The Government Shutdown is a Wake-Up Call for Every Investor

The recent government shutdown has left thousands of federal workers waiting for their next paycheck, a situation that reminds us all how fragile financial stability can be.

Even if your job feels secure, unexpected events like layoffs, medical emergencies, or economic slowdowns can disrupt your income quickly.

Federal employees with Thrift Savings Plan (TSP) accounts may be wondering how to manage expenses while their pay is paused. But this lesson goes far beyond government workers.

The truth is, every investor, whether you save through a 401(k), IRA, or TSP, needs a safety cushion to stay financially secure when income stops.

An emergency fund isn’t about predicting the next crisis. It’s about being ready when life throws you one so you can stay in control, avoid unnecessary debt, and protect your long-term investments from being disturbed.

This simple but powerful step is what separates financial stress from financial security.

Let’s explore why every investor needs an emergency fund and how you can build one without falling behind on your retirement goals.

What an Emergency Fund Really Does and Why It Matters

An emergency fund is money you set aside for life’s surprises, the kind that doesn’t wait for your paycheck to arrive.

It’s not for vacations, gadgets, or new furniture. It’s for unexpected costs like medical bills, car repairs, or short periods without income, such as a government shutdown or a job loss.

Think of it as a financial shock absorber.

When income stops or expenses rise suddenly, your emergency fund keeps you from tapping into your retirement savings or using high-interest credit cards.

Without it, even a short-term problem can force long-term consequences like withdrawing from your 401(k) plan, IRA, or TSP early and paying heavy penalties.

For federal workers, the recent government shutdown shows this clearly.

When paychecks are delayed, those who already have an emergency fund can breathe a little easier.

But those without one might have to borrow, pause bill payments, or even consider TSP loans — steps that can weaken long-term progress.

And it’s not just about government employees.

Private-sector workers face similar risks. Layoffs, business slowdowns, or medical leaves can all interrupt income.

That’s why building an emergency fund isn’t just a smart idea. It’s a core part of a complete investment strategy.

When you have cash reserves, you give yourself something invaluable: time and flexibility.

- You can make calm financial decisions instead of emotional ones.

- You can let your investments grow instead of selling them at the wrong time.

- You can stay invested, which is exactly what long-term success requires.

Now that you understand why an emergency fund matters, the next question is simple: How much should you save and how do you build it, especially if you’re already contributing to a 401(k) or TSP?

How Much to Save and a Simple Way to Do It Without Hurting Your Retirement Goals

Most financial experts recommend saving three to six months of essential living expenses in an emergency fund.

That might sound like a lot at first, but the goal isn’t to reach it overnight. It’s to build it step by step.

Start with a small, reachable target, such as $500 or $1,000.

That first cushion can cover smaller surprises, such as a car repair, a medical copay, or a few weeks of bills without needing to use credit cards or loans.

Once you reach that, keep going until you’ve saved enough to cover several months of rent, utilities, groceries, and transportation.

Here’s a practical way to make progress without falling behind on your 401(k) or TSP contributions:

- Keep contributing, but only up to the match.

If your employer matches 5% of your salary in a 401(k) or TSP, contribute just that amount for now. This ensures you still get your full match (free money!) while freeing up extra cash flow. - Redirect the rest into your emergency fund.

The difference between your usual contribution and the matched amount can go directly into a separate savings account. Think of it as a short-term “emergency investment” in your own stability. - Resume full contributions later.

Once your emergency fund reaches your comfort level, move that money back toward your long-term retirement plan. By then, you’ll have two financial safety nets working together, one for now, one for the future.

This balanced approach gives you short-term flexibility without sacrificing long-term growth.

And it’s a smart move for every kind of investor, whether you’re a federal worker building your TSP or a private-sector employee growing a 401(k) or IRA.

Protect Your Retirement Savings with a Rules-Based Strategy

With a clear goal in mind, the next step is understanding why an emergency fund matters even beyond security.

The Real Reason Investors Need a Financial Safety Buffer

Having an emergency fund isn’t just about peace of mind. It’s about protecting your long-term investments when life gets unpredictable.

Having an emergency fund isn’t just about peace of mind. It’s about protecting your long-term investments when life gets unpredictable.

Here’s why it matters:

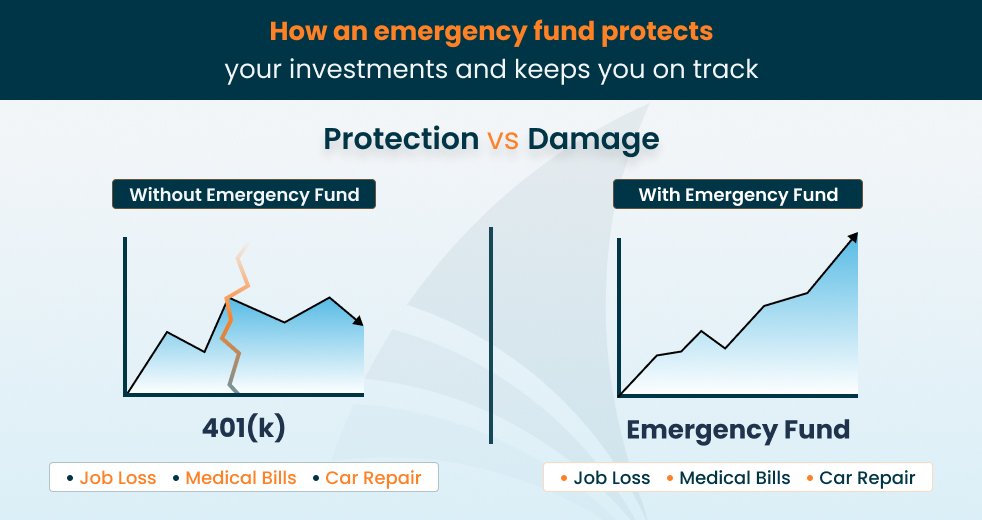

When you don’t have cash saved for emergencies, even a short gap in income can push you to make tough choices like withdrawing money from your 401(k), IRA, or TSP early.

That might solve today’s problem, but it creates a bigger one tomorrow.

Early withdrawals usually come with tax penalties and lost growth.

Every dollar pulled out is a dollar that can’t compound over the years, and that can cost you tens of thousands by retirement.

An emergency fund breaks this cycle. It lets your investments stay untouched and continue growing, no matter what happens in the short term.

Think of it like this:

- Your retirement accounts (401(k), IRA, or TSP) are for tomorrow.

- Your emergency fund is for today.

When both are in place, you’re protected on both fronts: stability now and growth later.

This is why smart investors don’t view emergency savings as a setback.

They see it as a shield that keeps their long-term strategy intact, especially during unpredictable times like the recent government shutdown.

How Smarter Investing Complements Your Emergency Fund

Once your emergency fund gives you breathing room for unexpected bills or income gaps, the next question becomes:

How do you keep your long-term investments protected and growing?

That’s where Model Investing comes in.

While your emergency fund shields you from short-term surprises like delayed paychecks or medical expenses, Model Investing’s rules-based tactical models protect your portfolio from long-term market shocks. Our system monitors economic trends and adjusts allocations automatically, reducing exposure when markets turn volatile and positioning you for growth when conditions improve.

This combination gives you a complete safety plan:

- Your emergency fund covers immediate needs without touching your retirement savings.

- Model Investing’s tactical models adapt your portfolio to changing markets, keeping your growth steady over time.

Together, they make sure your money is protected whether life throws you a curveball or the market takes a turn.

Which Investment Model is Right for me?

Next, let’s see where to keep your emergency fund so it’s both safe and easy to access when you need it most.

Where to Keep Your Emergency Fund (and What to Avoid)

Once you’ve started building your emergency fund, the goal isn’t to grow it fast. It’s to keep it safe and accessible.

The best place is somewhere separate from your everyday spending, such as a simple savings account or money market account that lets you withdraw quickly when needed.

Your emergency fund’s job is short-term protection, not earning high returns. Think of it as the cash cushion that keeps you from tapping into long-term investments when life throws a curveball.

Here’s what to avoid:

- Investing your emergency fund in the market. You don’t want it exposed to volatility when you might need it most.

- Locking it into long-term vehicles. Avoid CDs or retirement accounts, where access is limited or comes with penalties.

- Mixing it with other savings goals. Keep it clearly labeled “Emergency Fund” so you’re not tempted to use it for everyday spending.

Once your short-term safety net is in place, your long-term portfolio can focus entirely on growth. And this is where Model Investing can help by keeping your investments adaptive, data-driven, and protected through market swings.

Ready to protect your portfolio? View pricing to get started

Now that you know where to keep your emergency fund, let’s wrap up by looking at how this process can strengthen your entire financial plan.

Bringing It All Together: How an Emergency Fund Completes Your Financial Plan

When you look at your finances as a whole, your emergency fund and your investments play two equally important roles.

One protects your present, the other builds your future.

Without a cash buffer, even a short-term crisis like a paycheck delay or medical bill can force you to dip into your 401(k), IRA, or TSP too early. That not only disrupts your growth but can also trigger taxes and penalties.

But when you have money set aside for life’s surprises, you can stay calm, stay invested, and give your portfolio the time it needs to recover and grow.

Building Confidence That Lasts In Any Economy

Whether it’s a government shutdown, a market downturn, or a personal setback, real financial resilience comes from preparation, not prediction.

An emergency fund gives you short-term strength. A smarter investment strategy gives you long-term stability.

Together, they form a complete plan protecting what you need today while helping your money grow for tomorrow.

With Model Investing, you don’t have to guess when or how to adjust your portfolio.

Our rules-based investing models automatically adapt to changing market conditions, helping you stay balanced, confident, and in control no matter what’s happening in the headlines.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing