When it comes to investing, the focus is usually on returns, or risk. But believe it or not, the small expenses that you incur along the way can actually have a huge impact on your overall net worth.

For most investors, these expenses fly under the radar because of their stealthy nature. We never actually receive a bill for these charges; instead, they’re deducted from the net asset value of our funds. To the unwitting investor, the drop in fund value simply looks like a down day in the markets.

While these fees can’t be avoided, they can certainly be minimized … and doing so can save you a fortune. In this article we’ll discuss exactly what expense ratios are, why they matter, and how you can reduce their effect on your overall returns.

What Are Expense Ratios?

Whenever you invest in any type of fund, whether it’s a mutual fund, index fund or exchange traded fund (ETF), you’re going to pay a small ongoing fee. This fee is expressed in the form of an expense ratio, which tells you what percentage of your overall investment will go to cover the fund’s operating costs each year.

For example, if you invest in a fund that has an expense ratio of 1%, then you’ll pay the fund $10 per year for every $1,000 invested. That may not sound like a lot, but believe me, it adds up quick. If you had a portfolio worth half a million dollars, that 1% expense ratio would cost you $5,000 per year. That’s a chunk of change.

And unfortunately, it doesn’t matter how you’re investing – whether it’s through a brokerage account, your 401(k), the TSP, or an IRA – if you invest in any type of “fund” you’re going to incur these expenses. So it makes sense to minimize them whenever possible.

Expense ratios vary widely and are largely determined by whether a fund has “active” or “passive” management. Active management refers to a fund that has a team of money managers who are actively trying to pick investments so as to beat a particular benchmark or index. Passive management, on the other hand, refers to funds that simply track an index or benchmark. We’ll get into this more in a moment, but for now, just recognize that passive funds will have much lower expense ratios, and are typically preferred.

Understanding Their Impact

In order to understand why it’s worth paying attention to expense ratios, we need to see how big of an impact they can have over time. To do that, we’ll compare the hypothetical growth of two portfolios that achieve identical performance, but have different expense ratios.

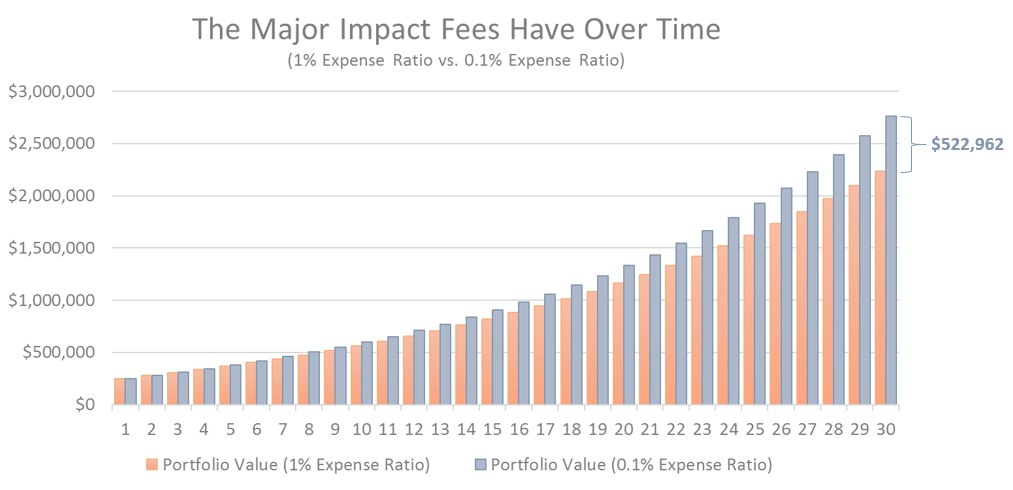

The table below shows the growth of two portfolios with the following characteristics: $250,000 initial balance, $1,000 per month contributions, and a 7% rate of return. The only difference between them is the red portfolio incurs an expense ratio of 1%, while the blue portfolio pays 0.1%.

As you can see, over just a 30-year period (less than half of the average person’s investing lifetime) the difference between paying an expense ratio of 1% and 0.1% amounts to $522,962. Think you could find something to do with that extra half-million dollars during retirement?

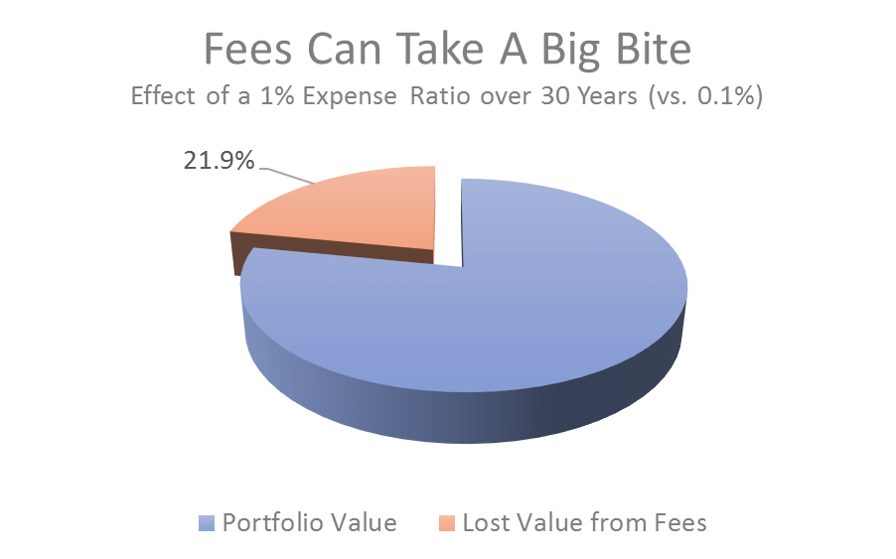

In terms of overall value, the portfolio that incurred the higher fees will be 21.9% lower after 30 years. Can you imagine giving up over a fifth of your net worth just to fees!? Oh the horror …

In case you’re wondering how a small change in the expense ratio can have such a large effect over time, let me explain. It all has to do with compounding …

If you read this article, then you know how big of a role time will play in your portfolio, as it is what facilitates the process of compounding. While it may not seem like 1% of your portfolio amounts to much, keep in mind that when you pay fees like this, you’re not just giving away money, you’re giving up the future growth on that money as well.

At 7% growth, giving away $1 in fees today is like giving away $7.61 30-years from now. Pay $1,000 in fees this year and that’s like giving up $7,613 30-years from now … and it only gets worse the better your investments do.

What’s a Typical Expense Ratio?

Now that you understand how important it is to minimize expenses, you’re probably wondering what the average expense ratio looks like. Well … it depends on a few factors.

Generally speaking, expense ratios have been coming down over the years as a result of improved automation, better economies of scale, and intense competition. But this doesn’t mean that you’ll necessarily have access to low-cost funds. Many 401(k) plans, for example, still contain an outdated selection of funds that have extraordinarily high expense ratios.

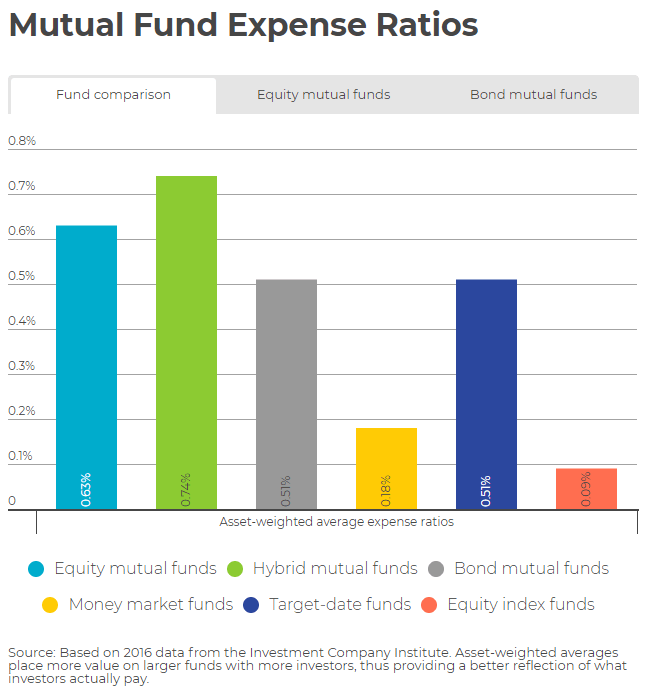

The chart below (courtesy of NerdWallet) shows average expense ratios by fund-type based on data from the Investment Company Institute.

Notice on the right side of this chart (in red) that index funds charge an average expense ratio of just 0.09%. This is incredibly low, and is roughly 1/5 or less the cost of the other “managed” funds. As a result, it begs the question – is it worth paying higher expenses in exchange for having a money manager in charge of the fund?

The answer, as we’re about to see, is an overwhelming NO!

Index Funds vs. Actively Managed Funds

As we briefly discussed above, there are actively managed funds – where a money manager tries to outperform his or her relevant benchmark, and then there are passive funds – which mathematically replicate the returns of a benchmark. Index funds, as you can probably guess, are all passively managed, and this is why their fees can be so low (there’s no fat-cat money manager to pay).

Over the years there has been an ongoing debate as to whether actively managed funds are worth the additional fees. In other words, do professional money managers as a group add more value to their funds than those same funds charge in fees?

While this argument has been going on for decades, the answer has actually always been quite clear: It’s NEVER worth paying for active management.

Standard & Poors maintains a tracking system called SPIVA (the S&P Indices Versus Active funds scorecard) that analyzes whether or not active money managers are able to beat their benchmarks over time. According to the latest data, the results are quite grim: The overwhelming majority of funds underperformed their benchmarks over 1, 3, 5, 10 and 15-year intervals.

The longer the time period in question, the worse these money managers tend to do. During the 15-year period through December 2016, 92% of large-cap fund managers underperformed the S&P 500. That means if you had simply bought an S&P 500 index fund (like we always recommend for exposure to domestic large-cap stocks), you would have beaten 92% of professional money managers …

The results are even worse for small and mid-cap funds. During the same time period, 95.4% of mid-cap managers and 93.2% of small-cap managers also underperformed their respective benchmarks. So the lesson should be clear: Stick with index funds, and leave actively managed funds for other investors who enjoy paying fees.

Identifying Your Expense Ratios

Hopefully at this point you recognize the drastic effect that expenses can have on your portfolio. The next step is to take a look at the expense ratios of the funds you’re invested in, and see if there are any changes you can make that would reduce you overall expenses without compromising returns.

We’re always happy to help our clients (and non-clients) do this, but in case you’d like to do it yourself, here’s how:

- Locate your expense ratios: The expense ratio for any fund can be found online, either in the fund’s prospectus or on financial websites such as MorningStar. In addition, if you invest through a 401(k) or other type of employer sponsored plan, you should be able to locate the expense ratios for your funds by simply logging in to your account and viewing your plan’s investment options.

- Move your investments to lower cost funds: Generally speaking, you will always want to choose the funds that have the lowest expense ratios that still provide you with the exposure that you’re looking for. Also, now that you know it’s a foolish bet to invest in any “actively managed” funds, make sure that you select low-cost index funds whenever possible. (Note: If you need help with investment selection in general, please see our Investment Models).

Keep in mind that for many employer sponsored plans, the options are limited (and often terrible), and you may not have a wide variety of low-cost index funds to choose from. On the other hand, if you happen to be part of the Thrift Savings Plan, then kudos to you, the C, S, I, F, and G Funds are all index funds, and they have some of the lowest expense ratios in the industry.

Conclusion

There are few things that we as investors have direct control over, but one of those is the ongoing expenses we pay for the funds we invest in. By choosing lower cost index funds, we can minimize these expenses, resulting in substantially higher portfolio growth over time.

The other benefit of index funds is that more often than not, they actually outperform their actively managed brethren! So not only do you pay lower costs going the index fund route, you also set yourself up for better performance over time. Altogether, it’s really a no-brainer.

An innovative approach for eaming higher returns with less risk

Download Report (1.2M PDF)You don’t want to look back and know you could’ve done better.

See Pricing