When you begin to save for retirement, the easiest way to get started is to enroll in your employer-sponsored retirement plan (401(k), 403(b), TSP, etc.). These types of accounts offer tax-deferred savings, and if your employer happens to provide a match, make sure to take full advantage of it.

The next step (or the first step, for those who don’t have access to an employer-sponsored plan) is generally to open an Individual Retirement Account (IRA). These types of accounts also provide tax advantages, and come in two types: “Roth” and “Traditional.”

Current guidelines allow most individuals (there are income limitations) to contribute a total of $5,500 per year ($6,500 for those age 50 and older) to both types of IRAs combined . This means that investors must take careful consideration regarding which type of account to open and fund. The rest of this article will detail how to go about making that decision.

Roth vs. Traditional, What’s the Difference?

The difference between a Roth IRA and a Traditional IRA comes down to taxes. When you make contributions to a Traditional IRA, those contributions are tax deductible in the current year, but when you withdraw those funds during retirement, you’ll have to pay income tax on that money. A Roth IRA is different in that contributions to this type of account are not tax deductible, but as result, when you withdraw that money during retirement, it’s not taxed at all.

Another way to think about it is like this: Traditional IRAs are tax-deferred accounts (payment of taxes is deferred until you withdraw the money, just like with a 401(k) or the TSP), while Roth IRAs are tax-free accounts (you’ve already paid the tax on those contributions, so you get to withdraw them, and their earnings, tax free).

As a result of the nature of these two different types of accounts, conventional wisdom suggests that you’re better off:

- Investing in a Traditional IRA if your current marginal tax bracket is higher than you expect it to be during retirement.

- Investing in a Roth IRA if your current marginal tax bracket is lower than you expect it to be during retirement

We all love simple and succinct guidelines, but when it comes to IRAs, there are a couple of problems with making your decision based on this logic alone. To ensure that we truly make the right decision, we’re going to have to dig a little deeper.

The Reinvestment Problem

Let’s think for a minute about how much we’re really contributing when we add funds to a Roth or Traditional IRA. If we contribute $5,500 to a Roth IRA, and we’re in the 25% marginal tax bracket, then we had to pay an additional $1,833 in taxes in order to invest that money. So technically, we’re investing $7,333 ($5,500 + 1,833) worth of “earned income.”

What about with a Traditional IRA? Since our contributions to this type of account are tax-deductible, contributing $5,500 dollars only requires $5,500 of earned income. This is a crucial distinction to recognize: While it may seem like contributing $5,500 to a Roth IRA is the same as contributing $5,500 to a Traditional IRA, it’s NOT.

There is a way that we can remedy the situation, however. If we were to invest $5,500 in a Traditional IRA, and then invest the tax savings that we receive in a separate investment account, then we would effectively be contributing the same amount. Make sense? For this, we would need to contribute an additional $1,375 ($5,500 x 25%) to a separate taxable account in order for our $5,500 Traditional IRA contribution to be equivalent to a $5,500 Roth IRA contribution.

But as you can probably imagine, very few people do this. Instead, they use their tax refund at the end of the year for a nice vacation or a new jet pack (we’re guilty of the latter).

So at this point, we can come to a quick and simple conclusion: If you’re NOT going to reinvest your tax savings from making Traditional IRA contributions, then you’re probably better contributing to a Roth IRA. Making an equivalent contribution to a Roth IRA will act as a form of forced-savings, because your tax refund at the end of the year won’t be as large as if you had made that contribution to a Traditional IRA.

To understand this better, let’s walk through a few hypothetical scenarios.

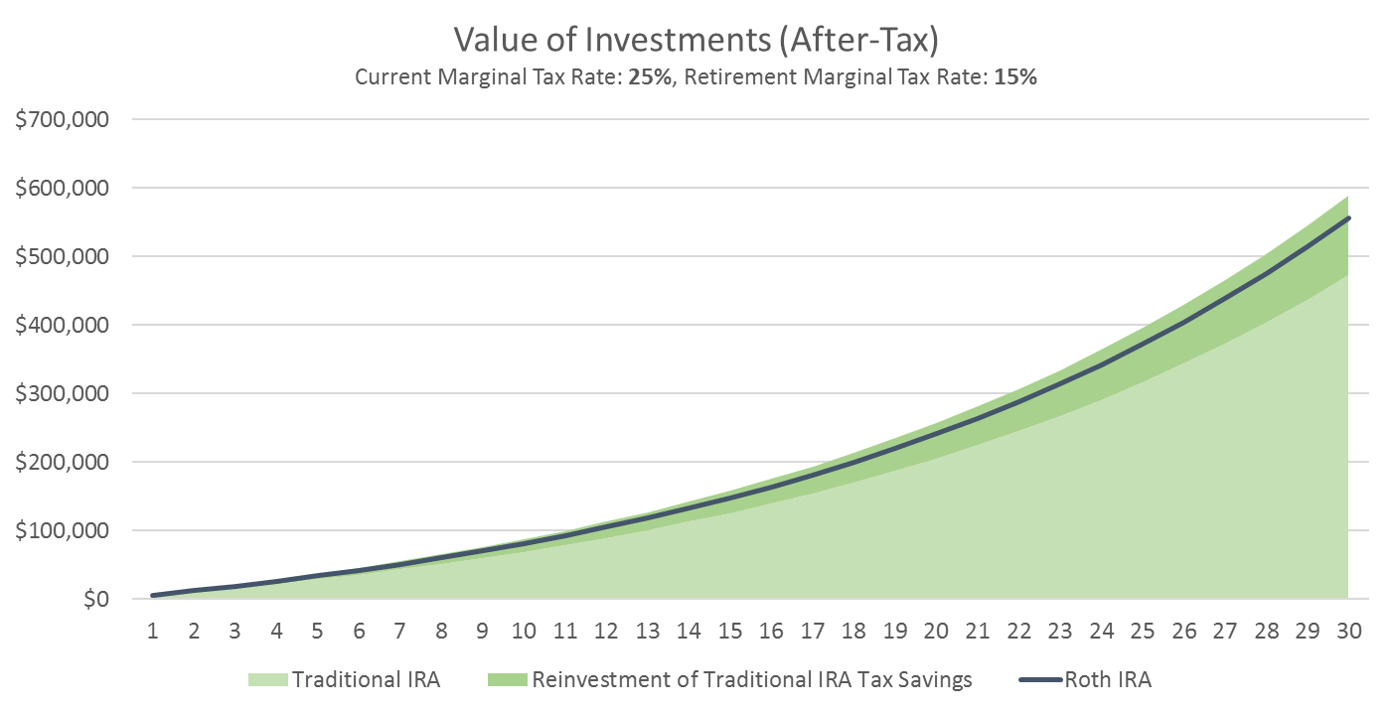

Example 1: Current Marginal Tax Rate: 25%, Retirement Marginal Tax Rate: 15%

In the chart below, we can see the effects of investing in both a Roth and Traditional IRA over a 30-year period. For this first example, we’re assuming that our current marginal tax rate is 25%, and our marginal tax rate at retirement will be 15%. In all the scenarios that follow we will assume contributions of $5,500 per year and an annual return of 7%.

Notice that even though our current tax rate is higher than it will be at retirement (which conventional wisdom therefore suggests we should use a Traditional IRA), the only way our after-tax value can be higher than with a Roth IRA is if we reinvest our tax savings. If we do not, then our after-tax value will be significantly below that of a Roth IRA (remember that this is a result of the forced-savings nature of Roth IRAs – without reinvesting the tax savings from a Traditional IRA, we’re simply not contributing as much to our retirement account).

Next, let’s explore the trade-off between a Roth and Traditional IRA when we expect to remain in the same tax bracket during retirement.

Example 2: Current Marginal Tax Rate: 25%, Retirement Marginal Tax Rate: 25%

This next chart also assumes contributions of $5,500 per year and a 7% annual return. The only adjustment is now we expect to be in a 25% marginal tax bracket during retirement, the same rate that we pay now. If you’re paying close attention, this chart should be a little surprising…

If we’re investing the same amount of earned income between a Roth IRA, and a Traditional IRA (including reinvestment of the tax savings), and we’re going to be in the same tax bracket during retirement that we are now, shouldn’t the two balances be even? In other words, shouldn’t the final after-tax value of the Roth IRA match the final after-tax value of the Traditional IRA, assuming we reinvest the tax savings?

You might be tempted to think so, but that’s not the case for two reasons:

- When you make contributions to your Roth IRA, you’re paying income tax on those contributions, but your gains are free to grow (and be withdrawn) tax free. In other words, the growth in a Roth IRA account is NEVER taxed (assuming the money has been in the account for at least 5 years and you’re age 59 1/2 or older when you withdraw). In contrast, when you make contributions to a Traditional IRA, you pay tax later (during retirement), but you also pay tax on all the growth your portfolio has seen as well.

- When you reinvest the tax savings from Traditional IRA contributions, this typically must be done in a taxable account (because you’ve already maxed out your IRA for the year). As a result, you will have to pay income tax on this money before you can invest it, and capital gains on any profits that accrue. (For the scenarios outlined, we assume a 15% long-term capital gains tax paid on the tax savings account.)

All things considered, if you think your marginal tax rate during retirement will be close to what it is currently, you’re probably better off opting for a Roth IRA. Here’s one final example to highlight that.

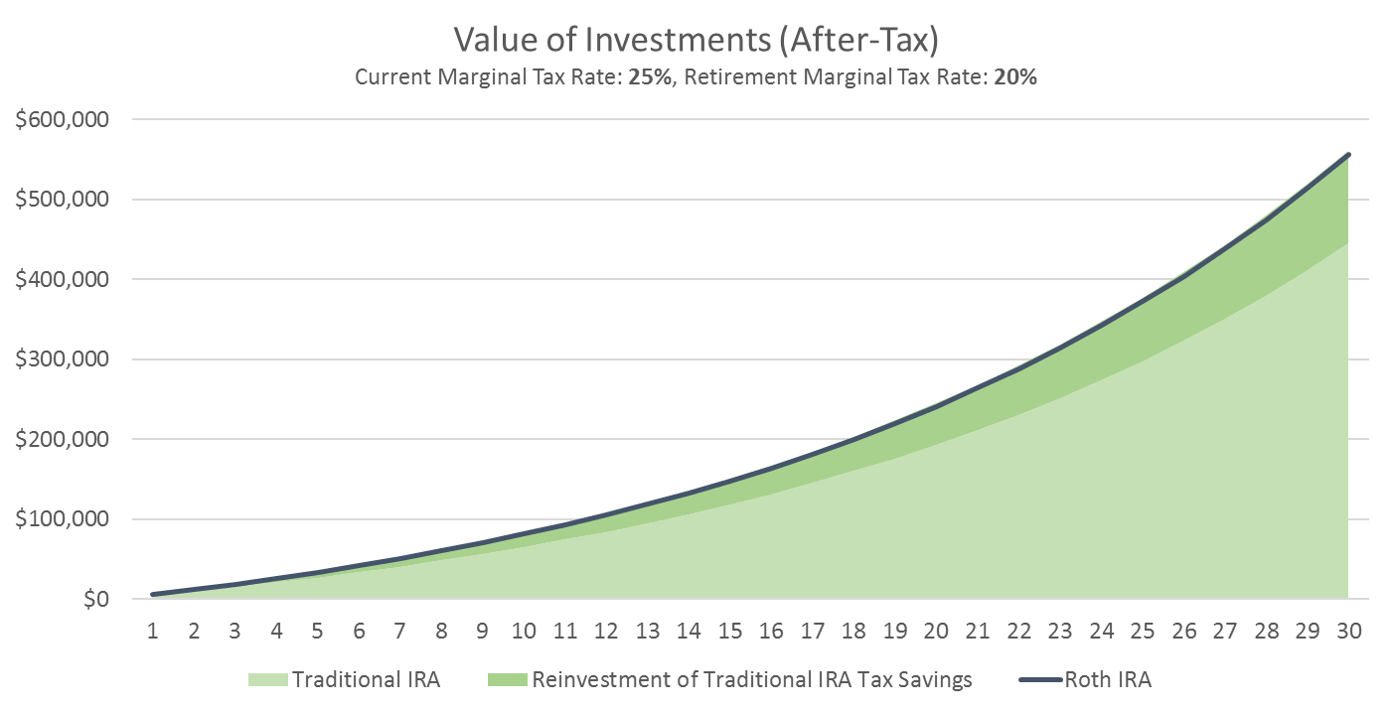

Example 3: Current Marginal Tax Rate: 25%, Retirement Marginal Tax Rate: 20%

The following chart shows the scenario that unfolds with a current marginal tax rate of 25%, and a marginal tax rate during retirement of 20%. Recognizing that conventional wisdom would suggest you opt for the Traditional IRA in this situation, what do think now that you’re becoming “enlightened?”

As you can see, even if your marginal tax rate during retirement is 5% lower than your current marginal tax rate, the Roth IRA can still be a better option.

I don’t know about you, but I’d much rather just contribute to a Roth IRA than have to go through the trouble of tracking the tax savings from my Traditional IRA contributions, investing that money in a separate taxable account, and then managing both accounts. Wouldn’t you agree? When forced to do things manually (such as track and add funds to a separate taxable account) many of us will either forget, or we’ll get sidetracked by other wants and needs and spend that money on something else. This is why automation is so important.

At this point, the one scenario we haven’t considered is when our marginal tax rate at retirement will be greater than our current marginal tax rate. The only people who are likely to find themselves in this type of situation are those who either own a businesses, or inherit a large sum of money later in life. It should go without saying that in a situation like this, you will be much better off using a Roth IRA. Not only will it allow the earnings in your account to be withdrawn tax-free, you will pay a lower effective tax rate by paying that tax now.

Key Takeaways

Let’s briefly sum up what we’ve learned so far:

- If you’re not planning on reinvesting the tax savings from your Traditional IRA contributions, opt for a Roth IRA. There are almost no situations in which the after-tax value of a Traditional IRA will exceed that of a Roth IRA when the tax savings are not reinvested.

- Investors who pay the highest tax rates in retirement stand to benefit the most from Roth IRAs. The higher you think your marginal income tax rate at retirement will be (compared to your current marginal tax rate), the more benefit a Roth IRA will provide.

- Even if you expect your marginal tax rate in retirement to be less than it is currently, AND you plan to reinvest the tax savings, a Roth IRA may STILL be more advantageous. In many cases you’ll still come out ahead with the Roth IRA, and you won’t have to deal with the hassle of reinvesting your tax savings in a separate account.

Additional Considerations

At this point you should have a relatively good idea of which type of IRA (Roth or Traditional) is right for you. But there are a couple last items that are worthy of your consideration.

The first is this: Tax brackets and the treatment of tax-deferred and tax-free accounts may change in the future as a result of legislative actions. Therefore, what makes sense now could end up being a suboptimal decision if the rules of the game change down the road. To prepare for this type of scenario, it may make sense to incorporate the concept of diversification into this decision.

You are allowed to open and maintain BOTH a Traditional and a Roth IRA at the same time. The only thing you must be aware of is that during any calendar year, total contributions to both accounts cannot exceed the annual cap (currently $5,500 for those age 49 or less, $6,500 for those 50 and older). This means you could adjust your contributions between the two accounts as conditions (such as your income, expected marginal tax bracket at retirement) change.

Another important consideration is that with Roth IRAs – what you see is what you get. In other words, if your Roth IRA balance is half a million bucks, you know that you’ll get a half million bucks when you liquidate it. With a Traditional IRA, because you must pay taxes, the actual amount you receive when you withdraw funds will be much less than your balance shows.

Along the same lines, because you’ve already paid taxes on money contributed to a Roth IRA, these types of accounts do not have Required Minimum Distributions (RMDs). Uncle Sam has already received his cut, so you’re not forced to withdraw those funds as you age in order to pay the government their share. This feature also makes Roth IRAs great wealth transfer vehicles.

The Bottom Line

Hopefully you now have a much better understanding of how to decide between contributing to a Roth vs. a Traditional IRA. But the bottom line is this: Regardless of which type of account you choose, the real WIN comes from making the darn contributions!

The type of account you choose will make a difference, but just getting those contributions in now, while you still have the power of time on your side, is much more important. $5,500 per year works out to a little more than $100 per week … so make it happen! Maxing out your IRA, regardless of the type, will put you on a great path toward retirement.

Eligibility Requirements

As a courtesy, we’re including Roth IRA contribution limits and Traditional IRA deduction limits below. These are straight from the IRS (irs.gov).

Please note that the 2017 and 2018 contribution limits for both Traditional and Roth IRAs is $5,500 per year for those age 49 and younger, and $6,500 for those age 50 and older.

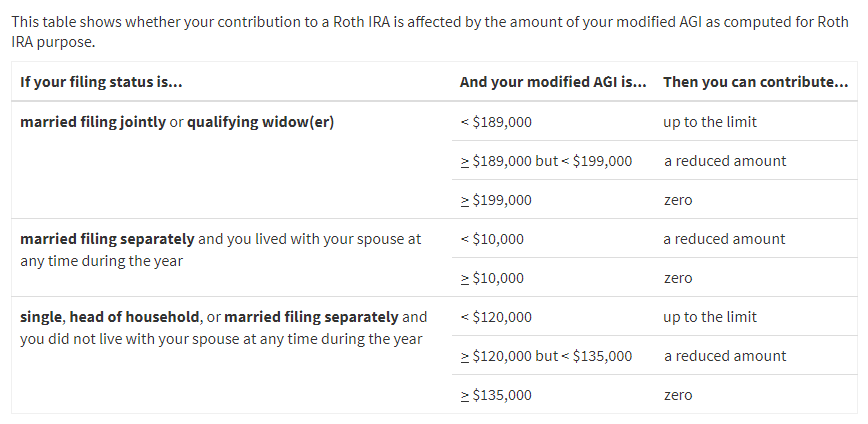

2018 Roth IRA Contribution Limits

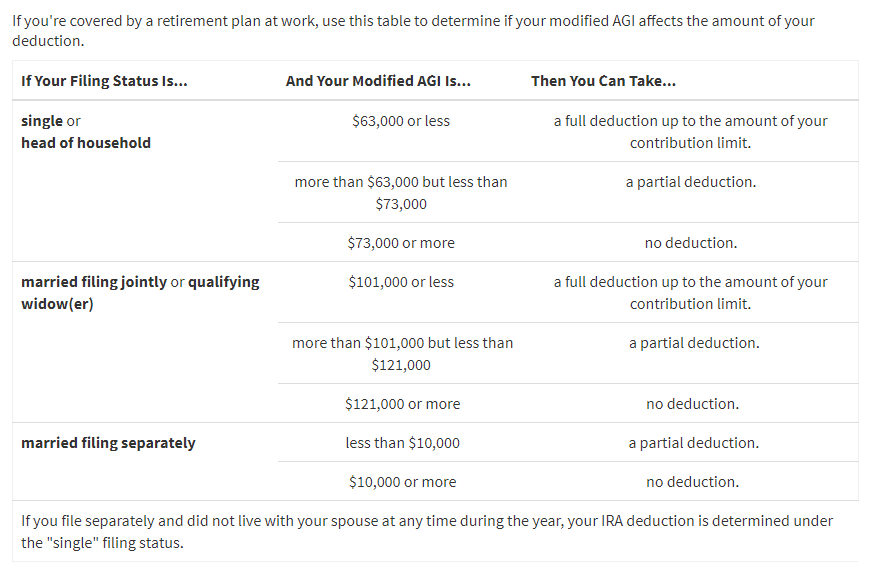

2018 Traditional IRA Deduction Limits – Effects of Modified AGI on Deductible Contributions if you ARE Covered by a Retirement Plan at Work

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing