

10. What’s the difference between traditional TSP and Roth TSP?

Traditional TSP = pay tax later (tax deduction now, but withdrawals are taxed).

Roth TSP = pay tax now (qualified withdrawals can be tax-free). A conversion moves dollars from “tax-later” to “tax-now.”

11. Traditional TSP vs Roth TSP: which is better?

It depends on your tax situation. Traditional TSP lets you defer taxes now and pay later in retirement, which works best if you expect a lower tax rate in the future. Conversely, if you expect the same or higher tax rate in retirement, converting to Roth now can be beneficial. Many participants use a mix of both to balance flexibility and manage taxes over time.

12. Will a TSP Roth conversion raise my Medicare IRMAA?

It can. Conversions increase AGI, which is used to calculate Medicare IRMAA two years later. Converting smaller amounts can help manage brackets and IRMAA thresholds.

13. Can the TSP withhold taxes from my conversion?

No. You cannot use the converted amount to pay taxes. Plan to pay the taxes due from personal funds.

14. Does a conversion change my fund mix (G, F, C, S, I)?

No. Converting changes the tax status of dollars, not the investments. If you want to change your fund mix, you must rebalance using an interfund transfer. You can follow this guide on how to update your TSP allocations on TSP.gov for step-by-step instructions.

15. Is it better to convert all at once or in phases?

Most TSP participants use phased conversions (small amounts year-by-year) to avoid jumping tax brackets and to control IRMAA impacts.

16. Should I wait for a down market to convert?

It can be beneficial to wait for a down year as the converted balance (and thus taxes owed) will be smaller. This method moves shares into Roth status before a potential recovery, allowing any subsequent growth due to a rebound in the market to be captured tax-free.

17. Can I undo a TSP Roth conversion?

No. Conversions are generally irrevocable. Double-check amounts before submitting.

18. How do I pick an amount to convert each year?

Estimate your income, see how much room remains in your current tax bracket, and convert only up to that ceiling. Keep cash aside for the tax bill.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See PricingPosted in